Blackberry 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

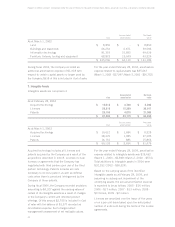

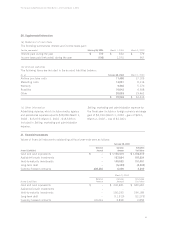

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

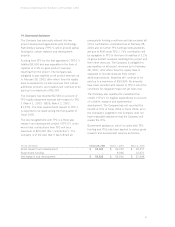

On January 22, 2004 the Company completed a

public share issue of 12.1 million common shares

for proceeds of $905,240, net of related issue costs

of $39,629.

During fiscal 2004, the Company’s share purchase

warrants were redeemed and converted into common

shares.

On October 3, 2002 the Company’s Board of Directors

approved the purchase during the subsequent

12 months of up to as many as 3.8 million common

shares, which approximated 5% of the common

shares outstanding at that date. All common shares

purchased by RIM have been cancelled. No shares

have been re-purchased under this Common Share

Purchase Program during fiscal 2004.

During the year ended March 1, 2003 the Company

repurchased 1.9 million common shares pursuant to

its Common Share Purchase Program at a cost of

$24,502. The amount paid in excess of the carrying

value of the common shares of $2,974 was charged

to retained earnings. All common shares repurchased

by the Company pursuant to its Common Share

Purchase Program have been cancelled.

During the year ended March 2, 2002 the Company

repurchased 370 common shares pursuant to its

Common Share Purchase Program at a cost of

$5,525. The amount in excess of the carrying value

of the common shares of $1,445 was charged to

retained earnings. All common shares repurchased

by the Company pursuant to its Common Share

Purchase Program have been cancelled.

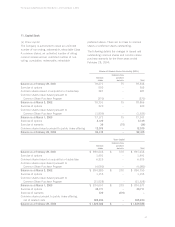

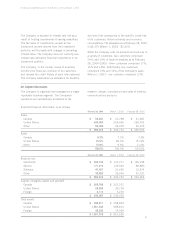

(b) Stock option plan

The Company has an incentive stock option plan for

all of its directors, officers and employees. The

option exercise price is the fair market value of the

Company’s common shares at the date of grant.

These options generally vest over a period of five

years after which they are exercisable for a

maximum of ten years after the grant date. The

Company’s shareholders approved the reconstitution

of the stock option plan at the Annual General

Meeting on August 12, 2002. The reconstitution

increased the number of common shares available

for the grant of options by 2,756. As at February

28, 2004, there were 8,009 options outstanding

with exercise prices ranging from $2.43 to $119.80.

Options issued and outstanding for 2,640 shares are

vested as at February 28, 2004 and there are 3,040

shares available for future grants under the plan.

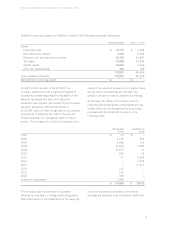

A summary of option activity since February 28, 2001 is shown below:

Options Outstanding

Weighted

Number average

(in 000’s) exercise price

Balance as at February 28, 2001 7,920 $17.04

Granted during the year 2,978 $ 21.83

Exercised during the year (515) $3.71

Forfeited during the year (297) $ 27.92

Balance as at March 2, 2002 10,086 $ 18.81

Granted during the year 956 $ 16.41

Exercised during the year (320) $ 3.88

Forfeited during the year (621) $ 31.35

Balance as at March 1, 2003 10,101 $18.29

Granted during the year 1,574 $30.34

Exercised during the year (3,129) $ 14.12

Forfeited during the year (537) $27.95

Balance as at February 28, 2004 8,009 $ 21.64