AT&T Wireless 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

55

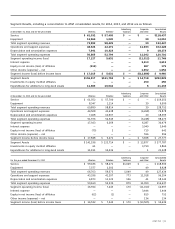

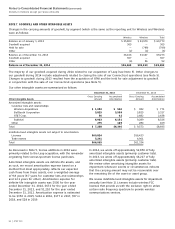

NOTE 9. DEBT

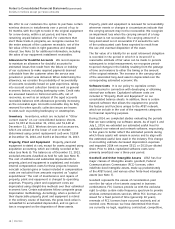

Long-term debt of AT&T and its subsidiaries, including

interest rates and maturities, is summarized as follows

at December 31:

2014 2013

Notes and debentures

Interest Rates Maturities1

0.60% – 2.99% 2015 – 2022 $22,127 $18,774

3.00% – 4.99% 2014 – 2045 31,516 22,327

5.00% – 6.99% 2014 – 2095 23,260 28,513

7.00% – 9.10% 2014 – 2097 6,153 6,268

Other — 1

Fair value of interest rate swaps

recorded in debt 125 154

83,181 76,037

Unamortized (discount) premium – net (1,549) (1,553)

Total notes and debentures 81,632 74,484

Capitalized leases 430 283

Total long-term debt, including

current maturities 82,062 74,767

Current maturities of long-term debt (6,051) (5,477)

Total long-term debt $76,011 $69,290

1 Maturities assume putable debt is redeemed by the holders at the next opportunity.

We had outstanding Euro, British pound sterling, Canadian

dollar and Swiss Franc denominated debt of approximately

$24,655 and $18,146 at December 31, 2014 and 2013.

The weighted-average interest rate of our entire long-term

debt portfolio, including the impact of derivatives,

decreased from 4.4% at December 31, 2013 to 4.2%

at December 31, 2014.

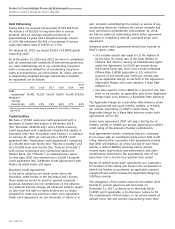

Current maturities of long-term debt include debt that may

be put back to us by the holders in 2015. We have $1,000

of annual put reset securities that may be put each April

until maturity in 2021. If the holders do not require us to

repurchase the securities, the interest rate will be reset

based on current market conditions. Likewise, we have an

accreting zero-coupon note that may be redeemed each

May, until maturity in 2022. If the zero-coupon note

(issued for principal of $500 in 2007) is held to maturity,

the redemption amount will be $1,030.

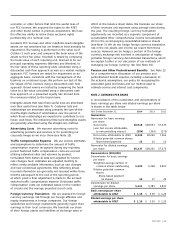

Debt maturing within one year consisted of the following at

December 31:

2014 2013

Current maturities of long-term debt $6,051 $5,477

Commercial paper — 20

Bank borrowings1 5 1

Total $6,056 $5,498

1 Outstanding balance of short-term credit facility of a foreign subsidiary.

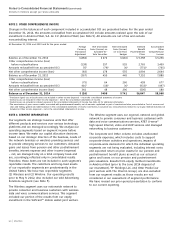

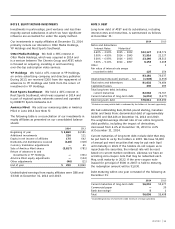

NOTE 8. EQUITY METHOD INVESTMENTS

Investments in partnerships, joint ventures and less than

majority-owned subsidiaries in which we have significant

influence are accounted for under the equity method.

Our investments in equity affiliates at December 31, 2014

primarily include our interests in Otter Media Holdings,

YP Holdings and Root Sports Southwest.

Otter Media Holdings We hold a 38% interest in

Otter Media Holdings, which was acquired in 2014 and

is a venture between The Chernin Group and AT&T, which

is focused on acquiring, investing in and launching

over-the-top subscription video services.

YP Holdings We hold a 47% interest in YP Holdings,

an online advertising company and directory publisher.

During 2013, we received $200 from the repayment of

advances to YP Holdings and $101 from the return of

investment in YP Holdings.

Root Sports Southwest We hold a 40% interest in

Root Sports Southwest, which was acquired in 2014 and

is part of regional sports networks owned and operated

by DIRECTV Sports Networks LLC.

América Móvil We sold our remaining stake in América

Móvil in June 2014 (see Note 5).

The following table is a reconciliation of our investments in

equity affiliates as presented on our consolidated balance

sheets:

2014 2013

Beginning of year $ 3,860 $4,581

Additional investments 226 111

Equity in net income of affiliates 175 642

Dividends and distributions received (148) (318)

Currency translation adjustments — 61

Sale of América Móvil shares (3,817) (781)

Return of advances to and

investments in YP Holdings — (301)

América Móvil equity adjustments — (124)

Other adjustments (46) (11)

End of year $ 250 $3,860

Undistributed earnings from equity affiliates were $88 and

$3,346 at December31, 2014 and 2013.