Air New Zealand 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

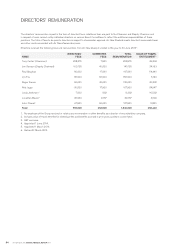

REMUNERATIONPHILOSOPHY

In order to attract and retain talented individuals, Air New Zealand’s performance and reward strategy is aligned with both the recruitment

philosophy – to source talented people, and our capability development agenda – to develop future leaders and provide succession

pipelines into key roles. The key objectives of the strategy are attracting high performing individuals, providing rich developmental

opportunities and recognising achievement through targeted performance and reward initiatives.

Air New Zealand’s remuneration strategy is underpinned by a pay for performance philosophy and accordingly positions base pay for

competent performance below the market median for all Individual Employee Agreements including the Chief Executive Officer (CEO), and

uses annual performance incentives to create opportunities for everyone to achieve market competitive remuneration levels and in the case

of superior performance, total remuneration in excess of market.

The overall remuneration strategy is designed to provide remuneration based on performance against agreed stretch targets, align actions

with shareholder interests and balance competitiveness with affordability. The CEO and executive remuneration packages are made up of

three components:

• Fixedbasesalary;

• Annualperformanceincentive;and

• Longtermincentive.

FIXED BASE SALARY

Air New Zealand’s philosophy is to set fixed base salaries at 90 percent of the market median for executives who are fully competent

in their role.

ANNUALPERFORMANCE INCENTIVE

The annual performance incentive component is delivered through the Air New Zealand Short Term Incentive Scheme (STI). The measures

used in determining the quantum of the STI are set annually. Targets relate to both Company financial performance and individual targets.

For the CEO the STI weighting is based 60% on Company nancial performance and 40% on individual performance against specic

targets. For all other employees the weighting is 50% Company nancial performance and 50% individual performance.

The main factors for assessment for the 2014 financial year were:

• Financialperformancefallingwithinanexecutive’sspecificresponsibilities;

• Businessperformance;

• Strategydevelopmentanddelivery;and

• People,cultureandleadershipperformance.

At the beginning of each nancial year the Board conrms a nancial target for the Company for incentive payments which is set 10%

above the average Normalised Earnings before Taxation achieved by the Company over the previous five year period.

LONG TERM INCENTIVE

Air New Zealand’s long term incentive plan arrangements are designed to align the interests of the CEO and senior executives with those

of our shareholders and to incentivise participants in the plan to enhance long term shareholder value. In the 2014 financial year the plan

available to executives was the Air New Zealand Long Term Incentive Plan (LTIP).

There are two main elements to the LTIP:

Mandatory Shareholding

Participantsarerequiredto committoinvestingaspecied amounttopurchasesharesin the Company,whichliesintherange of25%

to66%oftheirbasesalary,accordingto seniority.Untilthe minimumshareholdinglevel isattained, one thirdoftheexecutive’safter-tax

annualperformanceincentive payment(40%inthecaseoftheCEO) isretainedtopurchasesharesin the Company uptothepointwhere

this mandatory shareholding level is achieved. The holding must be maintained to enable the CEO or executive to exercise any options.

Options

LTIP participants must achieve a performance rating of on target or better against individual STI targets to be eligible to receive a grant of

options. Any grant of options is at the discretion of the People Remuneration and Diversity Committee (PRDC) of the Board of Directors

but, in the normal course of events, is expected to equate to a value of 55% of xed remuneration for the CEO, or 1½ times the STI

earned on individual targets for all other scheme participants (the factor for the CEO being fixed to reflect the higher proportion of STI

being based on Company performance rather than individual performance). The number of options to be allocated will be determined by an

independent valuation of the options carried out each year at the time of issue.

EMPLOYEE REMUNERATION (CONTINUED)

AIR NEW ZEALAND ANNUAL FINANCIAL REVIEW 2014 69