Air New Zealand 2014 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2014 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 201430

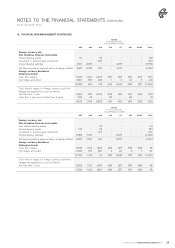

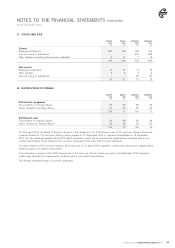

18. FINANCIAL RISK MANAGEMENT (CONTINUED)

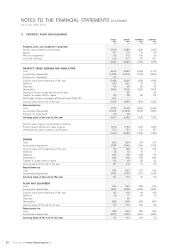

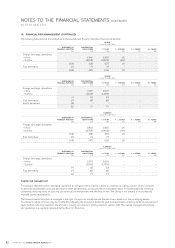

SIGNIFICANT FOREIGN EXCHANGE RATES USED AT BALANCE DATE

FOR ONE NEW ZEALAND DOLLAR ARE: 2014 2013

Australian Dollar

European Community Euro

Japanese Yen

United Kingdom Pound

United States Dollar

0.9315

0.6430

89.00

0.5150

0.8775

0.8400

0.5980

76.80

0 . 5110

0.7800

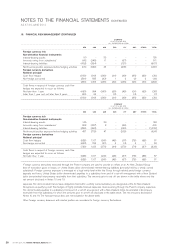

Fuel price risk

Air New Zealand has entered into fuel swap and option agreements to reduce the impact of price changes on fuel costs in accordance with

policy approved by the Board of Directors. Uplift in the first three months is hedged between 50% and 80% with the volume falling to 20%

in the twelfth month. The intrinsic value component of these fuel derivatives is designated as a cash flow hedge. All other components are

marked to market through earnings, as are any short-dated outright derivatives. As at 30 June 2014, the Group had hedged 4.2 million barrels

(30 June 2013: 3.6 million barrels) with a fair value asset of $25 million (30 June 2013: $1 million liability). The contracts mature within

11 months (30 June 2013: 11 months).

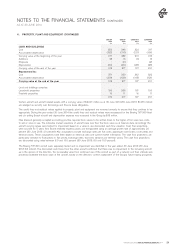

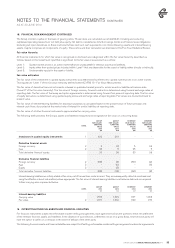

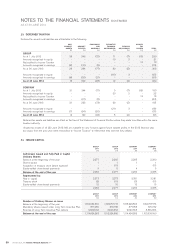

Fuel price sensitivity on financial instruments

The sensitivity of the fair value of these derivatives as at reporting date to a reasonably possible change in the price per barrel of crude oil is shown

below. This analysis assumes that all other variables, including the refining margin, remain constant and the respective impacts on profit before

taxation and equity are dictated by the proportion of intrinsic/time value of the options at reporting date as well as the proportion of effective/

ineffective hedges. In practice, these elements would vary independently. This analysis does not include the future forecast hedged fuel transactions.

GROUP AND COMPANY

Price movement per barrel:

2014

$M

+ USD 20

2014

$M

- USD 20

2013

$M

+ USD 20

2013

$M

- USD 20

On profit before taxation

On cash flow hedge reserve (within equity)

58

21

(49)

(14)

33

37

(34)

(31)

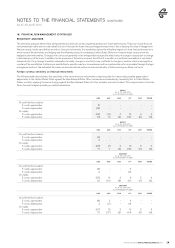

Interest rate risk

Interest rate risk is the risk of loss to Air New Zealand arising from adverse fluctuations in interest rates.

Air New Zealand has exposure to interest rate risk as a result of the long-term borrowing activities which are used to fund ongoing activities.

It is the Group’s policy to ensure the interest rate exposure is maintained to minimise the impact of changes in interest rates on its net floating

rate long-term borrowings. The Group’s policy is to fix between 70% to 100% of its exposure to interest rates, including fixed interest operating

leases, in the next 12 months. Interest rate swaps are used to achieve an appropriate mix of fixed and floating rate exposure if the volume of

fixed rate loans or fixed rate operating leases is insufficient.

In the year to 30 June 2014, there were no interest rate derivatives in place, nor any impact on earnings (30 June 2013: Nil).

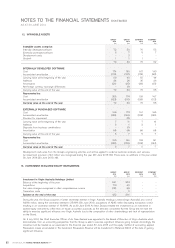

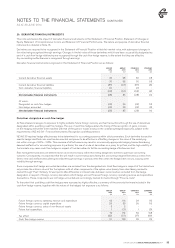

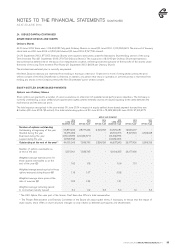

Interest rate sensitivity on financial instruments

Earnings are sensitive to changes in interest rates on the floating rate element of borrowings and finance lease obligations and the fair value of

interest rate swaps. Their sensitivity to a reasonably possible change in interest rates with all other variables held constant, is set out below:

Interest rate change:

2014

$M

+50 bp*

2014

$M

- 50 bp*

2013

$M

+ 50 bp*

2013

$M

- 50 bp*

On profit before taxation

Group (5) 5 (4) 4

Company (2) 2 (3) 3

*bp = basis points

The above assumes that the amount and mix of fixed and floating rate debt, including finance lease obligations, remains unchanged from that in

place at reporting date, and that the change in interest rates is effective from the beginning of the year. In reality, the fixed/floating rate mix will

fluctuate over the year and interest rates will change continually.

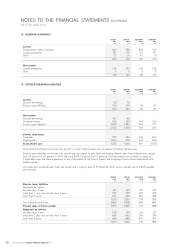

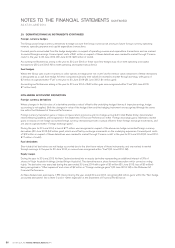

Equity price risk

Equity price risk is the risk of loss to Air New Zealand arising from adverse fluctuations in the price of an equity investment or equity derivative.

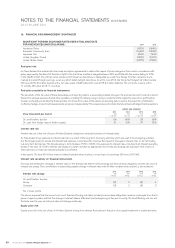

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2014