Air New Zealand 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2014 47

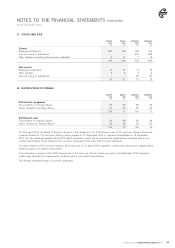

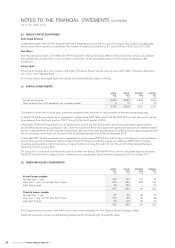

29. RELATED PARTIES (CONTINUED)

On 9 May 2014 the CEC declared a distribution to the Group of $4 million. The amount was outstanding as at 30 June 2014.

On 22 May 2013 the CEC paid a distribution of $15 million.

Other related party disclosures

Other balances and transactions with related parties are not considered material to Air New Zealand and are entered into in the normal

course of business on standard commercial terms. There have been no related party debts forgiven during the year.

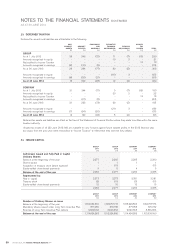

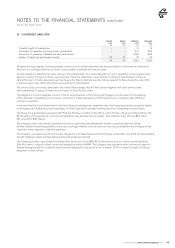

30. CHANGES IN ACCOUNTING POLICIES

The principal accounting policies used in the preparation of these financial statements are set out in the Statement of Accounting Policies.

The Group has adopted the following new framework, standards and amendments to standards, including any consequential amendments

to other standards, with a date of initial application of 1 July 2013.

(a) External Reporting Board Standard A1 “Accounting Standards Framework (For-profit Entities Update)” (XRB A1)

(b) NZ IFRS 10 - Consolidated Financial Statements

(c) NZ IFRS 11 - Joint Arrangements

(d) NZ IFRS 12 - Disclosure of Interests in Other Entities

(e) NZ IFRS 13 - Fair Value Measurement

(f) NZ IAS 19 (2011) - Employee Benefits

(g) NZ IAS 27 (2011) - Separate Financial Statements

(h) NZ IAS 28 (2011) - Investments in Associates and Joint Ventures

(i) Amendments to NZ IFRS 7 - Financial instruments: Disclosures and NZ IAS 32 - Financial Instruments: Presentation

Comparative information has been restated to reflect these new and amended standards and frameworks. The nature and effect of these

changes are explained below:

(a) XRB A1 “Accounting Standards Framework (For-profit Entities Update)”

XRB A1 establishes a for-profit tier structure and outlines which suite of accounting standards entities in different tiers must follow.

For the purposes of complying with NZ GAAP, the Group and Company are required to report in accordance with Tier 1 For-profit

Accounting Standards (NZ IFRS). XRB A1, which was adopted with effect from 1 July 2013, has had no financial impact on the

financial statements.

(b) NZ IFRS 10 - Consolidated Financial Statements

Upon adoption of NZ IFRS 10, the Group has changed its accounting policy for determining whether it has control over and

consequently consolidates its investees. NZ IFRS 10 builds on existing principles by identifying the concept of control as the

determining factor in whether an entity should be included in the consolidated financial statements of the parent company.

The standard, which was adopted with effect from 1 July 2013, has not had any impact on the consolidated financial statements.

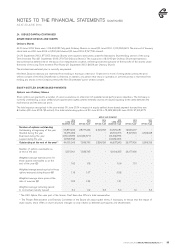

(c) NZ IFRS 11 - Joint Arrangements

Upon adoption of NZ IFRS 11, the Group has changed its accounting policy for its interests in joint arrangements. NZ IFRS 11

focuses on the rights and obligations of joint arrangements as opposed to the legal form, and requires the equity method of accounting

for joint ventures.

The Group has re-evaluated its involvement in the 51% investment in ANZGT Field Services LLC and has reclassified it from a

subsidiary to a joint venture with effect from 1 July 2013.

In the Statement of Financial Position, the previously consolidated property, plant and equipment, share capital and minority interests

are replaced by an equity accounted investment of $1 million. The standard has not had any net impact on the Statement of Financial

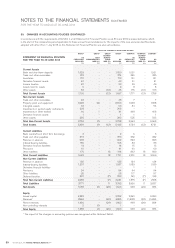

Performance. The quantitative impact of adopting NZ IFRS 11 is set out in the tables.

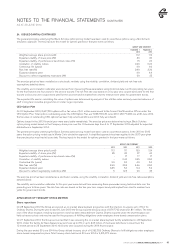

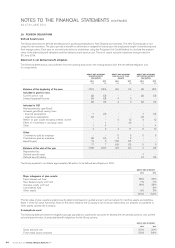

(d) NZ IFRS 12 - Disclosure of Interests in Other Entities

NZ IFRS 12 sets out disclosure requirements for entities that have interests in subsidiaries, joint arrangements, associates and

consolidated structured entities. The standard has not had any impact on the consolidated financial statements, with the exception of

additional disclosures relating to the primary statements of joint ventures or associates and a reconciliation from that information to

the carrying amount of the Groups’ investment in those entities.

(e) NZ IFRS 13 - Fair Value Measurement

NZ IFRS 13 replaces the fair value measurement guidance contained in individual NZ IFRSs with a single source of guidance. It

defines fair value, establishes a framework for measuring fair value and sets out disclosure requirements. The standard, which was

adopted with effect from 1 July 2013, has had no financial impact on the financial statements other than additional disclosure.

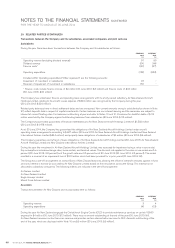

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE YEAR TO AND AS AT 30 JUNE 2014