Blackberry 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

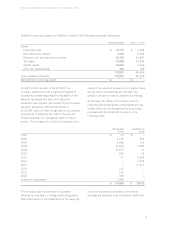

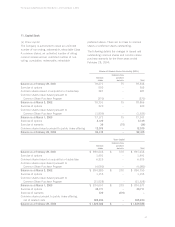

For the year ending

2005 $ 193

2006 207

2007 223

2008 239

2009 256

March 1, 2009 5,315

$ 6,433

10. Long-Term Debt

At February 28, 2004 long-term debt consisted of

mortgages with interest rates ranging between

6.88% and 7.90%, against which certain land and

buildings are pledged as collateral. All mortgage

loans are denominated in Canadian dollars and

mature on March 1, 2009.

Interest expense on long-term debt for the year was

$771 (March 1, 2003 - $852; March 2, 2002 - $661).

The scheduled long-term debt principal payments

for the fiscal years 2005 through to maturity are as

set out below:

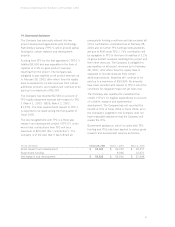

At February 28, 2004 the Company had demand

credit facilities totalling $92.6 million (March 1,

2003 - $19.9 million). As at February 28, 2004

the Company had drawn on its available credit

facilities in the amount of $64.1 million in the form

of letters of credit, including $48.0 million related

to litigation as described in note 16. $28.5 million

of available credit facilities remains unused. The

operating line portion of the facilities bear interest

on the outstanding balance at the bank’s prime rate.

Any balance owing is due on demand and is subject

to a general security agreement, general assignment

of book debts and the pledge of specific securities

in the Company’s investment portfolio.