BMW 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 Group Financial Statements

73 Group Financial Statements

73 Income Statements

74 Balance Sheets

76 Cash Flow Statements

78 Group Statement of Changes

in Equity

79 Statement of Income and

Expenses recognised directly

in Equity

80 Notes

80 – Accounting Principles

and Policies

89 – Notes to the Income

Statement

96 – Notes to the Balance Sheet

117 – Other Disclosures

131 – Segment Information

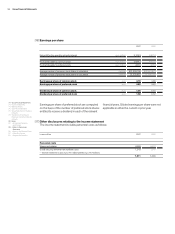

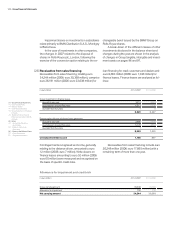

The deferred tax expense was euro 520 million

lower than in the previous year, primarily reflecting

the impact of the Business Tax Reform Act 2008,

adopted by the German Bundesrat (Federal Council)

on 6 July 2007.

Deferred taxes are recognised on temporary dif-

ferences between the carrying amount of assets and

liabilities for IFRS purposes and their tax bases. De-

ferred taxes are computed using enacted or planned

tax rates which are expected to apply in the relevant

national jurisdictions when the amounts are recovered.

A corporation tax rate of 15.0 % applies in Germany

with effect from 1 January 2008 onwards. After taking

account of the average multiplier rate (Hebesatz) of

410 % for municipal trade tax and the solidarity charge

of 5.5 %, the overall income tax rate for companies

in Germany is 30.2 % (2006: 38.9 %). This reduced

rate has been applied in 2007 to measure deferred

tax assets and liabilities. As in the previous year, the

tax rates for companies outside Germany remain in

a range of between 12.5 % and 40.7 %. A valuation

allowance is recognised on deferred tax assets when

recoverability is uncertain. In determining the level

of the valuation allowance, all positive and negative

factors concerning the likely existence of sufficient

taxable profit in the future are taken into account.

These estimates can change depending on the ac-

tual course of events.

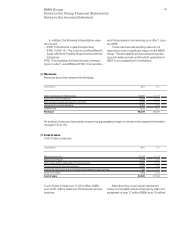

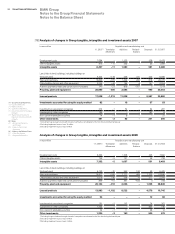

An analysis of deferred tax assets and liabilities

by position at 31 December is shown below:

Compared to the previous reporting period, the main

changes to deferred tax assets and liabilities were as

follows:

Application of the income tax rate of 30.2 %

(2006:

38.9 %), which is valid in Germany from 1 Jan-

uary 2008 onwards, significantly affected the meas-

urement of deferred tax assets and liabilities relating

to intangible assets, property, plant and equipment,

leased products, provisions and liabilities.

The changes in deferred tax assets and liabili-

ties relating to leased products and other current as-

sets are attributable primarily to the financial services

business.

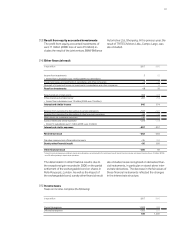

Deferred tax assets on tax losses available for

carryforward and on capital losses increased margin-

ally on a net basis. Tax losses available for carryfor-

ward, which for the most part can be carried forward

without restriction, totalled euro 1.8 billion at the

year-end (2006: euro 1.7 billion). A valuation allow-

ance of euro 43 million (2006: euro 65 million) was

recognised in 2007 on deferred tax assets relating

to tax losses. Capital losses in the United Kingdom

increased to euro 2.2 billion at the end of 2007

(2006: euro 1.5 billion). In this context, a definitive

agreement was reached with the UK tax authorities

in 2007. As in previous years, these tax losses

in euro million Deferred tax assets Deferred tax liabilities

2007 2006 2007 2006

Intangible assets 1 – 1,528 1,859

Property, plant and equipment 43 48 428 510

Leased products 558 572 3,205 3,368

Investments 2 2 1 –

Other current assets 1,110 1,058 3,767 3,696

Tax loss carryforwards 1,072 849 – –

Provisions 1,145 1,540 51 134

Liabilities 3,084 3,653 690 827

Consolidations 1,661 1,600 329 403

8,676 9,322 9,999 10,797

Valuation allowance – 671 – 528 – –

Netting – 7,285 – 8,039 – 7,285 – 8,039

720 755 2,714 2,758