BMW 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247

|

|

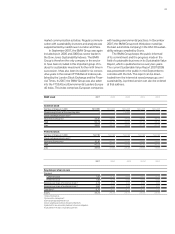

48 Group Management Report

10 Group Management Report

10 A Review of the Financial Year

13 General Economic Environment

17 Review of Operations

41 BMW Stock and Bonds

44 Disclosures relating to Takeover

Regulations and Explanatory Report

47 Financial Analysis

47 – Internal Management System

49 – Earnings Performance

51 – Financial Position

52 – Net Assets Position

55 – Subsequent Events Report

55 – Value Added Statement

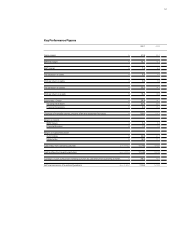

57 – Key Performance Figures

58 – Comments on BMW AG

62 Risk Management

68 Outlook

monitor and manage periodic targets on a long-term

basis in order to ensure that the BMW Group’s earn-

ings

performance can develop at a steady pace.

Periodic performance is managed in the light of de-

fined accounting policies and external financial re-

porting requirements. The BMW Group primarily

uses profit before tax and segment-specific rates of

return as the key indicator figures by which it manages

operating performance.

For example, return on capital employed is used

as the main performance indicator for the Automo-

biles and Motorcycles segments. Return on sales is

also used as a performance indicator. The return on

assets is used for the Group as a whole. In addition

to the return on assets, the Financial Services seg-

ment also manages its business using risk-based

performance indicators such as value-at-risk.

ROCE = Profit before financial result

Capital employed

ROA Group = Profit before interest expense and taxes

Balance sheet total

ROA Financial Services = Profit before tax

Operating assets

The ROCE is derived by dividing segment operat-

ing profit by segment capital employed. The latter

comprises all current and non-current operational

assets of the segment, less liabilities used opera-

tionally and which are not subject to interest e.g.

trade payables. This net amount is the capital em-

ployed.

The ROCE target value for the Automobiles

segment (i.e. the minimum required rate of return

derived from the cost of capital) is at least 26 %.

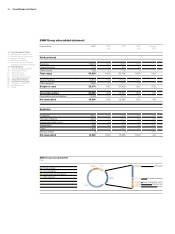

Key performance indicators 2007 2006 2005 2004* 2003

in %

*adjusted for new accounting treatment of pension obligations

Return on Capital Employed

Automobiles 22.8 21.7 23.2 25.4 23.8

Motorcycles 18.2 17.7 17.8 10.4 16.7

Return on Assets

Financial Services 1.3 1.4 1.3 1.4 1.4

BMW Group 5.3 6.3 5.6 6.5 6.6

Return on Assets Profit before tax / Profit before Operating assets / Return on Assets

interest expense and taxes Total assets

in euro million in euro million in %

2007 2006 2007 2006 2007 2006

Financial Services 743 685 59,040 50,529 1.3 1.4

BMW Group 4,721 4,979 88,997 79,057 5.3 6.3

Capital employed by 2007 2006

automobiles segment

in euro million

Assets employed 28,515 27,227

less: Non-interest bearing liabilities – 13,407 – 13,171

Capital employed 15,108 14,056