Air New Zealand 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2014 7

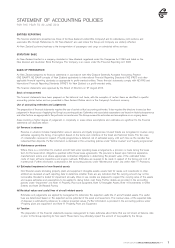

ENTITIES REPORTING

The financial statements presented are those of Air New Zealand Limited (the Company) and its subsidiaries, joint ventures and

associates (the Group). References to “Air New Zealand” are used where the Group and Company are similarly affected.

Air New Zealand’s primary business is the transportation of passengers and cargo on scheduled airline services.

STATUTORY BASE

Air New Zealand Limited is a company domiciled in New Zealand, registered under the Companies Act 1993 and listed on the

New Zealand and Australian Stock Exchanges. The Company is an issuer under the Financial Reporting Act 1993.

BASIS OF PREPARATION

Air New Zealand prepares its financial statements in accordance with New Zealand Generally Accepted Accounting Practice

(“NZ GAAP”). NZ GAAP consists of New Zealand equivalents to International Financial Reporting Standards (“NZ IFRS”) and other

applicable financial reporting standards as appropriate to profit-oriented entities. These financial statements comply with NZ IFRS and

International Financial Reporting Standards (“IFRS”). Air New Zealand is a profit-oriented entity.

The financial statements were approved by the Board of Directors on 27 August 2014.

Basis of measurement

The financial statements have been prepared on the historical cost basis, with the exception of certain items as identified in specific

accounting policies below and are presented in New Zealand Dollars which is the Company’s functional currency.

Use of accounting estimates and judgements

The preparation of financial statements requires the use of certain critical accounting estimates. It also requires the directors to exercise their

judgement in the process of applying the Group’s accounting policies. Estimates and associated assumptions are based on historical experience

and other factors, as appropriate to the particular circumstances. The Group reviews the estimates and assumptions on an ongoing basis.

Areas involving a higher degree of judgement or complexity, or areas where assumptions and estimates are significant to the financial

statements are disclosed below:

(a) Revenue in advance

Revenue in advance includes transportation sales in advance and loyalty programmes. Unused tickets are recognised in revenue using

estimates regarding the timing of recognition based on the terms and conditions of the ticket and historical trends. The fair value

of consideration received in respect of loyalty programmes is deferred, net of estimated expiry, until such time as the member has

redeemed their Airpoints. Further information is disclosed in the accounting policies under “Airline revenue” and “Loyalty programmes”.

(b) Maintenance provisions

Where there is a commitment to maintain aircraft held under operating lease arrangements, a provision is made during the lease

term for the lease return obligations specified within those lease agreements. The provision is based upon historical experience,

manufacturers’ advice and, where appropriate, contractual obligations in determining the present value of the estimated future

costs of major airframe inspections and engine overhauls. Estimates are required to be made in respect of the timing and cost of

maintenance. Further information is disclosed in the accounting policies under “Maintenance costs” and within Note 17 Provisions.

(c) Estimated impairment of non-financial assets

Non-financial assets (including property, plant and equipment, intangible assets, assets held for resale, and investments in other

entities) are reviewed at each reporting date to determine whether there are any indicators that the carrying amount may not be

recoverable. Goodwill is tested for impairment annually. Value in use models are prepared to support the carrying value of the assets

and require estimates and assumptions to be applied to derive future cash flows. Further details are provided in the accounting

policies under “Impairment” and Note 11 Property, Plant and Equipment, Note 12 Intangible Assets, Note 14 Investments in Other

Entities and Note 29 Related Parties.

(d) Residual values and useful lives of aircraft related assets

Estimates and judgements are applied by management to determine the expected useful life of aircraft related assets. The useful

lives are determined based on the expected service potential of the asset and lease term. The residual value, at the expected date

of disposal, is estimated by reference to external projected values. Further information is provided in the accounting policies under

“Property, plant and equipment” and Note 11 Property, Plant and Equipment.

(e) Taxation

The preparation of the financial statements requires management to make estimates about items that are not known at balance date

or prior to the Group reporting its final result. These items may ultimately impact the amount of tax payable by the Group.

STATEMENT OF ACCOUNTING POLICIES

FOR THE YEAR TO 30 JUNE 2014