BMW 2007 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2007 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

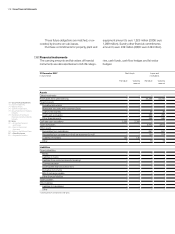

122 Group Financial Statements

73 Group Financial Statements

73 Income Statements

74 Balance Sheets

76 Cash Flow Statements

78 Group Statement of Changes

in Equity

79 Statement of Income and

Expenses recognised directly

in Equity

80 Notes

80 – Accounting Principles

and Policies

89 – Notes to the Income

Statement

96 – Notes to the Balance Sheet

117 – Other Disclosures

131 – Segment Information

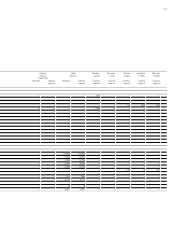

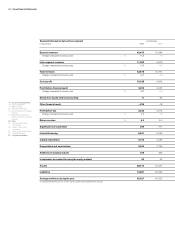

Gains/losses from the use of derivative instruments

relate primarily to fair value gains or losses arising on

stand-alone derivative instruments.

Write-downs of euro 49 million (2006: euro 2 mil-

lion)

on available-for-sale securities, for which fair

value changes were previously recognised directly

in equity, were recognised as expenses in 2007.

Reversals of write-downs on current marketable se-

curities of euro 2 million were recognised directly in

equity (2006: euro 4 million).

The disclosure of interest income resulting from

the unwinding of interest on future expected receipts

would normally only be relevant for the BMW Group

where assets have been discounted as part of the

process of determining impairment losses. However,

as a result of the assumption that most of the income

that is subsequently recovered is received within one

year and the fact that the impact is not material, the

BMW Group does not discount assets for the purposes

of determining impairment losses.

These interest rates were adjusted, where necessary, to take account of the credit quality and risk of the

underlying financial instrument.

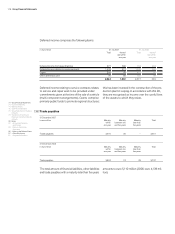

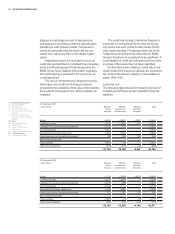

Fair value measurement of financial instruments

The fair values shown are computed using market

information available at the balance sheet date, on

the basis of prices quoted by the counterparties

or using appropriate measurement methods, e.g.

discounted cash flow models. In the latter case,

amounts were discounted at 31 December 2007

on the basis of the following interest rates:

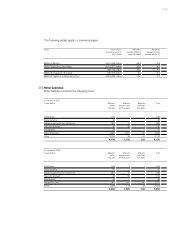

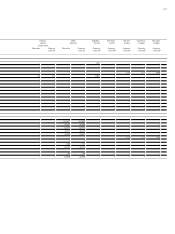

Gains and losses on financial instruments

The following table shows the net gains and losses arising for each of the categories of financial instrument

defined by IAS 39:

ISO-Code EUR USD GBP JPY

in %

Interest rate for six months 4.3 4.6 5.9 1.0

Interest rate for one year 4.3 4.2 5.7 1.1

Interest rate for five years 4.6 4.2 5.1 1.2

Interest rate for ten years 4.8 4.8 5.1 1.7

in euro million 2007 2006

Held for trading

Gains/losses from the use of derivative instruments – 39 17

Available-for-sale

Gains/losses on sale and fair value gains/losses on available-for-sale securities;

including equity investments carried at cost 49 44

Income from investments 3 62

Accumulated other equity

Balance at 1 January 214 562

Total change during the year – 179 – 348

– of which recognised in the income statement during the period under report – 168 – 431

Balance at 31 December 35 214

Loans and receivables

Impairment losses/reversals of impairment losses – 277 – 190

Other income/expenses – 12 – 31

Other liabilities

Income/expenses 168 108