BMW 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 Group Management Report

10 Group Management Report

10 A Review of the Financial Year

13 General Economic Environment

17 Review of Operations

41 BMW Stock and Bonds

44 Disclosures relating to Takeover

Regulations and Explanatory Report

47 Financial Analysis

47 – Internal Management System

49 – Earnings Performance

51 – Financial Position

52 – Net Assets Position

55 – Subsequent Events Report

55 – Value Added Statement

57 – Key Performance Figures

58 – Comments on BMW AG

62 Risk Management

68 Outlook

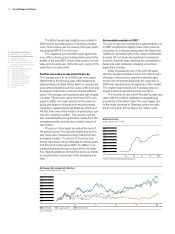

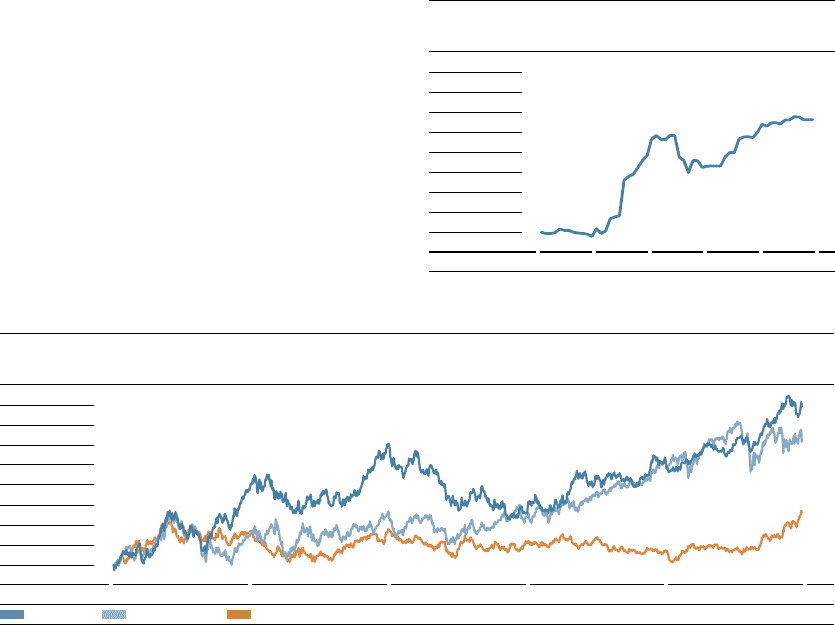

The British pound was slightly more volatile in

2007 than in preceding years. Following a healthy

start, it lost in value over the course of the year, finish-

ing at about GBP 0.73 to the euro.

The Japanese yen remained weak against the

euro. After a short period of appreciation around the

middle of the year 2007, the yen then went on to lose

value

and closed at yen 164 to the euro, some 4.5 %

lower than one year earlier.

Further increases in raw material prices

The average price of oil in 2007 was once again

higher than in the previous year. After dropping to

approximately US dollar 50 per barrel in January, the

price almost doubled over the course of the year and

by autumn it had risen to almost US dollar 100 per

barrel. The average cost during the year was roughly

US dollar 70 per barrel, up by more than 10 % com-

pared to 2006. The main reasons for this were on-

going shortages in oil production and processing

capacities, supplies being held back by OPEC and

the fact that some of the world’s oil-producing coun-

tries are currently unstable. This situation was fur-

ther exacerbated by rising demand, mainly from the

emerging markets and also by a certain amount of

speculation.

The price of steel again exceeded the level of

the previous year. This was also largely due to a fur-

ther sharp rise in demand coming mainly from the

emerging markets. The prices of most precious

metals have been rising continually for several years

and this trend continued in 2007. In addition to in-

creased demand, the loss in value of the US dollar

has created additional demand for precious metals

as investments, in particular in the emerging mar-

kets.

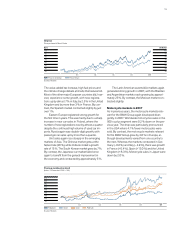

Automobile markets in 2007

The sale of cars rose worldwide by approximately 4 %

in 2007 and therefore slightly faster than in the pre-

vious year. As in the preceding years, the three main

traditional car markets (the USA, Japan and Western

Europe) did not show any significant momentum

in terms of growth rates, whereas the car markets in

Asian and Latin American emerging economies

again grew strongly.

Sales of passenger cars in the USA fell again,

this time by approximately 2.5 % to 16.1 million units.

Whereas in the previous year the market for light

trucks had contracted drastically, the reduction in

2007 was spread across all segments of the market.

The market share held by US manufacturers con-

tinued to decline and stood at just over 50 %.

The number of cars sold in Western Europe was

static with new vehicle registrations stagnating at

around the 14.8 million mark. This was largely due

to the sharp decrease in Germany, where car sales

fell by more than 9 % to below 3.2 million units.

Steel price trend

(Index: January 2003 = 100)

Source: German Federal Statistical Agency

03 04 05 06

180

170

160

150

140

130

120

110

100

07

Exchange rates compared to the Euro

(Index: 31 December 2002 = 100)

140

135

130

125

120

115

110

105

100

03 04 05 06 07

US

Dollar

Source: Reuters

Japanese Yen British Pound