AT&T Wireless 2014 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

15

Historically, our postpaid customers have signed two-year

service contracts when they purchase subsidized handsets.

However, through our Mobile Share plans, we have recently

begun offering postpaid services at lower prices for those

customers who either bring their own devices (BYOD) or

participate in our AT&T Next program. Approximately 52%

of all postpaid smartphone gross adds and upgrades

during 2014 chose AT&T Next. We also experienced a sharp

rise in the number of BYOD gross adds during 2014 to

approximately 1,492,000, compared to approximately

400,000 in 2013. While BYOD customers do not generate

equipment revenue, the lack of a device cost and subsidy

helps improve our margins. We expect continued increases

in our AT&T Next take rate as we have expanded the

program to additional distributors.

Our AT&T Next program allows for postpaid subscribers to

purchase certain devices in installments over a period of

up to 30 months. Additionally, after a specified period of

time, they also have the right to trade in the original device

for a new device and have the remaining unpaid balance

satisfied. For customers that elect these trade-in programs,

at the time of the sale, we recognize equipment revenue

for the amount of the customer receivable, net of the fair

value of the trade-in right guarantee and imputed interest.

A significant percentage of our customers on the AT&T Next

program pay a lower monthly service charge, which results

in lower service revenue recorded for these subscribers.

In the second quarter of 2014, we began offering the AT&T

Next program through other distributors and we expanded

the offering to almost all of our remaining distributors

during the third quarter, which further accelerated the

impacts on service revenues.

Prepaid

In March 2014, we completed our acquisition of Leap, which

included approximately 4.5 million prepaid subscribers at

closing. Since the acquisition, prepaid subscribers have

decreased approximately 7.0% due in part to the expected

transition of Cricket subscribers.

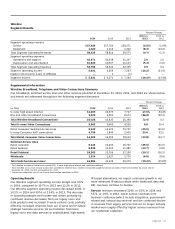

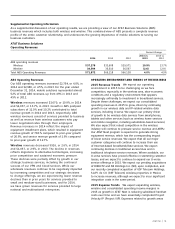

Operating Results

Our Wireless segment operating income margin was 23.1%

in 2014, compared to 25.6% in 2013 and 24.9% in 2012.

Our Wireless segment operating income decreased $796,

or 4.4%, in 2014 and increased $1,329, or 8.0%, in 2013.

The decreases in operating margin and income in 2014

reflected the increasing popularity of Mobile Share plans,

promotional activities and our continued investment in new

services. The operating income and margin increase in 2013

reflected continuing data revenue growth and operating

efficiencies, partially offset by high subsidies associated

with growing smartphone sales.

Service revenues decreased $520, or 0.8%, in 2014 and

increased $2,366, or 4.0%, in 2013. The decrease in 2014

was largely due to customers shifting to no-device-subsidy

plans, which allow for discounted monthly service charges

ARPU

In 2014, our wireless business, and to some extent, the

wireless industry, underwent a transformation in how

subscribers purchase services and devices. The rapid

expansion in the number of our subscribers who purchase

equipment on installment and choose Mobile Share Value

pricing, which offers lower prices for having multiple

devices (including tablets) sharing services on one billing

account, has highlighted the shortcomings of using the

traditional metric of ARPU (average revenue per average

wireless subscribers) to measure the economic value of a

customer to a carrier. By relying only on monthly revenue,

ARPU does not capture the total payments made by a

customer. We believe that postpaid phone-only subscriber

revenue per average user plus Next subscriber installment

billings (postpaid phone-only ARPU plus AT&T Next) is a

better representation of the monthly economic value per

postpaid subscriber. For 2014, postpaid phone-only ARPU

decreased 6.6% and postpaid phone-only ARPU plus AT&T

Next decreased 2.6% compared to 2013. Postpaid phone-

only ARPU increased 2.9% in 2013 as a result of a greater

use of smartphones by our subscribers. AT&T Next, which

launched later in 2013, did not have a significant impact

prior to 2014.

Churn

The effective management of subscriber churn is critical to

our ability to maximize revenue growth and to maintain and

improve margins. Total churn was higher in 2014 and 2013

due to increased competition and the expected pressure

in prepaid with the transition of former Leap customers.

Postpaid churn was lower for both 2014 and 2013.

Postpaid

Postpaid subscribers increased 4.5% and 3.0% in 2014

and 2013, respectively. At December 31, 2014, 83% of

our postpaid phone subscriber base used smartphones,

compared to 77% at December 31, 2013 and 70% at

December 31, 2012. About 97% of our postpaid

smartphone subscribers are on plans that provide for

service on multiple devices at reduced rates, and such

subscribers tend to have higher retention and lower churn

rates. A growing percentage of our postpaid smartphone

subscribers are on usage-based data plans, with

approximately 85% on these plans as compared to 75%

and 67%, respectively, in the prior two years. About 50%

of our Mobile Share accounts have chosen plans with

10 gigabytes or higher. Device connections on our Mobile

Share plans now represent almost 70% of our postpaid

customer base. Such offerings are intended to encourage

existing subscribers to upgrade their current services

and/or add connected devices, attract subscribers from

other providers and minimize subscriber churn.

As of December 31, 2014, approximately 90% of our

postpaid smartphone subscribers use a 4G-capable device

(i.e., a device that would operate on our LTE or HSPA+

network), and about 75% of our postpaid smartphone

subscribers use an LTE device.