Air New Zealand 2014 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2014 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 201422

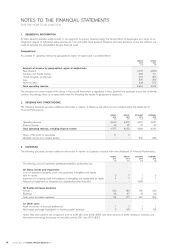

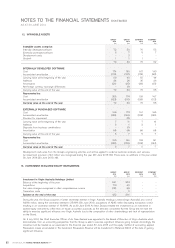

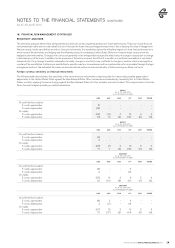

12. INTANGIBLE ASSETS

GROUP

2014

$M

GROUP

2013

$M

COMPANY

2014

$M

COMPANY

2013

$M

Intangible assets comprise:

Internally developed software

Externally purchased software

Development costs

Goodwill

72

6

-

1

59

7

2

1

70

5

-

1

55

7

-

-

79 69 76 62

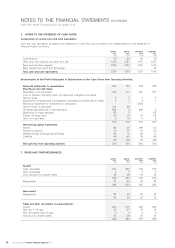

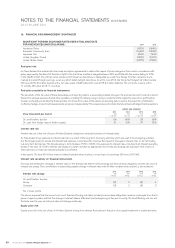

INTERNALLY DEVELOPED SOFTWARE

Cost

Accumulated amortisation

174

(115 )

150

(101)

167

(112 )

143

(99)

Carrying value at the beginning of the year

Additions

Amortisation

Net foreign currency exchange differences

59

34

(21)

-

49

26

(15)

(1)

55

35

(20)

-

44

26

(15)

-

Carrying value at the end of the year 72 59 70 55

Represented by:

Cost

Accumulated amortisation

205

(133)

174

(115 )

199

(129)

167

(112 )

Carrying value at the end of the year 72 59 70 55

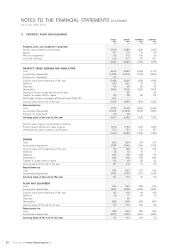

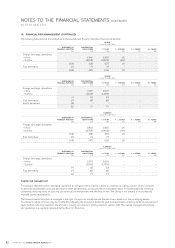

EXTERNALLY PURCHASED SOFTWARE

Cost

Accumulated amortisation

Provision for impairment

166

(159)

-

173

(160)

(2)

161

(154)

-

165

(155)

-

Carrying value at the beginning of the year

Additions

Disposals from business combinations

Amortisation

7

3

-

(4)

11

1

(1)

(4)

7

2

-

(4)

10

1

-

(4)

Carrying value at the end of the year 6 7 5 7

Represented by:

Cost

Accumulated amortisation

165

(159)

166

(159)

159

(154)

161

(154)

Carrying value at the end of the year 6 7 5 7

Development costs arise from the Group’s engineering activities and will be applied to external customer products and services.

An impairment provision of $1 million was recognised during the year (30 June 2013: Nil). There were no additions in the year ended

30 June 2014 (30 June 2013: Nil).

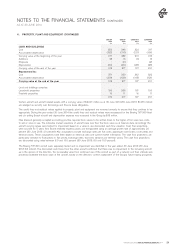

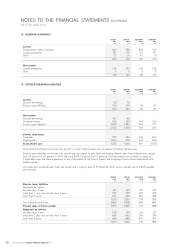

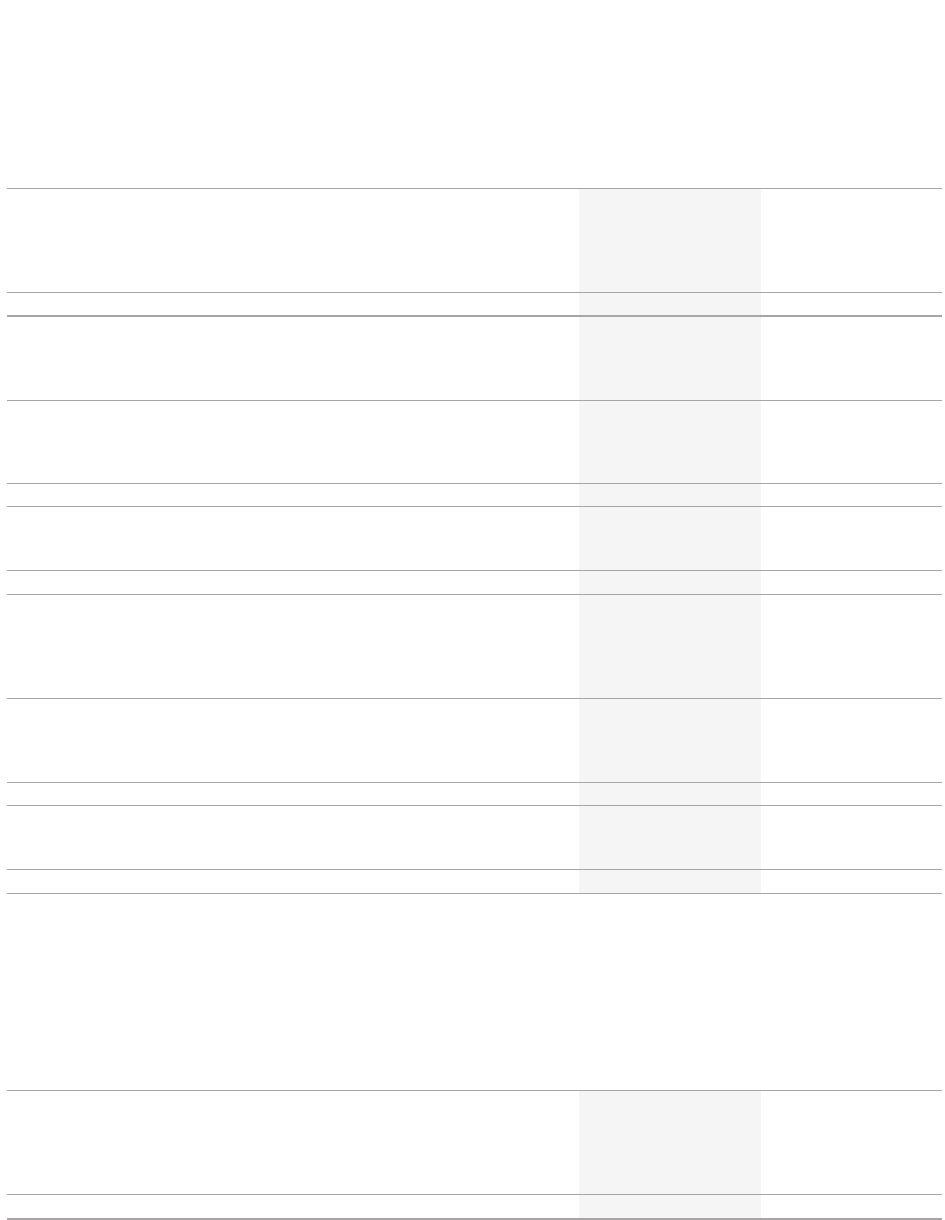

13. INVESTMENT IN QUOTED EQUITY INSTRUMENTS

GROUP

2014

$M

GROUP

2013

$M

COMPANY

2014

$M

COMPANY

2013

$M

Investment in Virgin Australia Holdings Limited

Balance at the beginning of the year

Acquisitions

Fair value changes recognised in other comprehensive income

Transaction costs

261

179

(18)

-

203

62

(6)

2

-

-

-

-

-

-

-

-

Balance at the end of the year 422 261 - -

During the year, the Group acquired a further ownership interest in Virgin Australia Holdings Limited (Virgin Australia) at a cost of

A$160 million, taking the ownership interest to 25.99% (30 June 2013: acquisitions of A$45 million (excluding transaction costs)

resulting in an ownership interest of 19.99%). As at 30 June 2014 Air New Zealand treated the investment as an investment in

quoted equity instruments, rather than an equity accounted associate, as the directors considered that the Group did not have the

ability to exercise significant influence over Virgin Australia due to the composition of other shareholdings and lack of representation

on the Board.

On 4 July 2014, the Chief Executive Officer of Air New Zealand was appointed to the Board of Directors of Virgin Australia which

demonstrates, from an accounting perspective, that the Group is able to exercise significant influence going forward. Accordingly, the

investment will be treated as an associate for the financial year ended 30 June 2015 and the equity method of accounting applied.

Revaluation losses accumulated in the Investment Revaluation Reserve will be transferred to Retained Deficit at the date of gaining

significant influence.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2014