Blackberry 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

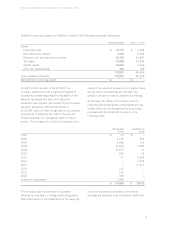

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

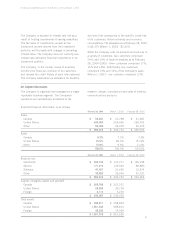

20. Supplemental Information

(a) Statement of cash flows

The following summarizes interest and income taxes paid:

For the year ended February 28, 2004 March 1, 2003 March 2, 2002

Interest paid during the year $ 770 $ 852 $ 779

Income taxes paid (refunded) during the year (196) 1,070 967

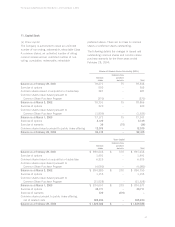

(b) Accrued liabilities

The following items are included in the accrued liabilities balance:

As at February 28, 2004 March 1, 2003

Airtime purchase costs 17,486 17,109

Marketing costs 13,081 8,116

Warranty 9,246 5,170

Royalties 10,042 4,558

Other 20,683 19,462

$ 70,538 $ 54,415

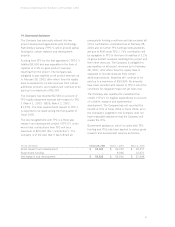

(c) Other information

Advertising expense, which includes media, agency

and promotional expenses equal to $18,206 (March 1,

2003 - $15,079; March 2, 2002 - $18,549) is

included in Selling, marketing and administration

expense.

Selling, marketing and administration expense for

the fiscal year includes a foreign currency exchange

gain of $2,156 (March 1, 2003 – gain of $293;

March 2, 2002 – loss of $1,042).

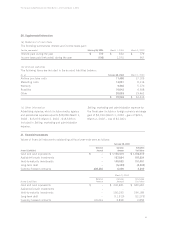

21. Financial Instruments

Values of financial instruments outstanding at fiscal year-ends were as follows:

February 28, 2004

Notional Carrying Estimated

Assets (Liabilities) Amount Amount Fair Value

Cash and cash equivalents $ – $ 1,156,419 $ 1,156,419

Available-for-sale investments – 187,824 187,824

Held-to-maturity investments –146,062 151,461

Long-term debt – (6,433) (6,808)

Currency forward contracts 208,850 5,399 5,399

March 2, 2003

Notional Carrying Estimated

Assets (Liabilities) Amount Amount Fair Value

Cash and cash equivalents $ – $ 340,681 $ 340,681

Available-for-sale investments – – –

Held-to-maturity investments – 190,030 194,189

Long-term debt – (11,919) (12,273)

Currency forward contracts 69,416 3,858 3,858