Blackberry 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

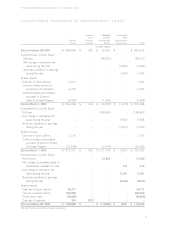

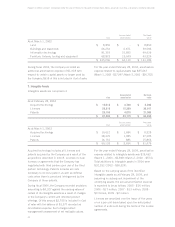

Held-to-maturity investments are carried at amortized cost and comprise:

Unrecognized

Amortized Holding Holding

Cost Gains Losses Fair Value

As at February 28, 2004

Government sponsored enterprise notes $–$–$–$–

Asset-backed securities 66,658 1,325 – 67,983

Corporate bonds 79,404 4,074 – 83,478

$ 146,062 $ 5,399 $ – $ 151,461

As at March 1, 2003

Government sponsored enterprise notes $ 15,110 $ 83 $ – $ 15,193

Asset-backed securities 69,002 770 (59) 69,713

Corporate bonds 105,918 3,365 – 109,283

$ 190,030 $ 4,218 $ (59) $ 194,189

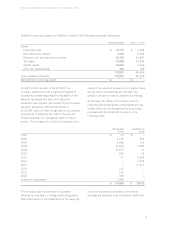

5. Inventory

Inventory is comprised as follows:

February 28,2004 March 1, 2003

Raw materials $35,119 $34,446

Work in process 8,713 8,205

Finished goods 7,679 4,286

Provision for excess and obsolete inventory (8,675) (15,662)

$ 42,836 $ 31,275

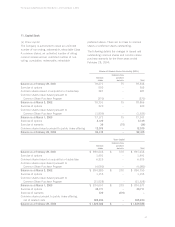

6. Capital Assets

Capital assets are comprised of:

Accumulated Net book

Cost amortization value

As at February 28, 2004

Land $ 8,850 $ – $ 8,850

Buildings and leaseholds 67,148 10,047 57,101

Information technology 91,950 47,605 44,345

Furniture, fixtures, tooling and equipment 78,955 41,542 37,413

$ 246,903 $ 99,194 $ 147,709

During fiscal 2004, the Company sold held-to-

maturity securities with a carrying value of $25,150

due to concerns with the credit quality of the issuer.

The gross realized losses on these sales totaled $6.

Held-to-maturity securities with a carrying value of

$15,203 were called for early redemption by the

issuer. The gross realized gains on these

redemptions were $10.

Investments carry weighted average yields of 3.1%

as at February 28, 2004 (March 1, 2003 – 3.8%)