Blackberry 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

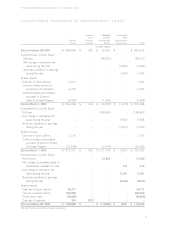

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

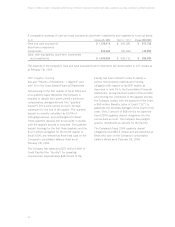

Aggregate Contractual Obligations

The following table sets out aggregate information about the Company’s contractual obligations and the periods

in which payments are due as at February 28, 2004:

Less than One to Four to More than

Total One Year Three Years Five Years Five Years

Long-term debt $ 6,433 $ 193 $ 667 $ 5,573 $ –

Operating lease obligations 8,008 2,165 4,840 1,003 –

Purchase obligations and

commitments 168,449 168,449 – – –

Total $ 182,890 $ 170,807 $ 5,507 $ 6,576 $ –

Purchase obligations and commitments of $168.4

million represent primarily purchase orders or

contracts for the purchase of raw materials and

other goods and services. The expected timing of

payment of these purchase obligations and

commitments is estimated based upon current

information. Timing of payment and actual amounts

paid may be different depending upon the time of

receipt of goods and services or changes to agreed-

upon amounts for some obligations.

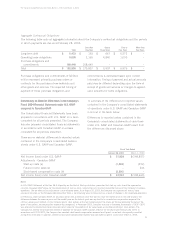

Commentary on Material Differences in the Company’s

Fiscal 2004 Financial Statements under U.S. GAAP

compared to Canadian GAAP

The Consolidated Financial Statements have been

prepared in accordance with U.S. GAAP on a basis

consistent for all periods presented. The Company

has also prepared consolidated financial statements

in accordance with Canadian GAAP on a basis

consistent for all periods presented.

There are no material differences to reported values

contained in the Company’s consolidated balance

sheets under U.S. GAAP and Canadian GAAP.

A summary of the differences to reported values

contained in the Company’s consolidated statements

of operations under U.S. GAAP and Canadian GAAP

is set out in the table below.

Differences to reported values contained in the

Company’s consolidated statements of cash flows

under U.S. GAAP and Canadian GAAP result from

the differences discussed above.

Fiscal Year Ended

February 28, 2004 March 1, 2003

Net income (loss) under U.S. GAAP $ 51,829 $(148,857)

Adjustments - Canadian GAAP

Start-up costs (a) (1,392) (452)

Future income taxes (a) –646

Stock-based compensation costs (b) (2,890) –

Net income (loss) under Canadian GAAP $ 47,547 $(148,663)

Notes:

a) U.S. GAAP, Statement of Position 98-5, Reporting on the Cost of Start-up Activities, prescribes that start-up costs should be expensed as

incurred. Canadian GAAP allows for the capitalization of start up costs, namely the costs incurred during the start-up of the Company’s European

operations. The tax affect of this adjustment is also reflected above. As of August 30, 2003, the Company has expensed all start-up costs

previously incurred, as the Company determined that there is no remaining value to these costs as a result of changes in the underlying operations.

b) Previously, under Canadian GAAP, for any stock option with an exercise price that was less than the market price on the date of grant, the

difference between the exercise price and the market price on the date of grant was required to be recorded as compensation expense (the

intrinsic value based method). As the Company grants stock options at the fair market value of the shares on the day preceding the date of the

grant of the options, no compensation expense was recognized. In November 2003, Canadian Institute of Chartered Accountants (“CICA”) 3870

was amended to provide transitional provisions which allow for the adoption of fair value based accounting recording of stock options. The

Company has elected the prospective method of adoption for Canadian GAAP purposes effective for the year ended February 28, 2004. In

accordance with CICA 3870, the Company has recorded stock-based compensation expense for all grants issued and subsequently cancelled

during the current year. In addition, proforma stock-based compensation expense was calculated on grants issued since March 2, 2003.