BMW 2007 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2007 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

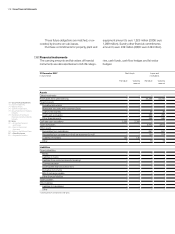

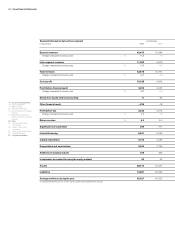

124 Group Financial Statements

73 Group Financial Statements

73 Income Statements

74 Balance Sheets

76 Cash Flow Statements

78 Group Statement of Changes

in Equity

79 Statement of Income and

Expenses recognised directly

in Equity

80 Notes

80 – Accounting Principles

and Policies

89 – Notes to the Income

Statement

96 – Notes to the Balance Sheet

117 – Other Disclosures

131 – Segment Information

dergoes a multi-stage process of repossession

and disposal in accordance with the legal situation

prevailing in each relevant market. The assets in-

volved are generally vehicles which can be con-

verted into cash at any time via the dealer organi-

sation.

Impairment losses are recorded as soon as

credit risks are identified on individual financial assets,

using a methodology specifically designed by the

BMW Group. More detailed information regarding

this methodology is provided in the section on ac-

counting policies.

The use of comprehensive rating and scoring

techniques and credit monitoring procedures

ensures the recoverability of the value of receivables

from sales financing which are neither overdue nor

impaired.

The credit risk relating to derivative financial in-

struments is minimised by the fact that the Group

only enters into such contracts with parties of first-

class credit standing. The general credit risk on de-

rivative financial instruments utilised by the BMW

Group is therefore not considered to be significant. A

concentration of credit risk with particular borrowers

or groups of borrowers has not been identified.

Further disclosures relating to credit risk, in par-

ticular impairment losses recognised, are provided in

the notes to the relevant category of receivables on

pages 100 to 105.

Liquidity risk

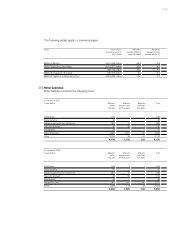

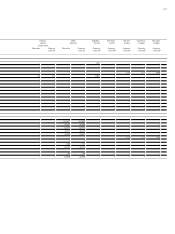

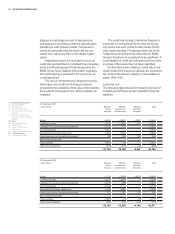

The following table shows the maturity structure of

contractual cash flows (undiscounted) for financial

liabilities:

31 December 2007

in euro million Maturity Maturity Maturity Total

within between one later than

one year and five years five years

Bonds – 5,947 – 10,627 – 4,920 – 21,494

Liabilities to banks – 4,736 – 1,630 – 551 – 6,917

Liabilities from customer deposits (banking) – 5,193 – 774 – – 5,967

Commercial paper – 5,474 – – – 5,474

Asset backed financing transactions – 1,854 – 5,043 – – 6,897

Interest and currency derivative instruments 63 234 132 429

Bills of exchange payable – – – –

Trade payables – 3,516 – 35 – – 3,551

Other financial liabilities – 497 – 273 – 128 – 898

– 27,154 – 18,148 – 5,467 – 50,769

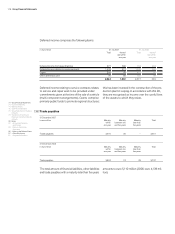

31 December 2006

in euro million Maturity Maturity Maturity Total

within between one later than

one year and five years five years

Bonds – 5,126 – 9,789 – 4,007 – 18,922

Liabilities to banks – 2,178 – 2,385 – 7 – 4,570

Liabilities from customer deposits (banking) – 5,250 – 699 – – 5,949

Commercial paper – 4,159 – – – 4,159

Asset backed financing transactions – 1,440 – 3,365 – – 4,805

Interest and currency derivative instruments – 127 287 127 287

Bills of exchange payable – 1 – – – 1

Trade payables – 3,624 – 74 – 39 – 3,737

Other financial liabilities – 260 – 235 – 220 – 715

– 22,165 – 16,260 – 4,146 – 42,571