Air New Zealand 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

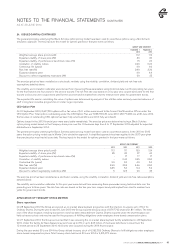

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2014 51

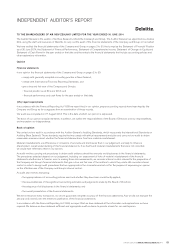

TO THE SHAREHOLDERS OF AIR NEW ZEALAND LIMITED FOR THE YEAR ENDED 30 JUNE 2014

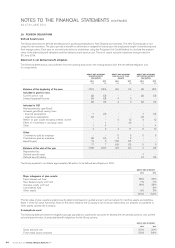

The Auditor-General is the auditor of Air New Zealand Limited (the Company) and Group. The Auditor-General has appointed me, Andrew

Dick, using the staff and resources of Deloitte, to carry out the audit of the financial statements of the Company and Group on her behalf.

We have audited the financial statements of the Company and Group on pages 2 to 50, that comprise the Statement of Financial Position

as at 30 June 2014, the Statement of Financial Performance, Statement of Comprehensive Income, Statement of Changes in Equity and

Statement of Cash Flows for the year ended on that date and the notes to the financial statements that include accounting policies and

other explanatory information.

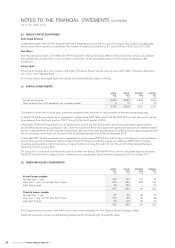

Opinion

Financial statements

In our opinion the financial statements of the Company and Group on pages 2 to 50:

•complywithgenerallyacceptedaccountingpracticeinNewZealand;

•complywithInternationalFinancialReportingStandards;and

•giveatrueandfairviewoftheCompanyandGroup’s:

- financial position as at 30 June 2014; and

- financial performance and cash flows for the year ended on that date.

Other legal requirements

In accordance with the Financial Reporting Act 1993 we report that, in our opinion, proper accounting records have been kept by the

Company and Group as far as appears from an examination of those records.

Our audit was completed on 27 August 2014. This is the date at which our opinion is expressed.

The basis of our opinion is explained below. In addition, we outline the responsibilities of the Board of Directors and our responsibilities,

and we explain our independence.

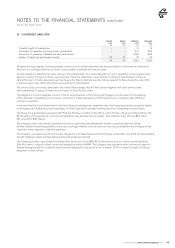

Basis of opinion

We carried out our audit in accordance with the Auditor-General’s Auditing Standards, which incorporate the International Standards on

Auditing (New Zealand). Those standards require that we comply with ethical requirements and plan and carry out our audit to obtain

reasonable assurance about whether the financial statements are free from material misstatement.

Material misstatements are differences or omissions of amounts and disclosures that, in our judgement, are likely to influence

shareholders’ overall understanding of the financial statements. If we had found material misstatements that were not corrected,

we would have referred to them in our opinion.

An audit involves carrying out procedures to obtain audit evidence about the amounts and disclosures in the financial statements.

The procedures selected depend on our judgement, including our assessment of risks of material misstatement of the financial

statements whether due to fraud or error. In making those risk assessments, we consider internal control relevant to the preparation of

the Company and Group’s financial statements that give a true and fair view of the matters to which they relate. We consider internal

control in order to design audit procedures that are appropriate in the circumstances but not for the purpose of expressing an opinion

on the effectiveness of the Company and Group’s internal control.

An audit also involves evaluating:

•theappropriatenessofaccountingpoliciesusedandwhethertheyhavebeenconsistentlyapplied;

•thereasonablenessofthesignicantaccountingestimatesandjudgementsmadebytheBoardofDirectors;

•theadequacyofalldisclosuresinthenancialstatements;and

•theoverallpresentationofthenancialstatements.

We did not examine every transaction, nor do we guarantee complete accuracy of the financial statements. Also we did not evaluate the

security and controls over the electronic publication of the financial statements.

In accordance with the Financial Reporting Act 1993, we report that we have obtained all the information and explanations we have

required. We believe we have obtained sufficient and appropriate audit evidence to provide a basis for our audit opinion.

INDEPENDENT AUDITOR’S REPORT