BMW 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247

|

|

51

3,232 million despite the adverse factors described

above.

Revenues of the Motorcycles segment fell by

2.9 %. Ongoing efficiency improvements neverthe-

less allowed the segment result to improve. The

segment profit before tax, at euro 71 million, im-

proved by 7.6 % compared to the previous year.

The Financial Services segment was again able

to expand its business successfully in 2007, enabling

the segment profit to be improved by 8.5 % on a

year-on-year comparison. Reconciliations to the

Group profit from ordinary activities were again neg-

ative in 2007, with a net expense of euro 173 million;

this represented a deterioration of euro 534 million

compared to the previous year. This was largely due

to the higher gain recognised in the previous year on

the settlement of the exchangeable bond on shares

in Rolls-Royce plc, London, and to fair value losses

recognised on derivative financial instruments.

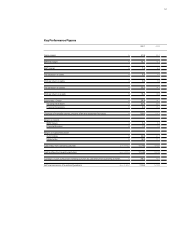

Financial Position

The Group cash flow statement shows the sources

and applications of cash flows for the financial years

2007 and 2006, classified into cash flows from oper-

ating, investing and financing activities.

Cash flows from operating activities are deter-

mined indirectly starting with the Group net profit. By

contrast, cash flows from investing and financing ac-

tivities are based on actual payments and receipts.

Cash and cash equivalents in the cash flow state-

ment correspond to the amount disclosed in the

balance sheet.

Operating activities of the BMW Group gener-

ated a positive cash flow of euro 11,794 million in

2007, an increase of euro 1,814 million or 18.2 %

compared to the previous year. Changes in net cur-

rent assets during 2007 generated a cash inflow of

euro 204 million (2006: euro 174 million). The cash

outflow for investing activities amounted to euro

17,248 million and was therefore euro 3,578 million

higher than in 2006. Capital expenditure for intangi-

ble assets and property, plant and equipment result-

ed in the cash outflow for investing activities de-

creasing by euro 46 million on a year-on-year

comparison. The cash outflow for net investments

in financial services activities rose steeply and was

euro 3,604 million higher than in the previous year.

Financing activities in 2007 generated a positive

cash flow of euro 6,557 million (2006: euro 3,323

million). Cash inflows from the issue of bonds to-

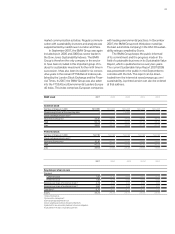

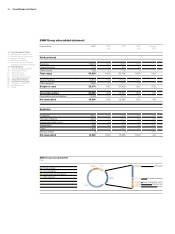

Revenues by segment

in euro million 2007 2006

Automobiles 53,818 47,767

Motorcycles 1,228 1,265

Financial Services 13,940 11,079

Reconciliations – 12,968 – 11,112

Group 56,018 48,999

Profit before tax by segment

in euro million 2007 2006

Automobiles 3,232 3,012

Motorcycles 71 66

Financial Services 743 685

Reconciliations – 173 361

Group 3,873 4,124