Blackberry 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

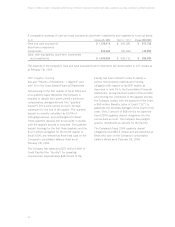

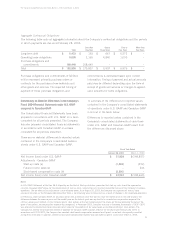

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

The following table sets forth certain consolidated statement of operations data expressed as a percentage of

revenue for the periods indicated:

Fiscal year ended February 28, 2004 March 1, 2003 Change 2004/2003 March 2, 2002

Revenue 100.0% 100.0% –100.0%

Cost of sales 54.4% 61.1% (6.7%) 71.3%

Gross margin 45.6% 38.9% 6.7% 28.7%

Expenses

Research and development 10.5% 18.2% (7.7%) 12.7%

Selling, marketing and administration 18.2% 34.2% (16.0%) 31.9%

Amortization 4.8% 7.3% (2.5%) 4.0%

Sub-total 33.5% 59.7% (26.2%) 48.6%

Restructuring charges –2.1% (2.1%) –

Litigation 5.9% 19.0% (13.1%) –

Restructuring and litigation 5.9% 21.1% (15.2%) –

39.4% 80.8% (41.4%) 48.6%

Income (loss) from operations 6.2% (41.9%) 48.1% (19.9%)

Investment income 1.8% 3.7% (1.9%) 8.8%

Write-down of investments –––(1.8%)

Income (loss) before income taxes 8.0% (38.2%) 46.2% (12.9%)

Provision for (recovery of) income tax (0.7%) 10.3% 11.0% (3.3%)

Net income (loss) 8.7% (48.5%) 57.2% (9.6%)

Executive Summary

As the above tables highlight, the Company’s results

were significantly improved in fiscal 2004 compared

to fiscal 2003. The four primary fiscal 2004 “profit

drivers” that contributed to this improvement are

discussed below. A more comprehensive analysis of

these factors is contained in “Results of

Operations”.

The Company’s net income increased by $200.7

million to $51.8 million or $0.65 basic earnings per

share and $0.62 diluted earnings per share in fiscal

2004, compared to a net loss of $148.9 million or

a loss per share of $1.92 in fiscal 2003.

Primary Fiscal 2004 Profit Drivers

Revenue and resulting gross margin growth

Revenue increased by $287.9 million to $594.6

million in fiscal 2004 from $306.7 million in the

preceding year. The number of BlackBerry

handhelds sold increased by 643,000 to 920,000

in fiscal 2004 compared to 277,000 in fiscal

2003. Factoring in a 15.8% reduction in average

selling price (“ASP”), handheld revenues increased

by $220.4 million to $343.2 million in fiscal 2004.

Service revenue increased by $41.9 million to

$171.2 million in fiscal 2004, consistent with the

Company’s increase in BlackBerry subscribers

during the year. Software revenue increased by

$25.8 million to $47.4 million in fiscal 2004.

Gross margin increased to $271.3 million or 45.6%

in fiscal 2004 compared to $119.4 million or

38.9% in fiscal 2003. The increase of 6.7% in the

gross margin ratio to 45.6% in fiscal 2004 was as a

result of the Company’s cost reduction efforts for its

BlackBerry handhelds and service revenue streams,

increased manufacturing cost efficiencies as a result

of the increase in handheld volumes and favorable

changes in BlackBerry handheld product mix.

Research and development, Selling, marketing and

administration and Amortization

The Company was focused on prudent cost

management and maximizing the financial net

income “leverage” to be obtained from the increase

in revenue and gross margin. Research and

development, Selling, marketing and administration

and Amortization expenses increased by $15.8