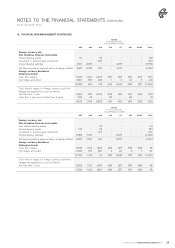

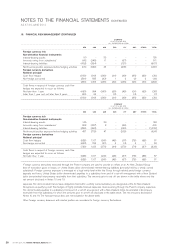

Air New Zealand 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 201424

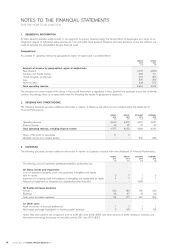

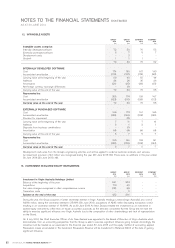

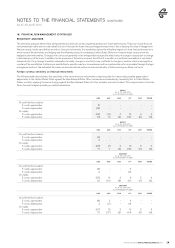

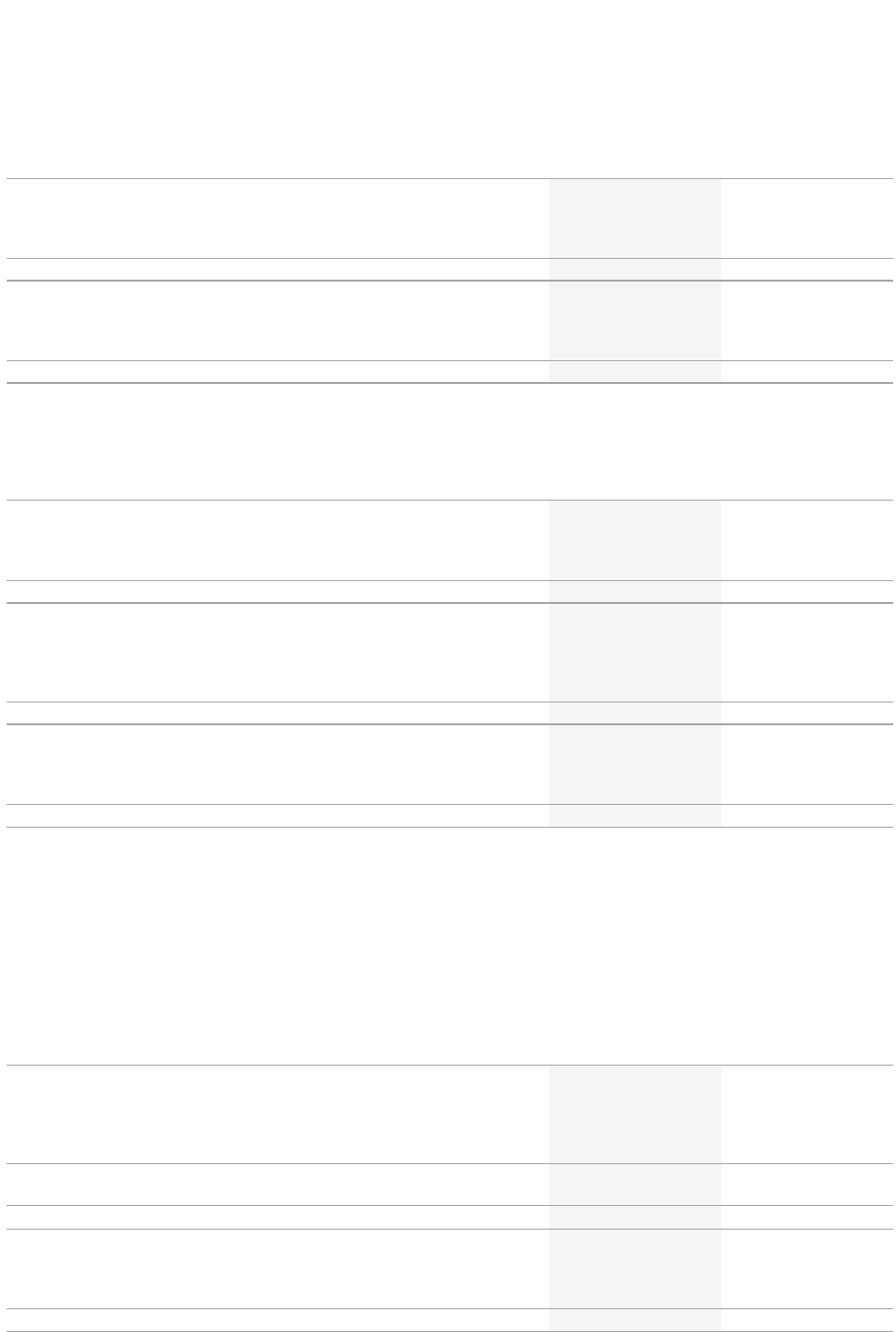

15. REVENUE IN ADVANCE

GROUP

2014

$M

GROUP

2013

$M

COMPANY

2014

$M

COMPANY

2013

$M

Current

Transportation sales in advance

Loyalty programme

Other

802

101

27

796

101

21

802

101

15

796

101

13

930 918 918 910

Non-current

Loyalty programme

Other

143

5

135

5

143

5

135

5

148 140 148 140

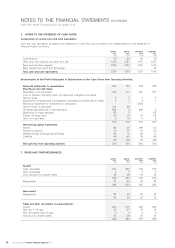

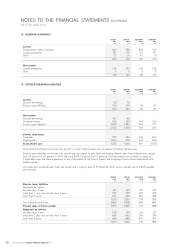

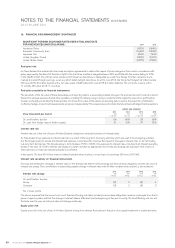

16. INTEREST-BEARING LIABILITIES

GROUP

2014

$M

GROUP

2013

$M

COMPANY

2014

$M

COMPANY

2013

$M

Current

Secured borrowings

Finance lease liabilities

22

168

15

144

-

86

-

87

190 159 86 87

Non-current

Secured borrowings

Unsecured bonds

Finance lease liabilities

191

150

1,202

69

150

1,251

-

150

631

-

150

771

1,543 1,470 781 921

Interest rates basis:

Fixed rate

Floating rate

727

1,006

756

873

434

433

500

508

At amortised cost 1,733 1,629 867 1,008

All secured borrowings are secured over aircraft or aircraft related assets and are subject to floating interest rates.

Finance lease liabilities are secured over aircraft and are subject to both fixed and floating interest rates. Fixed interest rates ranged

from 0.5 percent to 4.1 percent in 2014 (30 June 2013: 0.8 percent to 4.1 percent). Purchase options are available on expiry or,

if applicable under the lease agreement, on early termination of the finance leases. The Company’s finance lease liabilities are with

related parties.

The unsecured, unsubordinated fixed rate bonds have a maturity date of 15 November 2016 and an interest rate of 6.90% payable

semi-annually.

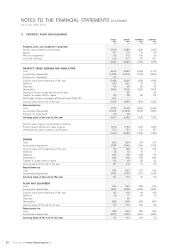

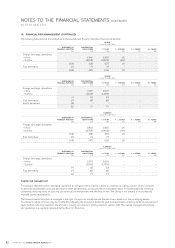

GROUP

2014

$M

GROUP

2013

$M

COMPANY

2014

$M

COMPANY

2013

$M

Finance lease liabilities

Repayable as follows:

Not later than 1 year

Later than 1 year and not later than 5 years

Later than 5 years

191

734

591

169

742

642

103

375

321

105

425

426

Less future finance costs

1,516

(146)

1,553

(158)

799

(82)

956

(98)

Present value of future rentals 1,370 1,395 717 858

Repayable as follows:

Not later than 1 year

Later than 1 year and not later than 5 years

Later than 5 years

168

654

548

144

663

588

86

331

300

87

374

397

1,370 1,395 717 858

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2014