Blackberry 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

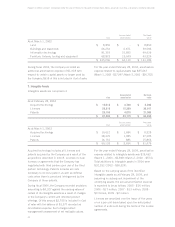

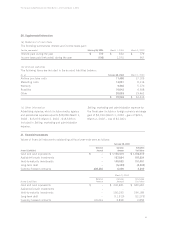

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

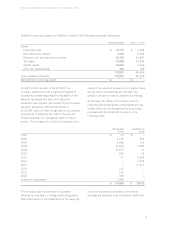

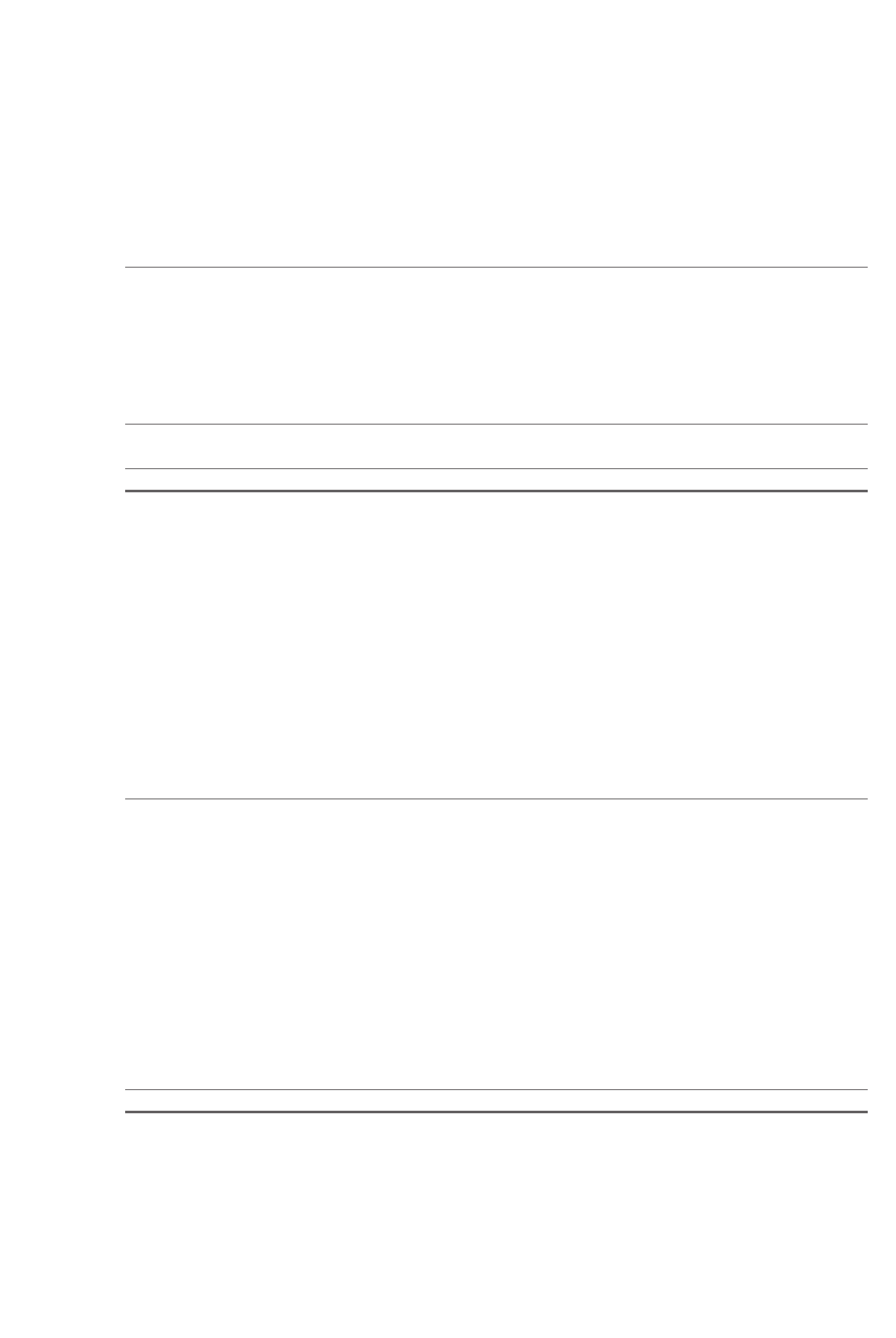

Deferred income tax assets and liabilities consist of the following temporary differences:

February 28, 2004 March 1, 2003

Assets

Financing costs $ 13,170 $ 4,398

Non-deductible reserves 3,492 6,622

Research and development incentives 45,735 24,897

Tax losses 37,428 29,938

Capital assets 18,252 2,614

Other tax carryforwards 204 186

118,281 68,655

Less: valuation allowance 118,281 68,655

Net deferred income tax assets $–$–

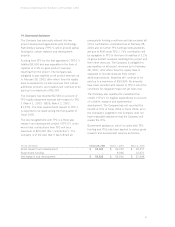

During the third quarter of fiscal 2003, the

Company determined that a significant degree of

uncertainty existed regarding the realization of the

deferred tax assets and that a full valuation

allowance was required. As a result of the increased

valuation allowance, deferred tax assets of

$118,281 have not been recognized for accounting

purposes as of February 28, 2004. This amount

remains available for use against taxes on future

profits. The Company will continue to evaluate and

examine the valuation allowance on a regular basis

and as future uncertainties are resolved, the

valuation allowance may be adjusted accordingly.

At February 28, 2004, the Company has the

following net operating loss carryforwards and tax

credits which are not recognized for accounting

purposes and are scheduled to expire in the

following years:

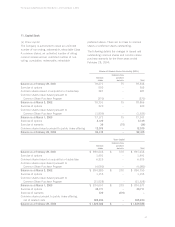

Net operating Investment tax

losses credits

2005 $21$ –

2006 1,259 490

2007 4,046 726

2008 12,860 2,385

2009 93,675 11

2010 976 13

2011 27 5,524

2012 –9,306

2014 –11,017

2020 102 –

2021 255 –

2022 359 –

Indefinite carryforward 1,080 –

$ 114,660 $ 29,472

The Company has not provided for Canadian

deferred income taxes or foreign withholding taxes

that would apply on the distribution of the earnings

of its non-Canadian subsidiaries, since these

earnings are intended to be reinvested indefinitely.