BMW 2007 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2007 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

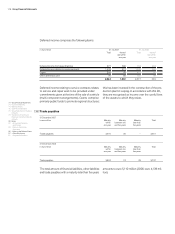

During the period under report, an expense of euro

4 million (2006: euro 3 million) was recognised in the

income statement to reflect the ineffective portion of

cash flow hedges.

At 31 December 2007, the BMW Group held

derivative instruments with terms of up to 41 months

(2006: 44 months) to hedge currency risks attached

to future transactions. It is expected that euro 384 mil-

lion

of net gains, recognised in equity at the balance

sheet date, will be recognised in the income state-

ment in 2008.

At 31 December 2007, the BMW Group held de-

rivative instruments with terms of up to 108 months

The difference between the gains/losses on hedging

instruments and the result recognised on hedged

items represents the ineffective portion of fair value

hedges.

Fair value hedges are mainly used to hedge

bonds and other financial liabilities.

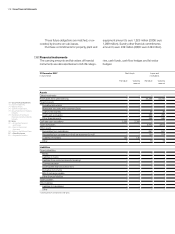

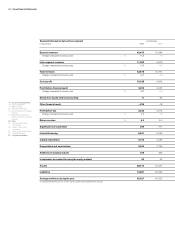

Credit risk

Notwithstanding the existence of collateral accepted,

the carrying amounts of financial assets generally

take account of the maximum credit risk arising from

the possibility that counterparties will not be able

to fulfil their contractual obligations. The maximum

credit risk for irrevocable credit commitments relat-

ing to credit card business amounted to euro 2,082

million (2006: euro 1,395 million). The equivalent

figure for dealer financing was euro 12,043 million

(2006: euro 9,968 million).

(2006: 120 months) to hedge interest rate risks

at-

tached to future transactions. It is expected that euro

5 million of net gains, recognised in equity at the

balance sheet date, will be recognised in the income

statement in 2008.

Cash flow hedges are used to hedge cash flows

arising in conjunction with the supply of vehicles to

subsidiaries.

Fair value hedges

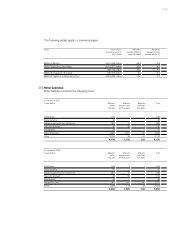

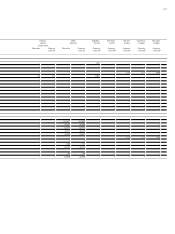

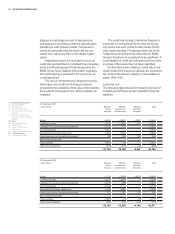

The following table shows gains and losses on

hedging instruments and hedged items which are

deemed to be part of a fair value hedge relationship:

In the case of performance relationships under-

lying non-derivative financial instruments, collateral

will be required, information on the credit standing

of the counterparty obtained or historical data based

on the existing business relationship (i.e. payment

patterns to date) reviewed in order to minimise the

credit risk, all depending on the nature and amount

of the exposure that the BMW Group is proposing to

enter into.

Within the financial services business, the

financed items (e.g. vehicles, equipment and prop-

erty) in the retail customer and dealer lines of busi-

ness serve as first-ranking collateral with a recover-

able value. Security is also put up by customers in the

form of collateral asset pledges, asset assignment

and first-ranking mortgages, supplemented where

appropriate by warranties and guarantees. If an item

previously accepted as collateral is acquired, it un-

in euro million 2007 2006

Balance at 1 January 178 29

Total changes during the year 260 149

– of which recognised in the income statement during the period under report – 260 – 266

Balance at 31 December 438 178

in euro million 31.12. 2007 31.12. 2006

Gains/losses on hedging instruments designated as part of a fair value hedge relationship 272 159

Profit/loss from hedged items – 271 – 147

1 12

Cash flow hedges

The effect of cash flow hedges on accumulated other equity was as follows: