AT&T Wireless 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

75

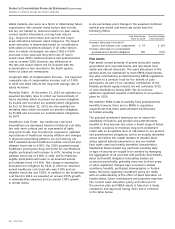

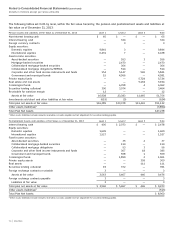

NOTE 19. QUARTERLY FINANCIAL INFORMATION (UNAUDITED)

The following tables represent our quarterly financial results:

2014 Calendar Quarter

First Second Third Fourth2 Annual

Total Operating Revenues $32,476 $32,575 $32,957 $34,439 $132,447

Operating Income (Loss) 6,278 5,616 5,402 (5,550) 11,746

Net Income (Loss) 3,734 3,621 3,059 (3,896) 6,518

Net Income (Loss) Attributable to AT&T 3,652 3,547 3,002 (3,977) 6,224

Basic Earnings (Loss) Per Share Attributable to AT&T1 $ 0.70 $ 0.68 $ 0.58 $ (0.77) $ 1.19

Diluted Earnings (Loss) Per Share Attributable to AT&T1 $ 0.70 $ 0.68 $ 0.58 $ (0.77) $ 1.19

Stock Price

High $ 35.50 $ 36.86 $ 37.48 $ 36.16

Low 31.74 34.32 34.17 32.07

Close 35.07 35.36 35.24 33.59

1 Quarterly earnings per share impacts may not add to full-year earnings per share impacts due to the difference in weighted-average common shares for the quarters versus

the weighted-average common shares for the year.

2 Includes an actuarial loss on pension and postretirement benefit plans (Note 12) and asset abandonment charges (Note 6).

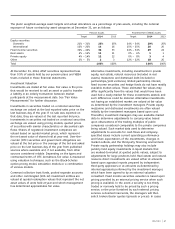

2013 Calendar Quarter

First Second Third Fourth2 Annual

Total Operating Revenues $31,356 $32,075 $32,158 $33,163 $128,752

Operating Income 5,940 6,113 6,188 12,238 30,479

Net Income 3,773 3,880 3,905 6,995 18,553

Net Income Attributable to AT&T 3,700 3,822 3,814 6,913 18,249

Basic Earnings Per Share Attributable to AT&T1 $ 0.67 $ 0.71 $ 0.72 $ 1.31 $ 3.39

Diluted Earnings Per Share Attributable to AT&T1 $ 0.67 $ 0.71 $ 0.72 $ 1.31 $ 3.39

Stock Price

High $ 36.87 $ 39.00 $ 36.31 $ 36.80

Low 32.76 34.10 33.19 33.09

Close 36.69 35.40 33.82 35.16

1 Quarterly earnings per share impacts may not add to full-year earnings per share impacts due to the difference in weighted-average common shares for the quarters versus

the weighted-average common shares for the year.

2 Includes an actuarial gain on pension and postretirement benefit plans (Note 12), special termination charges (Note 12) and charges for employee separations.

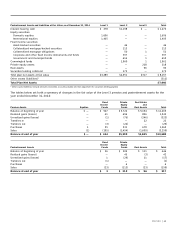

sheet. In our opinion, although the outcomes of these

proceedings are uncertain, they should not have a material

adverse effect on our financial position, results of

operations or cash flows.

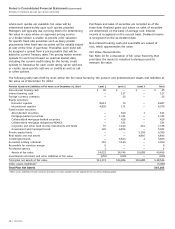

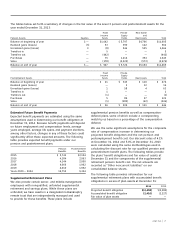

We have contractual obligations to purchase certain goods

or services from various other parties. Our purchase

obligations are expected to be approximately $19,129 in

2015, $21,386 in total for 2016 and 2017, $2,518 in total

for 2018 and 2019 and $691 in total for years thereafter.

See Note 10 for a discussion of collateral and credit-risk

contingencies.

Lease payments under the sublease arrangements were

$221 for 2014. At December 31, 2014, the future minimum

payments under the sublease arrangement are $225 for

2015, $229 for 2016, $234 for 2017, $239 for 2018,

$244 for 2019, and $2,553 thereafter.

NOTE 18. CONTINGENT LIABILITIES

We are party to numerous lawsuits, regulatory proceedings

and other matters arising in the ordinary course of business.

In evaluating these matters on an ongoing basis, we take

into account amounts already accrued on the balance