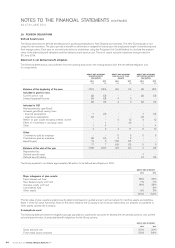

Air New Zealand 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2014 35

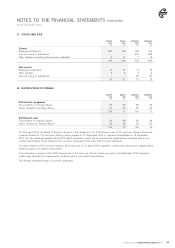

20. DERIVATIVE FINANCIAL INSTRUMENTS

This note summarises the impact of derivative financial instruments on the Statement of Financial Position, Statement of Changes in

Equity, Statement of Comprehensive Income and Statement of Financial Performance. The nature and purpose of derivative financial

instruments is detailed in Note 18.

Derivatives are required to be recognised in the Statement of Financial Position at their fair market value, with subsequent changes in

fair value being recognised through earnings. Changes in the fair value of those derivatives which have been successfully designated as

part of a cash flow hedge relationship are recognised through the cash flow hedge reserve, to the extent that they are effective.

Any accounting ineffectiveness is recognised through earnings.

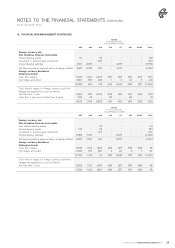

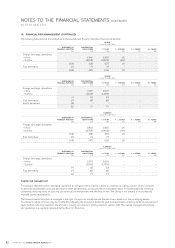

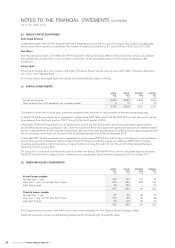

Derivative financial instruments recognised on the Statement of Financial Position are as follows:

GROUP

2014

$M

GROUP

2013

$M

COMPANY

2014

$M

COMPANY

2013

$M

Current derivative financial assets

30 98 30 98

30 98 30 98

Current derivative financial liabilities

Term derivative financial liabilities

(57)

(1)

(13)

-

(57)

(1)

(8)

-

(58) (13) (58) (8)

Net derivative financial instruments (28) 85 (28) 90

Of which:

Designated as cash flow hedges

Non-hedge accounted

(14)

(14)

56

29

(14)

(14)

55

35

Net derivative financial instruments (28) 85 (28) 90

Derivatives designated as cash flow hedges

Air New Zealand manages its exposure to highly probable future foreign currency and fuel transactions through the use of derivatives

designated within qualifying cash flow hedges. The use of cash flow hedges allows the timing of the recognition of gains or losses

on the hedging instrument to be matched with that of the gains or losses arising on the underlying hedged exposures, subject to the

requirements of NZ IAS 39 - Financial Instruments: Recognition and Measurement.

NZ IAS 39 requires hedge effectiveness to be determined for accounting purposes within strict parameters. Each derivative transaction

used to hedge identified risks must be documented and proven to be effective in offsetting changes in the value of the underlying

risk within a range of 80% - 125%. This measure of effectiveness may result in economically appropriate hedging transactions being

deemed ineffective for accounting purposes. In particular, the use of crude oil derivatives as a proxy for jet fuel, and the high volatility of

fuel markets may cause cash flow hedges in respect of fuel derivatives to fail the accounting hedge effectiveness test.

Risk management practices are determined on an economic basis, rather than being designed to achieve a particular accounting

outcome. Consequently, it is expected that this will result in some transactions failing the accounting hedge effectiveness criteria from

time to time and ineffectiveness being recorded through earnings in periods other than when the hedged item occurs, causing some

volatility through earnings.

Some components of hedge accounted derivatives are excluded from the designated risk. Cash flow hedges in respect of fuel derivatives

only include the intrinsic value of the fuel options with all other components of the option value (mainly time value) being marked to

market through “Fuel”. Similarly, forward points (the differential in interest rates between currencies) are excluded from the hedge

designation in respect of foreign currency derivatives which hedge account forecast foreign currency operating revenue and expenditure

transactions. These components are not hedge accounted and, accordingly, marked to market through “Finance costs”.

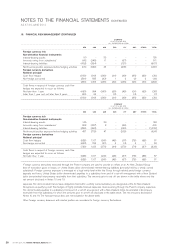

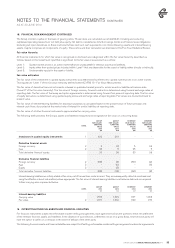

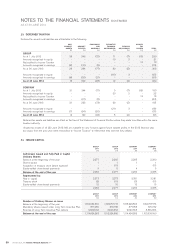

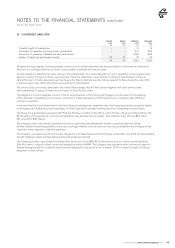

To the extent that qualifying cash flow hedges were assessed as highly effective, a summary of the amounts that were included in the

cash flow hedge reserve, together with the nature of the hedged risk exposure is as follows:

GROUP

2014

$M

GROUP

2013

$M

COMPANY

2014

$M

COMPANY

2013

$M

Future foreign currency operating revenue and expenditure

Future foreign currency capital expenditure

Future foreign currency sales of non-financial assets

Future fuel expenditure

43

26

3

1

116

59

2

(3)

29

26

-

1

112

59

-

(3)

Tax effect

73

(22)

174

(51)

56

(17)

168

(49)

Cash flow hedge reserve 51 123 39 119

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2014