Blackberry 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

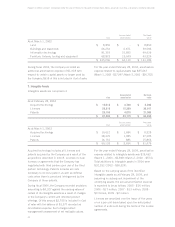

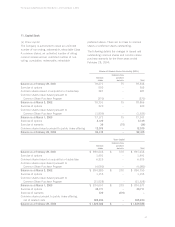

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

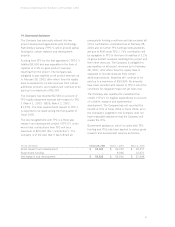

The Company is involved with in a dispute with

Inpro II Licensing, S.a.r.l. (“Inpro”) in connection

with two of Inpro’s patents. In a Delaware action,

Inpro is seeking a preliminary and permanent

injunction and an unspecified amount of damages

in relation to one of its patents. The matter is

currently scheduled for trial in September 2005 and

fact discovery must be complete by October 29,

2004. The Company filed an action for a declaratory

judgement of non-infringement with respect to one

of the two patents, which action is the subject of a

motion to stay or transfer to Delaware. Although the

Company has conducted a thorough review of the

relevant patents held by Inpro, and is of a view that

it does not infringe on such patents, at this time,

the likelihood of damages or recoveries and the

ultimate amounts, if any, with respect to all of the

Inpro actions is not determinable. Accordingly, no

amount has been recorded in these financial

statements as at February 28, 2004.

From time to time, the Company is involved in other

claims in the normal course of business.

Management regularly assesses such claims and

when matters are considered likely to result in a

material exposure and the amount of a related loss

is quantifiable, a provision for loss is made based

on management’s assessment of the likely outcome.

The Company does not provide for claims that are

considered unlikely to result in a significant loss,

claims for which the outcome is not determinable or

claims for which the amount of the loss cannot be

reasonably estimated. Any settlements or awards

under such claims are provided for when reasonably

determinable.

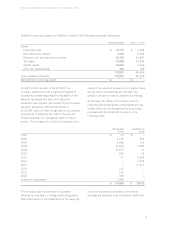

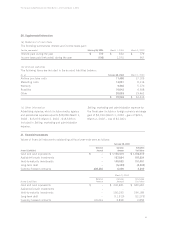

13. Product Warranty

The Company estimates its warranty costs at the

time of revenue recognition, based on historical

warranty claims experience, and records the expense

in Cost of sales. The warranty accrual balance is

reviewed quarterly to establish that it materially

reflects the remaining obligation, based on the

anticipated future expenditures over the balance of

the obligation period. Adjustments are made when

the actual warranty claim experience differs from

estimates.

The change in the Company’s accrued warranty

obligations from March 2, 2002 to February 28,

2004 was as follows:

Accrued warranty obligations at March 2, 2002 $ 3,355

Actual warranty experience during 2003 (577)

2003 warranty provision 5,465

Adjustments for changes in estimate (3,073)

Accrued warranty obligations at March 1, 2003 $ 5,170

Actual warranty experience during 2004 (3,946)

2004 warranty provision 8,648

Adjustments for changes in estimate (626)

Accrued warranty obligations at February 28, 2004 $ 9,246