BMW 2007 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2007 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

[39]

Other risks

The BMW Group is exposed to raw material price

risks. A description of how the raw material price risk

is managed is provided in the Group Management

Report on page 63. Derivative financial instruments

are used on a relatively small scale to reduce these

risks, primarily for the purchase of precious metals.

The risk from these derivatives was not material to

the Group in 2007 and 2006 and remains small at

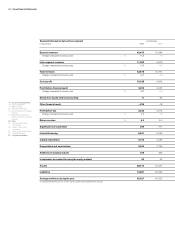

Explanatory notes to the cash flow statements

The cash flow statements show how the cash and

cash equivalents of the BMW Group, Industrial

Operations and Financial Operations have changed

in the course of the year as a result of cash inflows

and cash outflows. In accordance with IAS 7 (Cash

Flow Statements), cash flows are classified into cash

flows from operating, investing and financing activi-

ties. The cash flow statements of the BMW Group

are presented on pages 76 and 77.

Cash and cash equivalents included in the cash

flow statement comprise cash in hand, cheques,

and cash at bank, to the extent that they are available

within three months from the balance sheet date

and are subject to an insignificant risk of changes in

value. The negative impact of changes in cash and

cash equivalents due to the effect of exchange rate

fluctuations in 2007 was euro 47 million (2006:

negative impact of euro 42 million).

The cash flows from investing and financing ac-

tivities are based on actual payments and receipts.

The cash flow from operating activities is computed

using the indirect method, starting from the net profit

of the Group. Under this method, changes in assets

the balance sheet date. For this reason, a sensitivity

analysis for these derivatives is not provided.

A further exposure relates to the residual value

risk on vehicles returned to the Group at the end of

lease contracts. The risks from financial instruments

used in this context were not material to the

Group

in

the past or at the balance sheet date. A description

of how these risks are managed is provided in the

Group Management Report on pages 64 and 65.

and liabilities relating to operating activities are ad-

justed for currency translation effects and changes

in the composition of the Group. The changes in

balance sheet positions shown in the cash flow

statement do not therefore agree directly with the

amounts shown in the Group balance sheet.

If the BMW Group acts as the lessor in a finance

lease, the relevant cash flows are reported in the

cash flow statement as part of the cash flow from

investing activities. If the BMW Group acts as the

lessee in a finance lease, the cash flows are reported

as part of the cash flows from operating and invest-

ing activities.

If the BMW Group acts as the lessor in an oper-

ating lease, cash flows are reported as part of the

cash flow from investing activities. In the final case,

where the BMW Group acts as the lessee in an

operating lease, cash flows are reported as part of

the cash flow from operating activities.

The payment for the acquisition of DEKRA

SüdLeasing Services GmbH, Stuttgart, and that en-

tity’s subsidiaries (euro 121 million) is included for

the most part in investing activities.

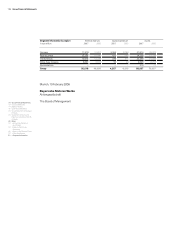

In the following table the potential volume of fair

value fluctuations – measured on the basis of the

value-at-risk approach – are compared with the ex-

pected value for the interest rate relevant positions

of the BMW Group for the three principal curren-

cies:

in euro million 31.12. 2007 31.12. 2006

Euro 76 62

US dollar 109 85

British pound 10 7