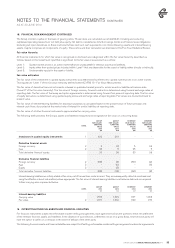

Air New Zealand 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2014 39

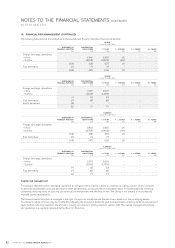

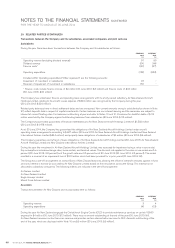

24. ISSUED CAPITAL (CONTINUED)

SHARE ISSUE DETAILS AND RIGHTS

Ordinary Shares

At 30 June 2014, there were 1,114,424,283 fully paid Ordinary Shares on issue (30 June 2013: 1,103,924,560). The amount of treasury

stock held as at 30 June 2014 is 2,515,463 shares (30 June 2013: 8,767,795 shares).

On 20 September 2013, 877,055 Ordinary Shares were issued to executives under the Mandatory Shareholding section of the Long

Term Incentive Plan (21 September 2012: 370,732 Ordinary Shares). The issue price of $1.043 per Ordinary Share represented a

discounted price determined on the basis of an independent valuation, reflecting restrictions placed on the transfer of the shares under

the terms of the Long Term Incentive Plan Rules (21 September 2012: $0.84 per Ordinary Share).

The dividend reinvestment plan is currently suspended.

Non New Zealand nationals are restricted from holding or having an interest in 10 percent or more of voting shares unless the prior

written consent of the Kiwi Shareholder is obtained. In addition, any person that owns or operates an airline business is restricted from

holding any shares in the Company without the Kiwi Shareholder’s prior written consent.

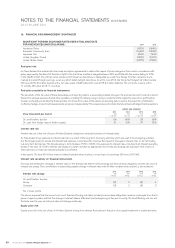

EQUITY-SETTLED SHARE-BASED PAYMENTS

Options over Ordinary Shares

Share options are granted to a number of senior executives on attainment of predetermined performance objectives. The Company is

currently undertaking a stock settled share appreciation rights scheme whereby shares are issued equating to the delta between the

market price and the exercise price.

The total expense recognised in the year ended 30 June 2014 in respect of equity-settled share-based payment transactions was

$4 million (30 June 2013: $5 million). The total outstanding options at 30 June 2014 is 74,389,248 (30 June 2013: 97,413,817).

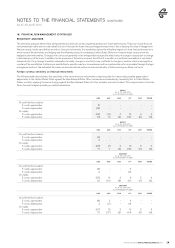

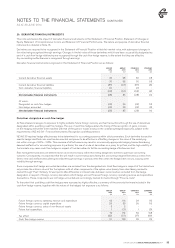

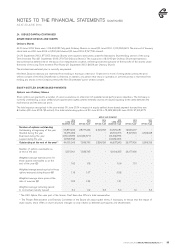

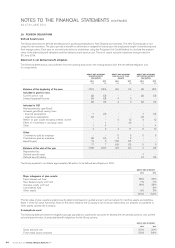

GROUP AND COMPANY

2014

LONG TERM

INCENTIVE PLAN

2014

CEO

OPTION PLAN*

2014

CFO

OPTION PLAN

2013

LONG TERM

INCENTIVE PLAN

2013

CEO

OPTION PLAN*

2013

CFO

OPTION PLAN

Number of options outstanding

Outstanding at beginning of the year

Granted during the year

Exercised during the year

Lapsed during the year

66,837,243

16,473,959

(18,101,585)

(1,158,272)

28,177,436

-

(20,238,671)

-

2,399,138

-

-

-

60,679,081

25,610,275

(16,412,875)

(3,039,238)

19,569,917

8,607,519

-

-

-

2,399,138

-

-

Outstanding at the end of the year** 64,051,345 7,938,765 2,399,138 66,837,243 28,177,436 2,399,138

Number of options exercisable as

at end of the year

Weighted average exercise price for

those options exercisable as at the

end of the year ($)

Weighted average exercise price for those

options exercised during the year ($)

Weighted average share price at the

date of exercise ($)

Weighted average remaining period

to contractual maturity (years)

5,517,001

1.42

1.18

1.90

3.0

7,938,765

1.18

1.07

1.94

0.2

-

-

-

-

3.3

12,134,225

1.06

0.98

1.31

3.0

28,177,436

1.10

-

-

1.2

-

-

-

-

4.3

* The CEO Option Plan was part of the former Chief Executive Officer’s total remuneration.

** The People Remuneration and Diversity Committee of the Board will adjust option terms, if necessary, to ensure that the impact of

share issues, share offers or share structure changes is value neutral as between participants and shareholders.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2014