AT&T Wireless 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

34

|

AT&T INC.

the year of payment is unknown and could not be reliably

estimated since past trends were not deemed to be an

indicator of future payment.

Substantially all of our purchase obligations are in our

Wireline and Wireless segments. The table does not include

the fair value of our interest rate swaps. Our capital lease

obligations and bank borrowings have been excluded

from the table due to the insignificant amounts of such

obligations at December 31, 2014. Many of our other

noncurrent liabilities have been excluded from the following

table due to the uncertainty of the timing of payments,

combined with the absence of historical trending to be used

as a predictor of such payments. Additionally, certain other

long-term liabilities have been excluded since settlement of

such liabilities will not require the use of cash. However, we

have included, in the following table, obligations that

primarily relate to benefit funding due to the certainty of

the timing of these future payments. Our other long-term

liabilities are: deferred income taxes (see Note 11) of

$37,544; postemployment benefit obligations of $37,079;

and other noncurrent liabilities of $17,989.

interest, or expected pension and postretirement payments

(we maintain pension funds and Voluntary Employee

Beneficiary Association trusts to fully or partially fund these

benefits) (see Note 12). In the ordinary course of business,

we routinely enter into commercial commitments for

various aspects of our operations, such as plant additions,

inventory and office supplies. However, we do not believe

that the commitments will have a material effect on our

financial condition, results of operations or cash flows.

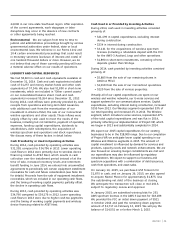

Our contractual obligations as of December 31, 2014, are

in the following table. The purchase obligations that follow

are those for which we have guaranteed funds and will be

funded with cash provided by operations or through

incremental borrowings. The minimum commitment for

certain obligations is based on termination penalties that

could be paid to exit the contract. Other long-term liabilities

are included in the table based on the year of required

payment or an estimate of the year of payment. Such

estimate of payment is based on a review of past trends

for these items, as well as a forecast of future activities.

Certain items were excluded from the following table, as

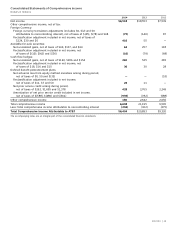

Contractual Obligations

Payments Due By Period

Less than 1-3 3-5 More than

Total 1 Year Years Years 5 Years

Long-term debt obligations1 $ 84,866 $ 6,482 $ 12,031 $ 12,148 $ 54,205

Interest payments on long-term debt 58,434 3,539 6,734 5,922 42,239

Finance obligations2 3,724 225 464 482 2,553

Operating lease obligations 31,047 3,879 6,931 5,694 14,543

Unrecognized tax benefits3 3,119 260 — — 2,859

Purchase obligations4 43,724 19,129 21,386 2,518 691

Total Contractual Obligations $224,914 $ 33,514 $ 47,546 $ 26,764 $117,090

1 Represents principal or payoff amounts of notes and debentures at maturity or, for putable debt, the next put opportunity.

2 Represents future minimum payments under the sublease arrangement for our tower transactions (see Note 17).

3 The noncurrent portion of the UTBs is included in the “More than 5 Years” column, as we cannot reasonably estimate the timing or amounts of additional cash payments, if

any, at this time. See Note 11 for additional information.

4 We calculated the minimum obligation for certain agreements to purchase goods or services based on termination fees that can be paid to exit the contract. If we elect to

exit these contracts, termination fees for all such contracts in the year of termination could be approximately $530 in 2015, $500 in the aggregate for 2016 and 2017, $82 in

the aggregate for 2018 and 2019, and $0 in the aggregate thereafter. Certain termination fees are excluded from the above table, as the fees would not be paid every year

and the timing of such payments, if any, is uncertain.

In managing market risks, we employ derivatives according

to documented policies and procedures, including interest

rate swaps, interest rate locks, foreign currency exchange

contracts and combined interest rate foreign currency

contracts (cross-currency swaps). We do not use derivatives

for trading or speculative purposes. We do not foresee

significant changes in the strategies we use to manage

market risk in the near future.

MARKET RISK

We are exposed to market risks primarily from changes

in interest rates and foreign currency exchange rates.

These risks, along with other business risks, impact

our cost of capital. It is our policy to manage our

debt structure and foreign exchange exposure in order

to manage capital costs, control financial risks and

maintain financial flexibility over the long term.