BMW 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 Group Management Report

10 Group Management Report

10 A Review of the Financial Year

13 General Economic Environment

17 Review of Operations

41 BMW Stock and Bonds

44 Disclosures relating to Takeover

Regulations and Explanatory Report

47 Financial Analysis

47 – Internal Management System

49 – Earnings Performance

51 – Financial Position

52 – Net Assets Position

55 – Subsequent Events Report

55 – Value Added Statement

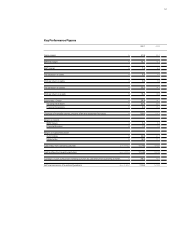

57 – Key Performance Figures

58 – Comments on BMW AG

62 Risk Management

68 Outlook

on the BMW Group investment in TRITEC Motors

Ltda., Campo Largo. These shares were sold to

the Chrysler Group in 2007. The net positive result

from investments decreased by euro 35 million. Net

interest expense improved by euro 31 million. Within

the net interest result, the net negative amount re-

sulting from unwinding the discounting on pension

obligations and recognising income for the expected

return on pension plan assets improved by 3.8 % on

a year-on-year basis.

As a result of the changes in the financial result

described above, profit before tax fell by 6.1 % com-

pared to the previous year. The pre-tax return on

sales was 6.9 % (2006: 8.4 %). Excluding the impact

of the settlement of the exchangeable bond on

shares in Rolls-Royce plc, London, and the fair mar-

ket loss on the option obligation, the profit before tax

improved by 0.6 % to euro 3,776 million.

The Group net profit was euro 260 million or

9.0% above the figure reported in the previous year.

The significantly lower effective tax rate is due to

effect of the Business Tax Reform Act 2008 and the

resulting decrease in deferred taxes.

The Automobiles segment recorded a 9.2 %

increase in sales volume and a 12.7 % increase in

revenues. Segment profit improved by 7.3 % to euro

The positive net amount from other operating in-

come and expenses fell by 11.9 % compared to the

previous year. Other operating income decreased

primarily as a result of lower income from the reversal

of provisions. Other operating expenses increased

slightly by euro 13 million or 2.5 %.

The profit before financial result increased by

euro 162 million (4.0 %) against the previous year

and therefore reached a new high level.

The financial result deteriorated by euro 413 mil-

lion, of which euro 445 million relates to the line

Other financial result. As stated above, earnings in

2006 included a gain of euro 372 million resulting

from the partial settlement of the exchangeable bond

on shares in Rolls-Royce plc, London. Further con-

versions in 2007 gave rise to a gain of euro 97 mil-

lion. The bond was completely settled by the end

of 2007. In addition to the gain on the exchangeable

bond, other financial result also includes losses on

other derivative financial instruments, in particular

stand-alone interest-rate derivatives. A changed

market interest rate structure caused the fair values

of these financial instruments to decrease. The net

result from using the equity method improved by

euro 36 million. This was primarily attributable to

an impairment loss recognised in the previous year

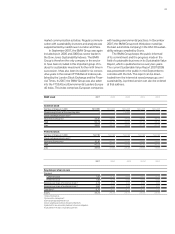

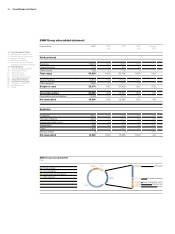

Group Income Statement

in euro million 2007 2006

Revenues 56,018 48,999

Cost of sales – 43,832 – 37,660

Gross profit 12,186 11,339

Sales and administrative costs – 5,254 – 4,972

Research and development costs – 2,920 – 2,544

Other operating income 730 744

Other operating expenses – 530 – 517

Profit before financial result 4,212 4,050

Result from equity accounted investments 11 – 25

Other financial result – 350 99

Financial result – 339 74

Profit before tax 3,873 4,124

Income taxes – 739 – 1,250

Net profit 3,134 2,874