Air New Zealand 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2014 33

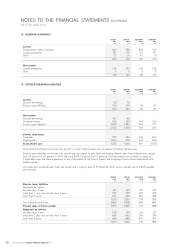

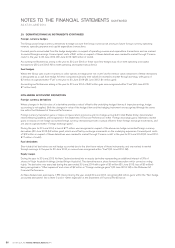

18. FINANCIAL RISK MANAGEMENT (CONTINUED)

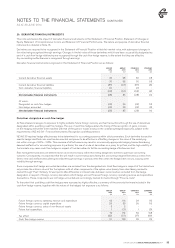

The Group monitors capital on the basis of gearing ratios. These ratios are calculated as net debt (both including and excluding

capitalised operating leases) over net debt plus equity. Net debt is calculated as total borrowings, bonds and finance lease obligations

(including net open derivatives on these instruments) less cash and cash equivalents, non interest-bearing assets and interest-bearing

assets. Capital comprises all components of equity. These ratios and their calculation are disclosed in the Five Year Statistical Review.

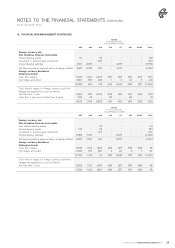

Fair value hierarchy

All financial instruments for which fair value is recognised or disclosed are categorised within the fair value hierarchy, described as

follows, based on the lowest level input that is significant to the fair value measurement as a whole:

Level 1: Quoted market prices in an active market (that are unadjusted) for identical assets and liabilities.

Level 2: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

Level 3: Unobservable inputs for the asset or liability.

Fair value estimation

The fair value of the investment in quoted equity instruments was determined by reference to quoted market prices in an active market.

This equates to “Level 1” of the fair value hierarchy defined within NZ IFRS 13 - Fair Value Measurement.

The fair value of derivative financial instruments is based on published market prices for similar assets or liabilities at balance date

(“Level 2” of the fair value hierarchy). The fair value of foreign currency forward contracts is determined using forward exchange rates at

reporting date. The fair value of fuel swap and option agreements is determined using forward fuel prices at reporting date. The fair value

of equity derivatives is determined using quoted equity prices and exchange rates at reporting date. Fair values are discounted back to

present value.

The fair value of interest-bearing liabilities for disclosure purposes is calculated based on the present value of future principal and

interest cash flows, discounted at the market rate of interest for similar liabilities at reporting date.

The fair value of all other financial instruments approximates the carrying value.

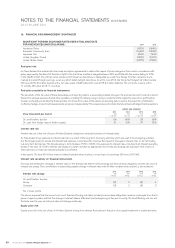

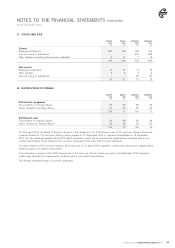

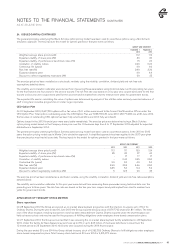

The following table presents the Group’s assets and liabilities measured and recognised at fair value on a recurring basis:

LEVEL

GROUP

FAIR VALUE/

CARRYING

VALUE

2014

$M

GROUP

FAIR VALUE/

CARRYING

VALUE

2013

$M

COMPANY

FAIR VALUE/

CARRYING

VALUE

2014

$M

COMPANY

FAIR VALUE/

CARRYING

VALUE

2013

$M

Investment in quoted equity instruments 1

422 261 - -

Derivative financial assets

Foreign currency

Fuel

2

2

5

25

93

5

5

25

93

5

Total derivative financial assets 30 98 30 98

Derivative financial liabilities

Foreign currency

Fuel

Equity

2

2

2

(58)

-

-

(2)

(6)

(5)

(58)

-

-

(2)

(6)

-

Total derivative financial liabilities (58) (13) (58) (8)

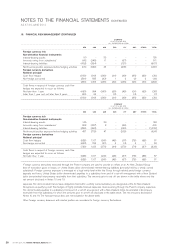

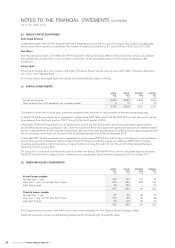

Interest-bearing liabilities are initially stated at fair value, net of transactions costs incurred. They are subsequently stated at amortised cost

using the effective interest rate method, where appropriate. The fair value of interest-bearing liabilities as at balance date and as compared

to their carrying value is presented below.

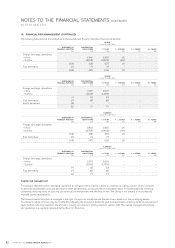

LEVEL

GROUP

2014

$M

GROUP

2013

$M

COMPANY

2014

$M

COMPANY

2013

$M

Interest-bearing liabilities

Carrying value

Fair value

2

1,733

1,671

1,629

1,560

867

849

1,008

970

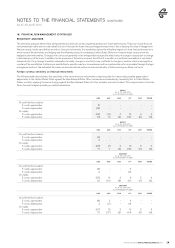

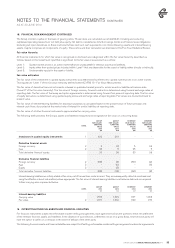

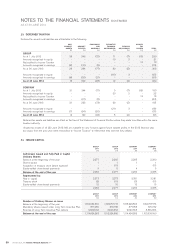

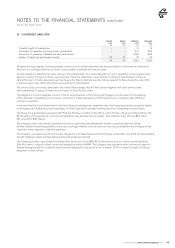

19. OFFSETTING FINANCIAL ASSETS AND FINANCIAL LIABILITIES

For financial instruments subject to enforceable master netting arrangements, each agreement allows the parties to elect net settlement

of the relevant financial assets and liabilities. In the absence of such election, settlement occurs on a gross basis, however each party will

have the option to settle on a net basis in the event of default of the other party.

The following financial assets and financial liabilities are subject to offsetting, enforceable master netting arrangements and similar agreements.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2014