Air New Zealand 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 201448

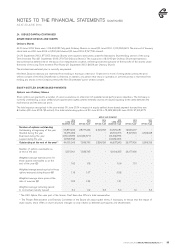

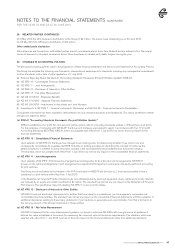

30. CHANGES IN ACCOUNTING POLICIES (CONTINUED)

(f) NZ IAS 19 (2011) - Employee Benefits

Following the adoption of the amendments to NZ IAS 19 (2011) - Employee Benefits, the Group has changed its accounting policy

with respect to both the recognition of actuarial gains and losses and also the basis for determining the income or expense related to

its post-employment defined benefit plans.

The amendments remove the use of the corridor method previously permitted for recognising actuarial gains and losses. Under NZ IAS

19 (2011), actuarial gains and losses will be recognised immediately as a remeasurement through other comprehensive income.

In the Statement of Financial Position, previously unrecognised actuarial losses of $13 million as at 30 June 2013 (30 June 2012:

$24 million) are now recognised within Retained Deficit, which results in the conversion of the previously recognised net defined

benefit asset into a net defined benefit obligation of $4 million as at 30 June 2013 (30 June 2012: $18 million). These balances

include the Group’s obligation to pay employer contribution withholding tax on future contributions. Deferred tax adjustments were

recognised in respect of the above.

There is a $1 million net decrease in the Statement of Financial Performance for the year to 30 June 2013. The changes include:

- actuarial gains or losses are no longer recognised in the Statement of Financial Performance (that is, those which fell outside

the corridor); and

- administration costs are now recognised as they are incurred with no allowance for future costs.

The quantitative impact of adopting NZ IAS 19 (2011) is set out in the tables below.

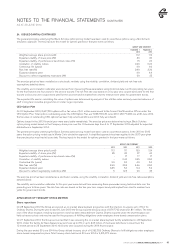

(g) NZ IAS 27 (2011) - Separate Financial Statements

NZ IAS 27 (2011) carries forward the existing accounting and disclosure requirements for separate financial statements with

some minor clarifications. The amendments, which were adopted with effect from 1 July 2013, have not had any impact on the

financial statements.

(h) NZ IAS 28 (2011) - Investments in Associates and Joint Ventures

NZ IAS 28 (2011) clarifies that an investment in an associate or joint venture that meets the criteria to be classified as held for sale

is within the scope of NZ IFRS 5 - Non-Current Assets Held for Sale and Discontinued Operations. The amendments, which were

adopted with effect from 1 July 2013, have not had any impact on the consolidated financial statements.

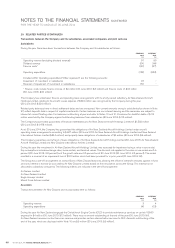

(i) Amendments to NZ IFRS 7 - Financial instruments: Disclosures and NZ IAS 32 - Financial Instruments: Presentation

Amendments to NZ IFRS 7 include minimum disclosures relating to financial assets and financial liabilities that are either offset in the

Statement of Financial Position or are subject to enforceable master netting or similar arrangements. The amendments, which were

adopted with effect from 1 July 2013, have had no impact on the financial statement other than disclosure. The new disclosure is set

out in Note 19 and includes a reconciliation of gross and net amounts of financial assets and financial liabilities showing separately

amounts offset and not offset in the Statement of Financial Position.

Amendments to NZ IAS 32 clarify that an entity currently has a legally enforceable right of set-off if that right is not contingent upon

a future event and is enforceable both in the normal course of business and in the event of default, insolvency or bankruptcy of the

entity and all counterparties. These amendments, which are effective for annual periods commencing on or after 1 January 2014,

have been adopted early with effect from 1 July 2013, and have not had any impact on the financial statements.

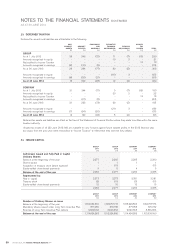

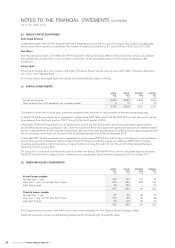

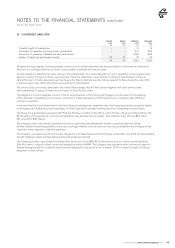

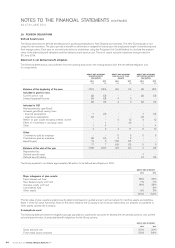

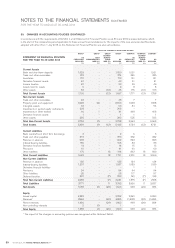

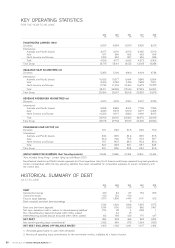

Summary of quantitative impacts

The following tables summarise the impacts of the above changes on the Group’s previously reported financial performance, other

comprehensive income, financial position and cash flows. The impacts relate to the changes related to joint arrangements (see (c)) and

the changes related to defined benefit pension plans (see (f)). Only the line items that have changed are shown in the tables below.

IMPACT OF CHANGES IN ACCOUNTING POLICIES

GROUP

AS

PREVIOUSLY

REPORTED

$M

GROUP

JOINT

ARRANGEMENTS

(SEE (C))

$M

GROUP

DEFINED

BENEFIT

PLANS

(SEE (F))

$M

GROUP

AS

RESTATED

$M

COMPANY

AS

PREVIOUSLY

REPORTED

$M

COMPANY

DEFINED

BENEFIT

PLANS

(SEE (F))

$M

COMPANY

AS

RESTATED

$M

STATEMENT OF FINANCIAL PERFORMANCE

FOR THE YEAR TO 30 JUNE 2013

Contract services 313 (3) - 310 242 -242

Operating revenue

Labour

Maintenance

4,618

(1,069)

(303)

(3)

2

1

-

(1)

-

4,615

(1,068)

(302)

4,221

(914)

(225)

-

(1)

-

4,221

(915)

(225)

Operating expenditure (3,720) 3(1) (3,718) (3,254) (1) (3,255)

Net Profit Attributable to Shareholders

of Parent Company

182

-

(1)

181

349

(1)

348

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE YEAR TO AND AS AT 30 JUNE 2014