AT&T Wireless 2014 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

25

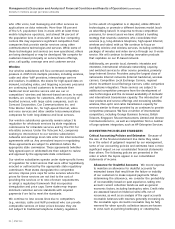

plan benefit obligation of $4,854 and decreased our

postretirement discount rate 0.80%, resulting in an

increase in our postretirement benefit obligation of

$2,786. For the year ended December 31, 2013, we

increased our discount rate by 0.70%, resulting in a

decrease in our pension plan benefit obligation of

$4,533 and a decrease in our postretirement benefit

obligation of $3,161. The 2014 increase of $7,640 in

our combined pension and postretirement obligations

caused by declines in our discount rates essentially

reversed the decrease in our benefit obligation

attributable to the discount rate change in 2013.

Our expected long-term rate of return on pension plan

assets is 7.75% for 2015 and 2014. Our expected

long-term rate of return on postretirement plan assets

will be adjusted to 5.75% for 2015 from 7.75% for 2014.

Our expected return on plan assets is calculated using

the actual fair value of plan assets. If all other factors

were to remain unchanged, we expect that a 0.50%

decrease in the expected long-term rate of return would

cause 2015 combined pension and postretirement cost

to increase $250, which under our accounting policy

would be recognized in the current year as part of our

fourth-quarter remeasurement of our retiree benefit

plans. In 2014, the actual return on our combined

pension and postretirement plan assets was 8.8%,

resulting in an actuarial gain of $566.

We recognize gains and losses on pension and

postretirement plan assets and obligations immediately

in our operating results. These gains and losses are

generally measured annually as of December 31 and

accordingly will normally be recorded during the

fourth quarter, unless an earlier remeasurement is

required. Should actual experience differ from actuarial

assumptions, the projected pension benefit obligation

and net pension cost and accumulated postretirement

benefit obligation and postretirement benefit cost would

be affected in future years. Note 12 also discusses the

effects of certain changes in assumptions related to

medical trend rates on retiree healthcare costs.

Depreciation Our depreciation of assets, including

use of composite group depreciation and estimates of

useful lives, is described in Notes 1 and 6. We assign

useful lives based on periodic studies of actual asset

lives. Changes in those lives with significant impact on

the financial statements must be disclosed. During 2014,

we completed studies evaluating the periods that we

were utilizing our software assets. As of April 1 and

July 1, 2014, we extended our estimated useful lives

for capitalized non-network and network software,

respectively, to five years to better reflect the estimated

periods during which these assets will remain in service

and to align with the estimated useful lives used in

The analysis of receivables is performed monthly, and

the allowances for doubtful accounts are adjusted

through expense accordingly. A 10% change in the

amounts estimated to be uncollectible would result in

a change in the provision for uncollectible accounts

of approximately $100.

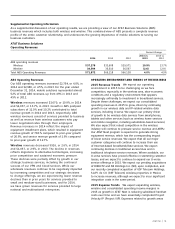

Deferred Purchase Price We offer our customers

the option to purchase certain wireless devices in

installments over a period of up to 30 months, with

the right to trade in the original equipment for a new

device, within a set period, and have the remaining

unpaid balance satisfied. In conjunction with this plan,

we have entered into uncommitted agreements with

various banks and purchasers that allow for the transfer

of these installment receivables for cash and additional

consideration upon settlement of the receivables,

referred to as the deferred purchase price. The deferred

purchase price is initially recorded at estimated fair

value, which is based on remaining installment

payments expected to be collected, adjusted by the

expected timing and value of device trade-ins, and

is subsequently carried at the lower of cost or net

realizable value. The estimated value of the device

trade-ins takes into account prices offered to us by

independent third parties that contemplate changes

in value after the launch of a device model. A 10%

decrease in the estimated trade-in value would result

in a decrease in the carrying value of our deferred

purchase price of approximately $40. A one-month

acceleration in the estimated timing of trade-in would

result in a decrease in the carrying value of our

deferred purchase price of approximately $90.

We review and update our assumptions used in

determining the deferred purchase price on a quarterly

basis. (See Note 16)

Pension and Postretirement Benefits Our actuarial

estimates of retiree benefit expense and the associated

significant weighted-average assumptions are discussed

in Note 12. Our assumed discount rate for pension and

postretirement benefits of 4.30% and 4.20%, respectively,

at December 31, 2014, reflects the hypothetical rate

at which the projected benefit obligations could be

effectively settled or paid out to participants. We

determined our discount rate based on a range of

factors, including a yield curve composed of the rates

of return on several hundred high-quality, fixed income

corporate bonds available at the measurement date

and the related expected duration for the obligations.

These bonds were all rated at least Aa3 or AA- by one of

the nationally recognized statistical rating organizations,

denominated in U.S. dollars, and neither callable,

convertible nor index linked. For the year ended

December 31, 2014, we decreased our pension discount

rate by 0.70%, resulting in an increase in our pension