Air New Zealand 2014 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2014 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 201426

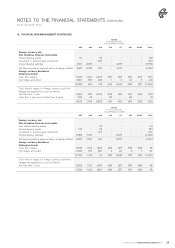

18. FINANCIAL RISK MANAGEMENT

Air New Zealand is subject to credit, foreign currency, interest rate, fuel and equity price risks. These risks are managed with various

financial instruments, using a set of policies approved by the Board of Directors. Compliance with these policies is reviewed and reported

monthly to the Board and is included as part of the internal audit programme. Group policy is not to enter, issue or hold financial instruments

for speculative purposes.

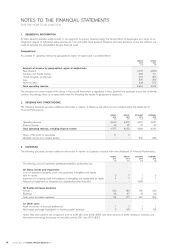

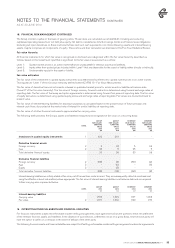

CREDIT RISK

Credit risk is the potential loss from a transaction in the event of default by a counterparty during the term of the transaction or on settlement

of the transaction. Air New Zealand incurs credit risk in respect of trade receivable transactions and other financial instruments in the normal

course of business. The maximum exposure to credit risk is represented by the carrying value of financial assets.

Air New Zealand places cash, short term deposits and derivative financial instruments with good credit quality counterparties, having a minimum

Standard and Poors credit rating of A. Limits are placed on the exposure to any one financial institution.

Credit evaluations are performed on all customers requiring direct credit. Air New Zealand is not exposed to any concentrations of credit risk

within receivables, other assets and derivatives. Air New Zealand does not require collateral or other security to support financial instruments

with credit risk. A significant proportion of receivables are settled through the International Air Transport Association (IATA) clearing mechanism

which undertakes its own credit review of members.

MARKET RISK

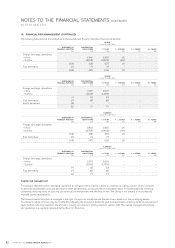

Foreign currency risk

Foreign currency risk is the risk of loss to Air New Zealand arising from adverse fluctuations in exchange rates.

Air New Zealand has exposure to foreign exchange risk as a result of transactions denominated in foreign currencies, arising from normal

trading activities, foreign currency borrowings and foreign currency capital commitments and sales.

Air New Zealand has a formal foreign exchange management policy (approved by the Board of Directors) to enter into foreign exchange contracts

to manage economic exposure to fluctuations in foreign exchange rates impacting operating cash flows, capital expenditure and foreign currency

denominated liabilities. Any exposure to gains or losses on these contracts is offset by a related loss or gain on the item being hedged.

Foreign currency operating cash inflows are primarily denominated in Australian Dollars, European Community Euro, Japanese Yen, Chinese

Renminbi, United Kingdom Pounds and United States Dollars. Foreign currency outflows are primarily denominated in United States Dollars.

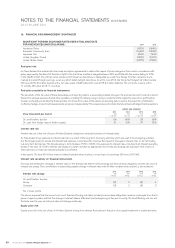

Excluding the Chinese Renminbi (which has a generally pegged exchange rate), the Group’s treasury risk management policy is to hedge

between 70% and 90% of forecast net operating cash flows for the first 6 months, with progressive reductions in percentages hedged over the

next 6 to 12 months. In accordance with this policy, the underlying forecast revenue and expenditure transactions in respect of foreign currency

cash flow hedges in place at reporting date, are expected to occur over the next 18 months. The parameters align the hedge terms for foreign

currency and fuel price risk. Hedges of foreign currency capital transactions are only undertaken if there is a large volume of forecast capital

transactions over a short period of time.

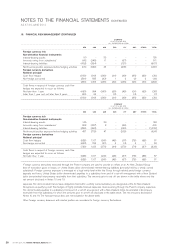

A proportion of United States Dollar denominated borrowings is designated as the hedging instrument in qualifying cash flow hedges of highly

probable forecast foreign currency sales of non-financial assets. Other USD denominated borrowings are designated in fair value hedges of

certain underlying USD aircraft values. A further proportion of United States denominated borrowings remains unhedged to provide a natural

offset to foreign currency movements within depreciation expense, resulting from revisions made to aircraft residual values during the year.

These strategies reduce the level of derivative cover required to offset the foreign exchange exposure on the remaining unhedged United States

borrowings and finance lease obligations. Japanese Yen denominated finance lease obligations are designated as the hedging instrument in

qualifying cash flow hedges of highly probable forecast Japanese Yen revenues.

The Group has certain investments in foreign operations, whose net assets are exposed to foreign currency translation risk. Currency exposure

arising on the net assets of the Group’s foreign operations is managed primarily through borrowings denominated in the relevant foreign currencies.

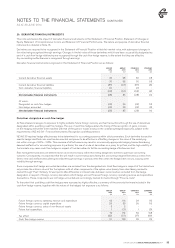

With the exception of foreign currency denominated working capital balances, which together are immaterial to foreign currency fluctuations,

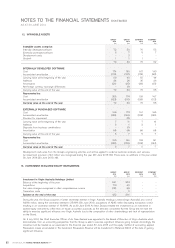

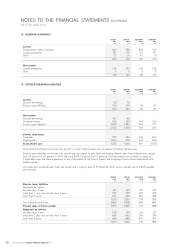

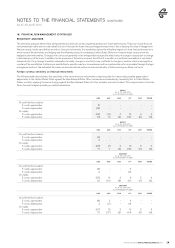

Air New Zealand’s exposure to foreign exchange risk arising on financial instruments outstanding at reporting date is summarised as follows:

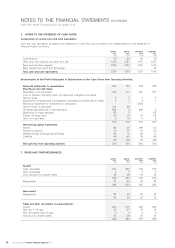

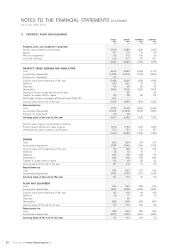

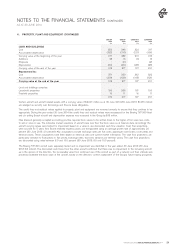

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2014