Blackberry 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

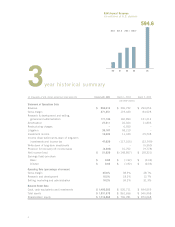

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

Valuation of long-lived assets,

intangible assets and goodwill

In connection with the business acquisitions

completed by the Company in fiscal 2002 and

2003, the Company identified and estimated the

fair value of assets acquired including certain

identifiable intangible assets other than goodwill

and liabilities assumed in the acquisitions. Any

excess of the purchase price over the estimated fair

value of the identified net assets was assigned to

goodwill.

The Company assesses the impairment of

identifiable intangibles, long-lived assets and

goodwill whenever events or changes in

circumstances indicate that the carrying value may

not be recoverable. The largest component of

Intangible assets is licenses. Licenses are amortized

over the lesser of five years or on a per unit basis

based upon the anticipated number of units to be

sold during the terms of the license agreements.

See “Results of Operations – Amortization”.

Unforeseen events, changes in circumstances and

market conditions, and material differences in the

value of licenses and other long-lived and intangible

assets and goodwill due to changes in estimates of

future cash flows could affect the fair value of the

Company’s assets and require an impairment

charge. Intangible assets are reviewed quarterly to

determine if any events have occurred that would

warrant further review. In the event that a further

assessment is required, the Company will analyze

estimated future cash flows.

Income taxes

The Company’s deferred tax asset balance

represents temporary differences between the

financial reporting and tax bases of assets and

liabilities, including research and development costs

and incentives, financing costs, capital assets, non-

deductible reserves, operating loss carryforwards and

capital loss carryforwards, net of valuation

allowances. The Company evaluates its deferred tax

assets based upon cumulative losses in recent years,

estimated future earnings as per internal forecasts

for periods in which temporary differences become

deductible as well as prudent and feasible tax

planning strategies. The Company records a

valuation allowance to reduce deferred income tax

assets to the amount that is more likely than not to

be realized. In fiscal 2003, the Company

determined that it was no longer able to satisfy the

“more likely than not” standard under U.S. GAAP

with respect to the valuation of its deferred income

tax asset balance and recorded a full valuation

allowance against the entire deferred tax asset

balance.

Should RIM determine that it is more likely than not

that it is able to realize its deferred tax assets in the

future in excess of its net recorded amount, net

income would increase in the reporting periods

when such determinations are made.

Litigation

The Company has been involved in patent litigation

where it is seeking to protect its patents (see note

12(b) to the Consolidated Financial Statements and

“Events Subsequent to February 28, 2004 Year End

- Settlement of Patent Litigation”) and where it is

currently seeking to defend itself in a patent

infringement suit (the “NTP matter” - see note 16

to the Consolidated Financial Statements). RIM

capitalizes costs incurred for patent litigation where

it is seeking to protect its patents.

If the Company is not successful in such litigation,

RIM will review its related intangible asset balance,

including previously capitalized litigation costs, for

impairment. RIM has recorded liabilities for the

estimated probable costs for the resolution of the

NTP matter, based upon court rulings to date and

the Company’s current and estimated future costs

with respect to ongoing legal fees. The actual

resolution of the NTP matter may differ materially

from these estimates as a result of future rulings

issued by the appellate courts at the conclusion of

the appeals process, or by the United States Patent

and Trademark Office (“PTO”) in connection with its

re-examinations of the five patents-in-suit. Future

quarterly or annual financial reporting may be

materially affected, either adversely or favorably, as

a result of future rulings by the courts and the PTO.