Blackberry 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

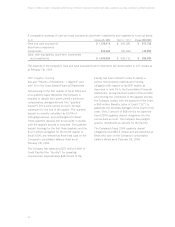

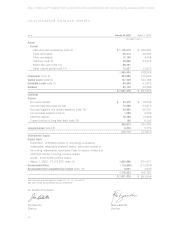

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

The Company qualifies for investment tax credits

(“Tics”) on eligible expenditures on account of

scientific research and experimental development.

The Company has not recorded the benefit of Tics in

fiscal 2004 or fiscal 2003. See “Income Taxes” and

note 9 to the Consolidated Financial Statements.

Selling, Marketing and Administration

Selling, marketing and administration expenses

increased $3.5 million or 3.3% to $108.5 million

for fiscal 2004 compared to $105.0 million for

fiscal 2003. As a percentage of revenue, Selling,

marketing and administration expenses declined to

18.2% in fiscal 2004 compared to 34.2% in the

preceding year, primarily due to the increase in

fiscal 2004 revenues over fiscal 2003.

The net increase in Selling, marketing and

administration expenses for fiscal 2004 was

primarily attributable to marketing, advertising

and promotion expenses. Other cost increases were

for information technology support expenses,

infrastructure and maintenance expenses, building

maintenance and professional fees, including the

costs of complying with the Sarbanes-Oxley Act of

2002 and similar Canadian regulatory initiatives.

The cost increases were partially offset by a foreign

exchange gain of $2.2 million in fiscal 2004,

compared to a lesser foreign exchange gain of

$0.3 million in fiscal 2003 (see note 20 to the

Consolidated Financial Statements) and a reduction

in bad debt expense. Compensation expense was

approximately equal in fiscal 2004 compared to

fiscal 2003 generally as a result of the Company’s

cost restructuring undertaken in November 2002.

See “Restructuring Charge”.

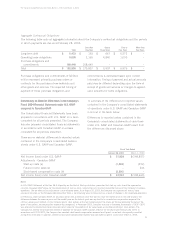

Amortization

Amortization expense on account of certain capital

and certain intangible assets increased by $5.6

million to $27.9 million for fiscal 2004 compared

to $22.3 million for fiscal 2003. The increased

amortization expense in fiscal 2004 reflects the

impact of a full year’s amortization expense with

respect to capital and certain intangible asset

expenditures during fiscal 2003 and also incremental

amortization with respect to capital and certain

intangible asset expenditures during fiscal 2004.

Amortization expense with respect to capital

assets employed in the Company’s manufacturing

operations and BlackBerry service operations

was $7.9 million in fiscal 2004 compared to

$7.7 million in fiscal 2003 and is charged to

Cost of sales in the Consolidated Statements of

Operations. See also note 6 to the Consolidated

Financial Statements. The Company expects

amortization expense with respect to capital assets

employed in the Company’s manufacturing

operations and BlackBerry service operations to

increase in fiscal 2005 compared to fiscal 2004 as

it incurs capital expenditures necessary to expand

its manufacturing and service business operations.

Amortization expense with respect to licenses (a

component of Intangible assets) is charged to Cost

of sales and was $18.7 million in fiscal 2004

compared to $1.1 million in fiscal 2003. This

increase is due generally to the increase in the

number of handhelds sold in fiscal 2004 versus

fiscal 2003. See “Revenue”. Total amortization

expense with respect to intangible assets was

$19.5 million in fiscal 2004 compared to $2.8

million in fiscal 2003. See also note 7 to the

Consolidated Financial Statements.

Restructuring Charge

During the third quarter of fiscal 2003, as part of

the implementation of a plan to improve operating

results, the Company recorded restructuring charges

of $6.6 million including the costs associated with

the termination of employees, related costs and the

closure and exit of certain leased facilities. See note

15 to the Consolidated Financial Statements.

Litigation

See also the discussion of the NTP matter in

“Liquidity and Capital Resources – NTP Litigation

Funding” and note 16 to the Consolidated Financial

Statements.

The Company is the defendant in a patent litigation

matter brought by NTP, Inc. (“NTP”) alleging that

the Company infringed on eight of NTP’s patents

(the “NTP matter”).

On May 23, 2003, the Court ruled on the issues

of enhanced compensatory damages, plaintiff’s

attorney fees and certain other matters.