BMW 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

New purchasing and supplier network

corporate division

As part of its strategic realignment and in the light of

the ever-increasing complexity of the supplier chain

structure, the BMW Group created a new Purchas-

ing and Supplier Network corporate division with

effect from 1 October 2007. In addition to purchas-

ing, the following functions have been assigned to

the division: quality management of parts, logistics,

vehicle components and systems. This new division

has been charged with the task of achieving even

further improvements in the areas of quality, supplier

loyalty and costs. This will involve keeping the num-

ber of system interfaces to a minimum and opti-

mising processes right from the raw material stage

through to the finished product.

Purchase volume increased in Central and

Eastern Europe

The BMW Group’s purchase volume went up in

2007 in line with the expansion of production activi-

ties. Increased global sourcing activities as well as

the successful implementation of a quality and cost

initiative resulted in an increase in the volume of

purchases sourced in Central and Eastern Europe.

The purchase volume in Western Europe also in-

creased, reflecting increased production of the

MINI. The purchase volume in the NAFTA region

was also up, due to the first full year of production

of the new BMW X5 at the Spartanburg plant in the

USA. The volume of purchases sourced in South

America fell sharply due to the fact that the engine

cooperation arrangements with TRITEC are wound

down.

The proportion of production material purchases

sourced in Germany was down in percentage terms

and accounted for approximately one half of mate rial

procurements. In the remaining regions, volumes in-

creased in line with production growth. The ratio of

material procurements to the total purchase volume

remained practically unchanged.

Situation on the commodity markets

remains tense

The high price levels on the raw material markets

once again represented a major challenge for the

Group’s purchasing departments in 2007. The addi-

tional costs were spread over the entire value-added

chain with the BMW Group also bearing its share.

Compared to the previous year, the average market

prices of steel and plastics were up by 10 % and 6 %

respectively in 2007. By contrast, the price of alu-

minium fell by 5 % and that of copper by 1 %.

Overall, the prices of industrial raw materials,

non-ferrous metals and energy raw materials in-

creased by 7 %, 4 % and 2 % respectively in 2007.

Compared to the previous year, the prices of pre-

cious metals relevant for the BMW Group went up

in 2007 by rates of between 11 % and 35 %. In the

case of precious metals (rhodium, palladium, plati-

num), purchase price hedges reduced the impact of

sharp market price rises for the BMW Group.

Close cooperation with suppliers strengthens

competitiveness

Given the high share of suppliers in the value-added,

cooperating closely with them represents a major

factor in improving products and processes. The

BMW Group is involving its large system suppliers

from the very initial stage of a development project

even more intensively. Joint analyses are carried out

to identify potential areas where efficiency can be

improved and development and manufacturing costs

reduced. Any solutions that these joint teams come

up with are taken into account in current and future

development projects.

Further investigations are made along the entire

value-added chain to identify potential ways of

achieving further product and/or process improve-

ments. Ensuring that close networks are in place

between internal and external partners has an impor-

tant role to play here. Increasing the transparency

of activities with suppliers is also seen as being vital

for the BMW Group.

One of the main objectives of supplier manage-

ment is to raise the quality of bought-in material.

Suppliers to the Group are increasingly taking over

responsibility in this respect. As part of the process

of managing supplier performance and expertise,

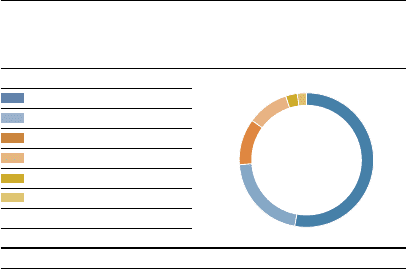

Regional mix of BMW Group purchase volumes 2007

in %, basis: production material

Germany

Rest of Western Europe

Central and Eastern Europe

NAFTA

Asia/Australia

Africa

10

11

32

21

53