BMW 2007 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2007 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13

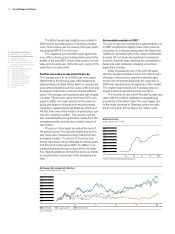

Economic developments in 2007

The global economy again grew strongly in 2007,

albeit at a slightly slower pace than in the previous

year. In addition to rising interest rates and the con-

tinuing high level of raw material prices, the main

reason for this development was the weakening of

the US residential property market and the resulting

weaker economic growth in the USA. Although the

credit crisis became acute from the middle of the

year onwards, the effects it had on the economy in

2007 were relatively minor and mainly restricted

to

the USA. In other countries, primarily the financial

markets were affected. In a number of instances,

central banks were forced to take measures to en-

sure that sufficient liquid funds were available on

the markets.

After a slow start at the beginning of the year,

the US economy picked up pace again over the

course of 2007, despite the enormous pressure

coming from the residential property sector. Rising

interest rates in recent years resulted in a large vol-

ume of bad debt losses, primarily in the area of sub-

prime borrowers. As a consequence, investment on

new residential property fell to an all-time low, with

property prices dropping for the first time in more

than 15 years. Despite these developments, private

consumption nevertheless grew sharply due to the

employment market remaining strong up to autumn.

In the face of the weak residential property market,

the rise in investment volumes was far lower than

that of the previous year. On the back of a weaker US

dollar, exports provided some momentum for the first

time in years with the result that the USA’s current

account deficit decreased slightly. Overall, the USA’s

gross domestic product grew by 2.2 % in 2007.

The euro region also registered strong growth

in 2007, albeit at a somewhat slower rate than in the

previous year. Despite the positive changes evident

on the employment market, consumers were more

reluctant to spend than one year earlier, whereas in-

vestment activity continued to increase sharply. Ex-

ports grew despite the strong euro. The current bal-

ance of the region as a whole was slightly positive,

although the results in individual countries varied con-

siderably. Overall, the euro region’s economy grew

by 2.7 % in 2007.

Economic growth in Germany weakened slightly

in 2007, reflecting the trend seen in the euro region

as a whole. Investment and exports again contributed

strongly to economic growth. By contrast, private

consumption failed to match the mildly positive trends

seen in previous years and stagnated in 2007. One

of the main negative factors was the value-added tax

increase that took effect in Germany at the beginning

of the year. Although the employment market im-

proved, and large numbers of new jobs were creat-

ed, this did not motivate consumers to spend more.

On top of this, from the summer onwards, the impe-

tus generated by the construction industry tailed off

sharply. Despite these adverse factors, the growth

rate of 2.5 % was only marginally below the previous

year’s level.

The economies of the new EU member coun-

tries also continued to grow robustly in 2007. Private

consumption and investment rose sharply in many

countries, but in spite of the increase in exports,

the current accounts of these countries remained,

for the most part, negative and in some cases quite

considerably so.

The Japanese economy remained on a stable

growth course in 2007 with momentum coming

from both domestic demand and exports. However,

the persisting worry of deflation remained in 2007,

resulting in price stagnation during the year. The

general price level increased only marginally, almost

entirely due to higher energy prices. The Japanese

Central Bank was therefore only able to raise interest

rates very slightly above zero. Overall, Japan’s gross

domestic product grew by approximately 2.1 % in

2007.

Alongside the emerging economies of Eastern

Europe, the fastest growth rates were again recorded

in 2007 by the markets in Latin America and East

Asia. Once again, China was one of the fastest grow-

ing markets. The investment boom there continued

in 2007 with the export surplus reaching a new record

figure. The monetary policy measures taken, includ-

ing higher interest rates, failed to hold down

eco-

nomic growth and a growth rate in excess of 11 % was

registered for the year. In India, too, economic growth

remained extremely strong at over 8 %. As in previous

years, however, the Indian current account remained

negative.

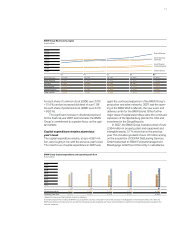

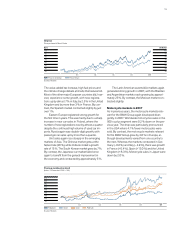

US dollar continues to lose value over the

course of the year

The US dollar continued to lose value sharply over

the course of 2007. After standing at US dollar 1.32

to the euro in January, it closed the year almost

10 % weaker at US dollar 1.46 to the euro. A rate of

almost US dollar 1.50 to the euro was recorded at

some stage during the period.

General Economic Environment