Blackberry 2004 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

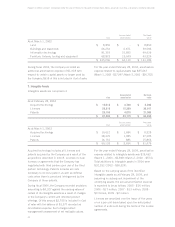

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

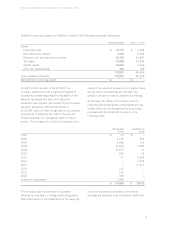

February 28, 2004 March 1, 2003 March 2, 2002

Expected Canadian tax rate 36.5% 38.3% 41.2%

Expected income tax provision (recovery) $17,394 $ (44,817) $ (15,685)

Differences in income taxes resulting from:

Manufacturing and processing activities (900) 3,951 1,801

Increase in valuation allowance 29,100 61,969 1,530

Non-deductible portion of unrealized

capital losses ––1,013

Foreign exchange 3,820 (1,408) 1,112

Foreign tax rate differences (45,088) 7,352 (3,192)

Enacted tax rate changes (9,743) 4,835 2,960

Other differences 1,217 (130) 683

$(4,200) $ 31,752 $ (9,778)

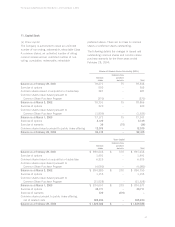

February 28, 2004 March 1, 2003 March 2, 2002

Income (loss) before income taxes:

Canadian $ 29,309 $ (102,954) $ (46,845)

Foreign 18,320 (14,151) 8,746

$ 47,629 $ (117,105) $ (38,099)

The provision for income taxes consists of the following:

February 28, 2004 March 1, 2003 March 2, 2002

Provision for (recovery of) income taxes:

Current

Canadian $ 484 $ (8) $ 6,756

Foreign (4,684) 3,521 302

Deferred

Canadian –27,593 (17,283)

Foreign –646 447

$(4,200) $ 31,752 $ (9,778)

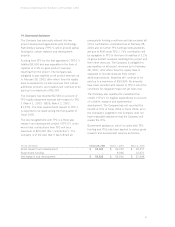

The acquisitions were accounted for using the

purchase method whereby assets acquired and

liabilities assumed were recorded at their fair value

as of the date of acquisition. The excess of the

purchase price over such fair value was recorded as

goodwill. Acquired technology includes current and

core technology. Of the $16,193 of goodwill

acquired during fiscal 2003, $13,316 is expected

to be deductible for tax purposes.

If the four fiscal 2003 acquisitions had occurred on

March 1, 2001, the Company’s unaudited proforma

consolidated revenue would have increased by $nil

for the year ended February 28, 2004 (March 1,

2003 - $226; March 2, 2002 - $816) and the

unaudited proforma net income (loss) would have

been $51,829 (March 1, 2003 - ($151,713);

March 2, 2002 - ($35,748)).

9. Income Taxes

The difference between the amount of the provision

for (recovery of) income taxes and the amount

computed by multiplying income before taxes by the

statutory Canadian rate is reconciled as follows: