AT&T Wireless 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

49

effect at the balance sheet dates. We translate our share

of their revenues and expenses using average rates during

the year. The resulting foreign currency translation

adjustments are recorded as a separate component of

accumulated other comprehensive income (accumulated

OCI) in the accompanying consolidated balance sheets

(see Note 3). We do not hedge foreign currency translation

risk in the net assets and income we report from these

sources. However, we do hedge a portion of the foreign

currency exchange risk involved in anticipation of highly

probable foreign currency-denominated transactions, which

we explain further in our discussion of our methods of

managing our foreign currency risk (see Note 10).

Pension and Other Postretirement Benefits See Note 12

for a comprehensive discussion of our pension and

postretirement benefit expense, including a discussion of

the actuarial assumptions, our policy for recognizing the

associated gains and losses and our method used to

estimate service and interest cost components.

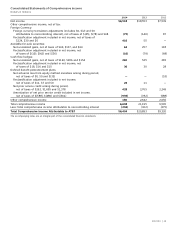

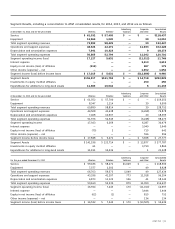

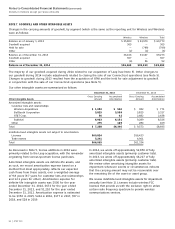

NOTE 2. EARNINGS PER SHARE

A reconciliation of the numerators and denominators of

basic earnings per share and diluted earnings per share

is shown in the table below:

Year Ended December 31, 2014 2013 2012

Numerators

Numerator for basic earnings

per share:

Net income $6,518 $18,553 $7,539

Less: Net income attributable

to noncontrolling interest (294) (304) (275)

Net income attributable to AT&T 6,224 18,249 7,264

Dilutive potential common shares:

Share-based payment 13 12 12

Numerator for diluted earnings

per share $6,237 $18,261 $7,276

Denominators (000,000)

Denominator for basic earnings

per share:

Weighted-average number of

common shares outstanding 5,205 5,368 5,801

Dilutive potential common

shares:

Share-based payment

(in shares) 16 17 20

Denominator for diluted

earnings per share 5,221 5,385 5,821

Basic earnings per share

attributable to AT&T $ 1.19 $ 3.39 $ 1.25

Diluted earnings per share

attributable to AT&T $ 1.19 $ 3.39 $ 1.25

economic or other factors that limit the useful lives of

our FCC licenses. We acquired the rights to the AT&T

and other brand names in previous acquisitions. We have

the effective ability to retain these exclusive rights

permanently at a nominal cost.

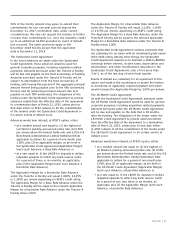

Goodwill, FCC licenses and other indefinite-lived intangible

assets are not amortized but are tested at least annually for

impairment. The testing is performed on the value as of

October 1 each year, and compares the book value of the

assets to their fair value. Goodwill is tested by comparing

the book value of each reporting unit, deemed to be our

principal operating segments (Wireless and Wireline), to

the fair value of those reporting units calculated using a

discounted cash flow approach as well as a market multiple

approach. FCC licenses are tested for impairment on an

aggregate basis, consistent with the management of the

business on a national scope. We perform our test of the

fair values of FCC licenses using a discounted cash flow

approach. Brand names are tested by comparing the book

value to a fair value calculated using a discounted cash

flow approach on a presumed royalty rate derived from

the revenues related to the brand name.

Intangible assets that have finite useful lives are amortized

over their useful lives (see Note 7). Customer lists and

relationships are amortized using primarily the sum-of-the-

months-digits method of amortization over the period in

which those relationships are expected to contribute to our

future cash flows. The remaining finite-lived intangible assets

are generally amortized using the straight-line method.

Advertising Costs We expense advertising costs for

advertising products and services or for promoting our

corporate image as we incur them (see Note 15).

Traffic Compensation Expense We use various estimates

and assumptions to determine the amount of traffic

compensation expense recognized during any reporting

period. Switched traffic compensation costs are accrued

utilizing estimated rates and volumes by product,

formulated from historical data and adjusted for known

rate changes. Such estimates are adjusted monthly to

reflect newly available information, such as rate changes

and new contractual agreements. Bills reflecting actual

incurred information are generally not received within three

months subsequent to the end of the reporting period,

at which point a final adjustment is made to the accrued

switched traffic compensation expense. Dedicated traffic

compensation costs are estimated based on the number

of circuits and the average projected circuit costs.

Foreign Currency Translation We are exposed to foreign

currency exchange risk through our foreign affiliates and

equity investments in foreign companies. Our foreign

subsidiaries and foreign investments generally report their

earnings in their local currencies. We translate our share

of their foreign assets and liabilities at exchange rates in