AT&T Wireless 2014 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

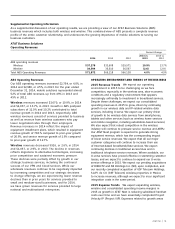

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

12

|

AT&T INC.

The 2013 expense decreased by $12,757 as a result of

recording actuarial gains in 2013 and actuarial losses

in 2012. Expense reductions in 2013 also reflect lower

employee-related Wireline costs, gains on spectrum

transactions, lower financing-related costs associated

with our pension and postretirement benefits (referred

to as Pension/OPEB expenses) and the sale of our

Advertising Solutions segment. These decreases were

partially offset by increased charges for employee

separations and higher selling and advertising expenses.

Abandonment of network assets In 2014, we recorded

a noncash charge of $2,120 for the abandonment in place

of certain network assets (see Note 6). During the fourth

quarter of 2014, we completed a study of our network

assets and determined that specific copper assets will not

be necessary to support future network activity, due to

declining customer demand for our legacy voice and data

products and the transition of our networks to next

generation IP-based technology.

Depreciation and amortization expense decreased

$122, or 0.7%, in 2014 and increased $252, or 1.4%, in

2013. The 2014 expense decrease was primarily due to

extending the estimated useful life of software, an

increase in fully depreciated assets and lower amortization

of intangibles for customer lists. These decreases were

largely offset by ongoing capital spending for network

upgrades and expansion and additional expense associated

with the assets acquired from Leap.

The 2013 expense increase was primarily due to ongoing

capital spending for network upgrades and expansion,

partially offset by fully depreciated assets and lower

amortization of intangibles for customer lists and the

sale of our Advertising Solutions segment.

Interest expense decreased $327, or 8.3%, in 2014 and

increased $496, or 14.4%, in 2013. The decrease in 2014

was primarily due to a $581 charge related to debt tender

offers in 2013 and lower interest rates resulting from

refinancing activity, partially offset by interest expense

related to our December 2013 tower transaction (see

Note 17), higher debt balances and charges associated

with the early redemption of debt during 2014.

The increase in interest expense for 2013 was primarily

due to a $581 charge related to our debt tender offers

in 2013, partially offset by charges associated with early

debt redemptions in 2012. Lower average interest rates

offset higher average debt balances.

offset by continued declines in revenues from legacy

wireline voice and data services and the loss of revenues

resulting from the sale of our Advertising Solutions

segment in 2012.

The telecommunications industry is rapidly evolving from

fixed location, voice-oriented services into an industry

driven by customer demand for instantly available, data-

based services (including video). We have been investing

heavily to expand our broadband network and upgrade

our wireless network to meet this demand. We have also

launched new wireless offerings to give our customers

additional choices for data and handset purchase plans.

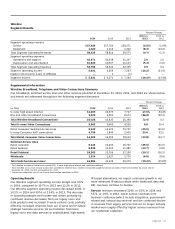

Equipment revenues increased $4,510, or 47.5%, in 2014

and $572, or 6.4%, in 2013. Growth in equipment revenues

reflected the continuing trend by our postpaid wireless

subscribers to choose devices on installment purchase

rather than the device subsidy model, which resulted in

increased equipment revenue recognized for device sales.

The revenue increase in 2013 was primarily due to growth

in wireless equipment revenues, reflecting the increasing

percentage of wireless subscribers choosing smartphones.

Cost of services and sales expenses increased $9,147,

or 17.8%, in 2014 and decreased $3,764, or 6.8%, in 2013.

The 2014 expense increased by $4,406 as a result of

recording actuarial losses in 2014 and actuarial gains in

2013. Wireless handset sales and upgrades contributed

to higher equipment costs and handset insurance costs in

2014. The increase also reflects higher wireless network

costs and wireline costs attributable to U-verse content

costs and subscriber growth and employee-related charges.

The 2013 expense decreased by $4,822 as a result of

recording actuarial gains in 2013 and losses in 2012.

Lower interconnect and long-distance expenses, lower costs

associated with Universal Service Fund (USF) fees and the

sale of our Advertising Solutions segment also contributed

to expense declines in 2013. These decreases were partially

offset by increased wireless equipment costs related to

device sales and increased wireline costs attributable to

growth in U-verse subscribers.

Selling, general and administrative expenses increased

$11,283, or 39.7%, in 2014 and decreased $12,652, or

30.8%, in 2013. The 2014 expense increased by $11,047

as a result of recording actuarial losses in 2014 and

actuarial gains in 2013. Expense increases in 2014 also

reflect higher selling and administrative expenses in our

Wireless segment and gains on spectrum transactions

in 2013. These increases were partially offset by lower

employee-related costs and Wireless commissions expenses.