Air New Zealand 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2014 43

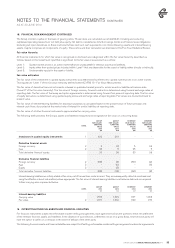

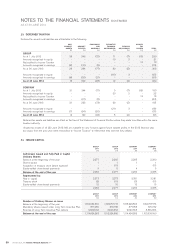

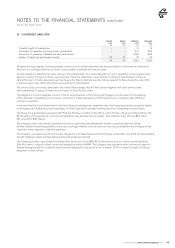

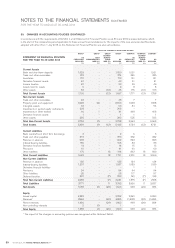

27. CONTINGENT LIABILITIES

GROUP

2014

$M

GROUP

2013

$M

COMPANY

2014

$M

COMPANY

2013

$M

Uncalled capital of subsidiaries

Guarantee of subsidiary operating lease commitments

Guarantee of subsidiary indebtedness and performance

Letters of credit and performance bonds

-

-

-

52

-

-

-

51

10

641

1,584

47

12

853

1,482

46

52 51 2,282 2,393

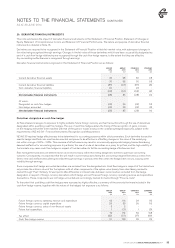

All significant legal disputes involving probable loss that can be reliably estimated have been provided for in the financial statements.

There are no contingent liabilities for which it is practicable to estimate the financial effect.

Air New Zealand is defending two class actions in the United States. One makes allegations of anti-competitive conduct against many

airlines in relation to pricing in the air cargo business. Following settlements, seven airlines including Air New Zealand continue to

defend the claim. A similar, previously reported class action filed in Australia was discontinued against Air New Zealand in June 2014

resulting in legal costs of $3 million being recovered by Air New Zealand.

The second class action being defended in the United States alleges that Air New Zealand together with other airlines acted

anti-competitively in respect of fares and surcharges on trans-Pacific routes.

The allegations of anti-competitive conduct in the air cargo business in Hong Kong and Singapore are the subject of proceedings

by the Australian Competition and Consumer Commission. A defended hearing in the Federal Court concluded in May 2013 and

a decision is awaited.

In the event that the Court determined that Air New Zealand had breached competition laws, the Company would have potential liability

for damages or (in Australia) pecuniary penalties. No other significant contingent liability claims are outstanding at balance date.

The Group has a partnership agreement with Pratt and Whitney in relation to the CEC in which it holds a 49 percent interest (Note 14).

By the nature of the agreement, joint and several liability exists between the two parties. Total liabilities of the CEC are $82 million

(30 June 2013: $47 million).

The Company enters into financial guarantee contracts to guarantee the indebtedness of other companies within the Group.

Air New Zealand treats the guarantee contract as a contingent liability until such time as it becomes probable that the Company will be

required to make a payment under the guarantee.

The Company guarantees aircraft end of lease obligations of Air New Zealand Aircraft Holdings Limited (30 June 2013: Air New Zealand

Aircraft Holdings Limited and New Zealand International Airlines Limited).

The Company provides a guarantee to the Royal New Zealand Air Force (RNZAF) of the performance of a wholly owned subsidiary,

Safe Air Limited, in respect of their contractual obligations with the RNZAF. The Company also provided a letter of financial support to

Altitude Aerospace Interiors Limited (a wholly owned subsidiary) for the period to 30 November 2014 to enable it to meet its financial

obligations as they fall due.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2014