BMW 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

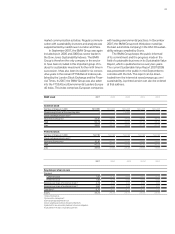

cash equivalents (+ 79.1 %) and receivables from

sales financing (+ 12.8 %). On the equity and liabili-

ties side of the balance sheet, the main increases

related to equity (+ 13.7 %) and financial liabilities

(+ 20.5 %).

Intangible assets increased by 6.7 % to euro

5,670 million. Within intangible assets, capitalised

development costs went up by 4.7 % to euro 5,034

million. Development costs recognised as assets

during the year under report amounted to euro 1,333

million (– 13.2 %), equivalent to a capitalisation ratio

of 42.4 % (2006: 47.9 %). The lower level of addi-

tions to capitalised development costs in 2007 was

due to the smaller number of projects in the series

development phase. Amortisation on intangible

assets amounted to euro 1,109 million (+27.2 %).

The carrying amount of property, plant and

equipment decreased slightly (– 1.6 %) to euro

11,108 million. The bulk of capital expenditure related

to further expansion of the worldwide production

and sales networks. Capital expenditure on property,

plant and equipment was euro 2,684 million or 1.1 %

more than in the previous year. Depreciation on prop-

erty, plant and equipment totalled euro 2,471 million

(+ 6.8 %). Balances brought forward for subsidiaries

being consolidated for the first time amounted to

euro 5 million. Capital expenditure on intangible as-

sets and property, plant and equipment totalled euro

4,267 million (– 1.1 %), which, as in the previous year,

was financed fully out of cash flow. Capital expendi-

ture as a percentage of revenues was 7.6 % (2006:

8.8 %).

As a result of the growth of financial services busi-

ness,

the total carrying amount of leased products

increased sharply by 24.7 % to euro 17,013 million.

Adjusted for changes in exchange rates, leased

products would have risen by 33.2 %.

The carrying amount of other investments de-

creased by 47.9 % to euro 209 million, mainly as a

result of the settlement of the exchangeable bond on

the investment in Rolls-Royce plc, London, com-

pleted in 2007. The BMW Group no longer holds any

shares in Rolls-Royce plc, London.

Receivables from sales financing were up by

12.8 % to euro 34,244 million due to higher busi-

ness volumes. Of this amount, retail customer and

dealer financing accounted for euro 26,181 million

(+ 13.6 %) and finance leases accounted for euro

8,063 million (+10.0 %). Inventories increased by

euro 555 million or 8.2 % to euro 7,349 million, mainly

due to higher business volumes. Trade receivables

went up by 18.3 % compared to one year earlier.

Financial assets increased by 21.4 % to euro

4,795 million, mainly as a result of higher fair values

of derivative financial instruments.

Liquid funds increased by 29.1 % to euro 4,352

million. Whereas marketable securities were roughly

at the previous year’s level, cash and cash equiva-

lents increased by euro 1,057 million compared to

one year earlier.

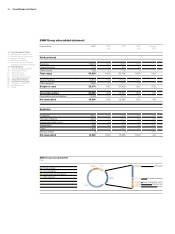

On the equity and liabilities side of the balance

sheet, equity grew by 13.7 % to euro 21,744 million.

The profit for the year attributable to shareholders of

BMW AG increased equity by euro 3,126 million. Fair

value changes recognised directly in other accumu-

lated equity reduced equity by euro 61 million (2006:

reduction of euro 43 million). The latter comprises

translation differences, fair value gains and losses

on financial instruments and available-for-sale secu-

rities as well as actuarial gains and losses for pension

provisions. The increase in the discount factor applied,

especially

in Germany, in 2007 gave rise to actuarial

gains totalling euro 528 million. The carrying amounts

of investments decreased, mainly reflecting the

settle ment of the exchangeable bond on shares in

Rolls-Royce plc, London. Translation differences re-

duced accumulated other equity by a further euro

384 million. By contrast, derivative financial instru-

ments increased by euro 366 million. Deferred taxes

on fair value gains and losses recognised directly

in equity corresponded to a negative amount of euro

388 million at 31 December 2007.

Minority interests amounted to euro 11 million.

The equity ratio of the BMW Group therefore im-

proved by 0.2 percentage points to 24.4 %.

The equity ratio for Industrial Operations was

43.8 % compared to 40.6 % at the end of the previ-

ous year. The equity ratio for Financial Operations fell

from 10.4 % at the end of the previous year to 9.2 %

at 31 December 2007.

The amount recognised in the balance sheet

for pension obligations decreased by 7.8 % to euro

4,627 million. As in the previous year, the amount re-

ported under pension provisions corresponds to the

full defined benefit obligation (DBO). In the case of

pension plans with fund assets, the fair value of fund

assets is offset against the defined benefit obliga-

tion. The decrease in pension obligations was attrib-

utable principally to the higher discount factor in

Germany.