BMW 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

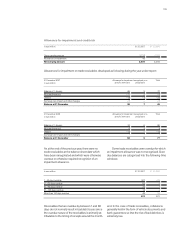

107

lion). This includes a minority interest of euro 8 mil-

lion (2006: euro 6 million) in the results for the

period.

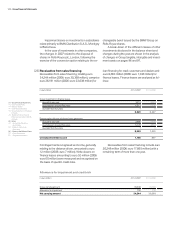

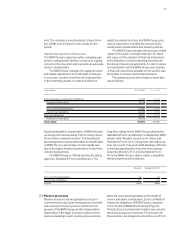

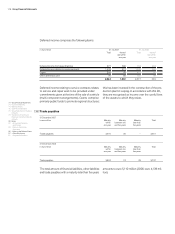

Capital management disclosures

The BMW Group’s objectives when managing capi-

tal are to safeguard the ability to continue as a going

concern in the long-term and to provide an adequate

return to shareholders.

The BMW Group manages the capital structure

and makes adjustments to it in the light of changes

in economic conditions and the risk characteristics

of the underlying assets. In order to maintain or

adjust the capital structure, the BMW Group uses

various instruments including the amount of divi-

dends paid to shareholders and share buy-backs.

The BMW Group manages the structure of debt

capital on the basis of a target debt ratio. An impor-

tant aspect of the selection of financial instruments

is the objective to achieve matching maturities for

the Group’s financing requirements. In order to reduce

non-systematic risk, the BMW Group uses a variety

of financial instruments available on the world’s capi-

tal markets to achieve optimal diversification.

The capital structure at the balance sheet date

was as follows:

Equity attributable to shareholders of BMW AG went

up during the financial year by 13.6 %, mainly due to

the increase in revenue reserves. The decrease in

percentage terms (equity attributable to shareholders

of BMW AG as a percentage of total capital) was

due to the higher funding requirements for the finan-

cial services business.

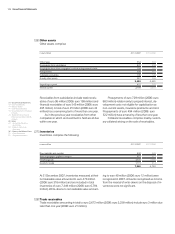

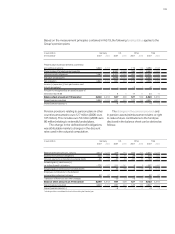

The BMW Group is officially rated by the rating

agencies, Standard & Poor’s and Moody’s. The

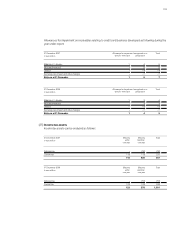

Pension provisions

Pension provisions are recognised as a result of

commitments to pay future vested pension benefits

and current pensions to present and former em-

ployees of the BMW Group and their dependants.

Depending on the legal, economic and tax circum-

stances prevailing in each country, various pension

long-term ratings for the BMW Group published by

Standard & Poor’s and Moody’s in September 2005

remain valid. Moody’s issued an A1 rating and

Standard & Poor’s an A+ rating, both with stable out-

look. As a result of its good credit standing, reflected

in the long-standing first-class short-term ratings

issued by Moody’s (P-1) and Standard & Poor’s

(A-1), the BMW Group is able to obtain competitive

refinancing terms and conditions.

plans are used, based generally on the length of

service and salary of employees. Due to similarity of

nature, the obligations of BMW Group companies

in the US and of BMW (South Africa) (Pty) Ltd.,

Pretoria, for post-employment medical care are also

disclosed as pension provisions. The provision for

these pension-like obligations amounts to euro 55 mil-

in euro million 31.12. 2007 31.12. 2006

Equity attributable to shareholders of BMW AG 21,733 19,126

Proportion of total capital 33.1 % 34.4 %

Non-current financial liabilities 21,428 18,800

Current financial liabilities 22,493 17,656

Total financial liabilities 43,921 36,456

Proportion of total capital 66.9 % 65.6 %

Total capital 65,654 55,582

Moody’s Standard & Poor’s

Non-current financial liabilities A1 A+

Current financial liabilities P-1 A-1

Outlook stable stable

[31]