Blackberry 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

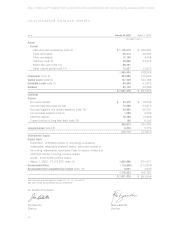

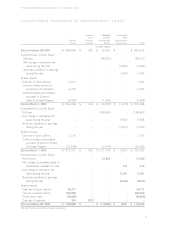

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

(j) Inventories

Raw materials are stated at the lower of cost and

replacement cost. Work in process and finished

goods inventories are stated at the lower of cost and

net realizable value. Cost includes the cost of

materials plus direct labor applied to the product

and the applicable share of manufacturing overhead.

Cost is determined on a first-in-first-out basis.

(k) Long-lived assets

The Company reviews long-lived assets such as

property, plant and equipment, and intangible assets

with finite useful lives for impairment whenever

events or changes in circumstances indicate that

the carrying amount may not be recoverable. If the

total of the expected undiscounted future cash flows

is less than the carrying amount of the asset, a loss,

if any, is recognized for the difference between the

fair value and carrying value of the asset.

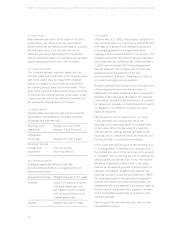

(l) Capital assets

Capital assets are stated at cost less accumulated

amortization. Amortization is provided using the

following rates and methods:

Buildings and Straight-line over terms

leaseholds between 5 and 40 years

Information

technology Straight-line over 5 years

Furniture, fixtures,

tooling, and 20% per annum

equipment declining balance

(m) Intangible assets

Intangible assets are stated at cost less

accumulated amortization. Intangible assets are

amortized as follows:

Acquired technology Straight-line over 2 to 5 years

Licenses Lesser of 5 years or on a per

unit basis based upon the

anticipated number of units

sold during the terms of the

license agreements

Patents Straight-line over 17 years

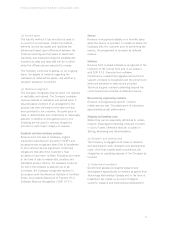

(n) Goodwill

Effective March 3, 2002, the Company adopted the

new recommendations in accordance with SFAS 142

with regards to goodwill and intangible assets and

accordingly, goodwill is no longer amortized to

earnings, but periodically tested for impairment. The

Company performed the required annual impairment

tests of goodwill as at February 28, 2004 and March

1, 2003 and concluded that the existing goodwill

was not impaired. The Company did not have any

goodwill prior to the adoption of the new

recommendation, therefore, there was no impact to

prior year’s earnings upon its adoption.

Goodwill represents the excess of the purchase price

of business acquisitions over the fair value of

identifiable net assets acquired in such acquisitions.

Goodwill is allocated as at the date of the business

combination. Goodwill is not amortized, but is tested

for impairment annually, or more frequently if events

or changes in circumstances indicate the asset

might be impaired.

The impairment test is carried out in two steps.

In the first step, the carrying amount of the

reporting unit including goodwill is compared with

its fair value. When the fair value of a reporting

unit exceeds its carrying amount, goodwill of the

reporting unit is considered not to be impaired, and

the second step is considered unnecessary.

In the event that the fair value of the reporting unit,

including goodwill, is less than the carrying value,

the implied fair value of the reporting unit’s goodwill

is compared with its carrying amount to measure the

amount of the impairment loss, if any. The implied

fair value of goodwill is determined in the same

manner as the value of goodwill is determined in a

business combination using the fair value of the

reporting unit as if it was the purchase price. When

the carrying amount of the reporting unit goodwill

exceeds the implied fair value of the goodwill, an

impairment loss is recognized in an amount equal to

the excess and is presented as a separate line item

in the consolidated statements of operations and

retained earnings.

The Company has one reporting unit, which is the

consolidated Company.