AT&T Wireless 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

36

|

AT&T INC.

Customers are changing their buying habits in response

to both ongoing economic conditions and technological

advances. Should we fail to respond promptly to address

these changes in customer demands, we are likely to

experience greater pressure on pricing and margins as

we continue to compete for customers who would have

even less discretionary income.

Adverse changes in medical costs and the U.S. securities

markets and a further decline in interest rates could

materially increase our benefit plan costs.

Our costs to provide current benefits and funding for

future benefits are subject to increases, primarily due to

continuing increases in medical and prescription drug costs,

and can be affected by lower returns on funds held by our

pension and other benefit plans, which are reflected in our

financial statements for that year. Investment returns on

these funds depend largely on trends in the U.S. securities

markets and the U.S. economy. We have experienced

historically low interest rates during the last several years.

While we expect rates to increase during 2015, we expect

relatively stable rates to continue for the next several years.

Recent increases in market returns have led to better than

assumed investment returns on our plan assets; however

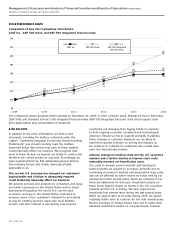

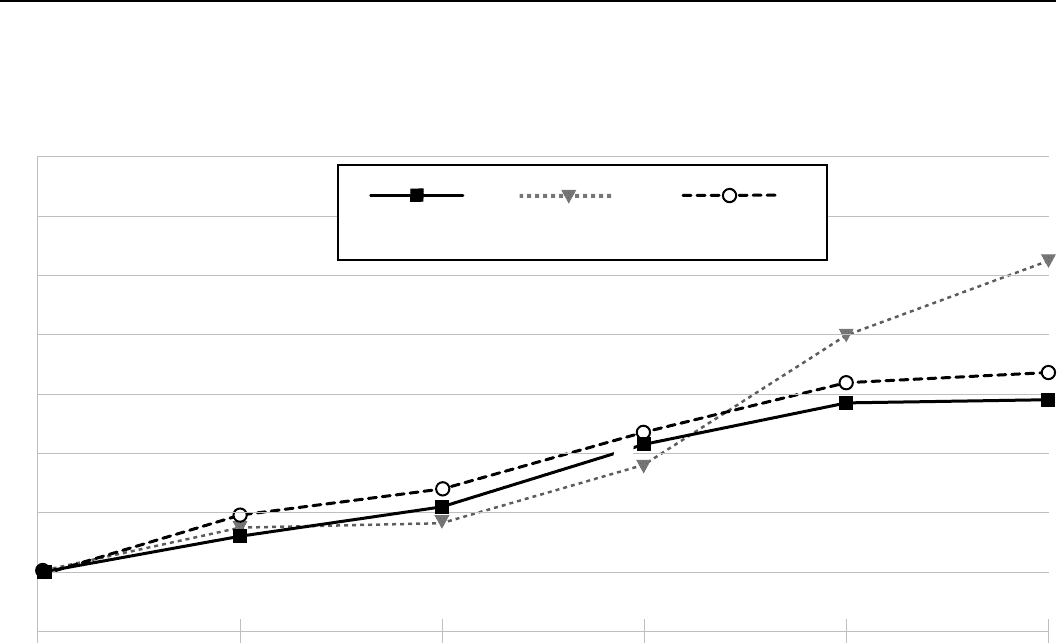

STOCK PERFORMANCE GRAPH

Comparison of Five Year Cumulative Total Return

AT&T Inc., S&P 500 Index, and S&P 500 Integrated Telecom Index

115

117

136

180

205

128

164 167

147

119

12/09 12/10 12/11 12/12 12/13 12/14

240

220

200

180

160

140

120

100

80

S&P 500 Integrated

Telecom Index

AT&T Inc. S&P 500 Index

158

122

157

112

143

The comparison above assumes $100 invested on December 31, 2009, in AT&T common stock, Standard & Poor’s 500 Index

(S&P 500), and Standard & Poor’s 500 Integrated Telecom Index (S&P 500 Integrated Telecom). Total return equals stock

price appreciation plus reinvestment of dividends.

RISK FACTORS

In addition to the other information set forth in this

document, including the matters contained under the

caption “Cautionary Language Concerning Forward-Looking

Statements,” you should carefully read the matters

described below. We believe that each of these matters

could materially affect our business. We recognize that

most of these factors are beyond our ability to control and

therefore we cannot predict an outcome. Accordingly, we

have organized them by first addressing general factors,

then industry factors and, finally, items specifically

applicable to us.

The current U.S. economy has changed our customers’

buying habits and a failure to adequately respond

could materially adversely affect our business.

We provide services and products to consumers and large

and small businesses in the United States and to larger

businesses throughout the world. The current slow

economic recovery in the United States continues to

pressure some of our customers’ demand for and ability

to pay for existing services, especially local landline

service, and their interest in purchasing new services.