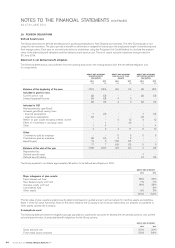

Air New Zealand 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 201436

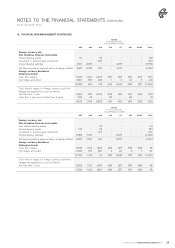

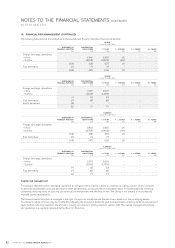

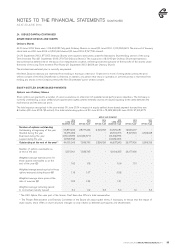

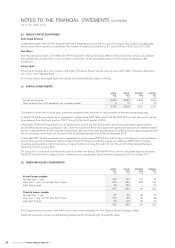

20. DERIVATIVE FINANCIAL INSTRUMENTS (CONTINUED)

Foreign currency hedges

The Group uses foreign currency derivatives to hedge account the foreign currency risk arising on future foreign currency operating

revenue, operating expense and capital expenditure transactions.

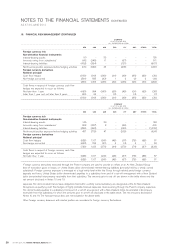

Forward points are excluded from the hedge designation in respect of operating revenue and expenditure transactions and are marked

to market through earnings. Forward point costs of $21 million in respect of these derivatives were marked to market through “Finance

costs” in the year to 30 June 2014 (30 June 2013: $23 million of costs).

Accounting ineffectiveness arising in the year to 30 June 2014 on these cash flow hedges was nil on both operating and capital

transactions (30 June 2013: Nil on both operating and capital transactions).

Fuel hedges

Where the Group uses crude oil options or collar options to hedge price risk in jet fuel, the intrinsic value component of these derivatives

is designated as a cash flow hedge. All other components (mainly time value) are marked to market through earnings, with gains of

$2 million recognised within “Fuel” in the year to 30 June 2014 (30 June 2013: $1 million gain).

Accounting ineffectiveness arising in the year to 30 June 2014 of $40 million gain was recognised within “Fuel” (30 June 2013:

$7 million loss).

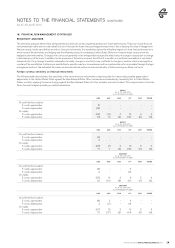

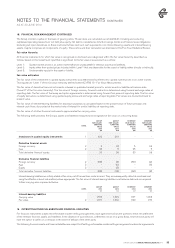

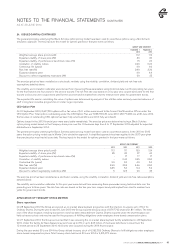

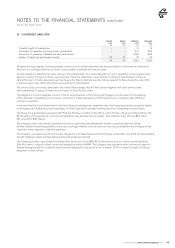

NON-HEDGE ACCOUNTED DERIVATIVES

Foreign currency derivatives

Where changes in the fair value of a derivative provide a natural offset to the underlying hedged item as it impacts earnings, hedge

accounting is not applied. Both the changes in value of the hedged item and the hedging instrument are recognised through the same

line within the Statement of Financial Performance.

Foreign currency translation gains or losses on lease return provisions and non-hedge accounted United States Dollar denominated

interest-bearing liabilities are recognised in the Statement of Financial Performance within “Foreign exchange gains”. Marked to market

gains or losses on non-hedge accounted foreign currency derivatives provide a natural offset to these foreign exchange movements, and

are also recognised within “Foreign exchange gains”.

During the year to 30 June 2014, a loss of $77 million was recognised in respect of the above non-hedge accounted foreign currency

derivatives (30 June 2013: $8 million gain), which was offset by exchange movements on the underlying exposures. Forward point costs

of $18 million in respect of these derivatives were marked to market through “Finance costs” in the year to 30 June 2014 (30 June 2013:

$17 million of costs).

Fuel derivatives

Short-dated fuel derivatives are not hedge accounted due to the short term nature of these instruments, and are marked to market

through earnings. In the year to 30 June 2014, no amount was recognised within “Fuel” (30 June 2013: Nil).

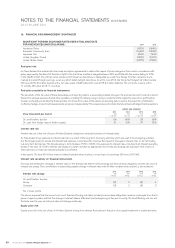

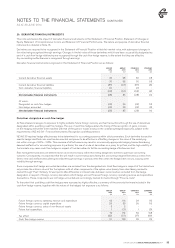

Equity swaps

During the year to 30 June 2013, Air New Zealand entered into an equity derivative representing an additional interest of 3% of

shares in Virgin Australia Holdings Limited (Virgin Australia). The derivative was a share forward transaction which carried no voting

rights. The derivative was exercised during the year ended 30 June 2014 with a gain of $5 million (30 June 2013: loss of $5 million)

being recognised in “Other expenses” and a loss of $2 million in “Foreign exchange gains” (30 June 2013: Nil) in the Statement of

Financial Performance.

Air New Zealand also exercised a 1.5% interest during the year ended 30 June 2013, recognising $2 million gains within the “Non-hedge

accounted derivatives” line in Note 3 and in “Other expenses” in the Statement of Financial Performance.

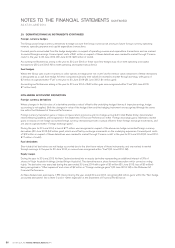

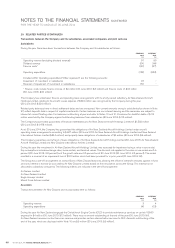

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2014