AT&T Wireless 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

53

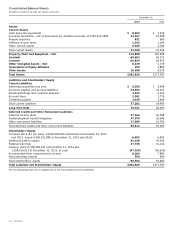

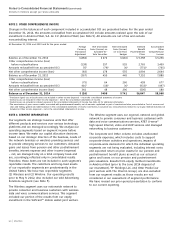

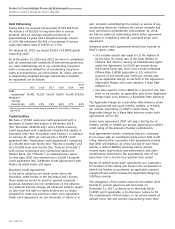

NOTE 6. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment is summarized as follows at

December 31:

Lives (years) 2014 2013

Land — $ 1,567 $ 1,523

Buildings and improvements 10-44 32,204 31,485

Central office equipment1 3-10 89,857 86,370

Cable, wiring and conduit 15-50 72,766 76,107

Other equipment 3-15 74,244 67,887

Software 3-52 8,604 8,150

Under construction — 3,053 3,276

282,295 274,798

Accumulated depreciation

and amortization 169,397 163,830

Property, plant and

equipment – net $112,898 $110,968

1 Includes certain network software.

2 Reflects extended estimated useful life (see Note 1).

Our depreciation expense was $17,773 in 2014, $17,722 in

2013 and $16,933 in 2012. Depreciation expense included

amortization of software totaling $1,504 in 2014, $2,142 in

2013 and $2,130 in 2012.

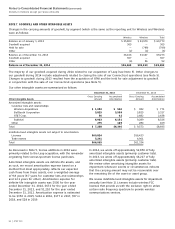

We periodically assess our network assets for impairment,

and our analysis in 2014 indicated no impairment. However,

due to declining customer demand for our legacy voice and

data products and the migration of our networks to next

generation technologies, we decided in the fourth quarter

of 2014 to abandon in place specific copper network assets

classified as cable, wiring and conduit. These abandoned

assets had a gross book value of approximately $7,141,

with accumulated depreciation of $5,021. We recorded a

$2,120 noncash charge for this abandonment, which is

included in “Abandonment of network assets” on our

consolidated statements of income.

Certain facilities and equipment used in operations are

leased under operating or capital leases. Rental expenses

under operating leases were $4,345 for 2014, $3,683 for

2013, and $3,507 for 2012. At December 31, 2014, the

future minimum rental payments under noncancelable

operating leases for the years 2015 through 2019 were

$3,879, $3,641, $3,290, $2,981, and $2,713, with $14,543

due thereafter. Certain real estate operating leases contain

renewal options that may be exercised. Capital leases are

not significant.

between AT&T and DIRECTV, satisfying one of the conditions

to closing the merger. Under certain circumstances relating

to a competing transaction, DIRECTV may be required to

pay a termination fee to us in connection with or following

a termination of the agreement.

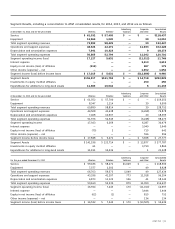

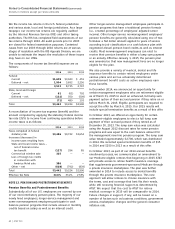

Dispositions

Connecticut Wireline On October 24, 2014, we sold

our incumbent local exchange operations in Connecticut

for $2,018 and recorded a pre-tax gain of $147, which

is included in “Other income (expense) – net,” on our

consolidated statements of income. In conjunction with

the sale, we allocated $743 of goodwill from our Wireline

reporting unit. Because the book value of the goodwill

did not have a corresponding tax basis, the resulting net

income impact of the sale was a loss of $289.

We applied held-for-sale treatment to the assets and

liabilities of the Connecticut operations, and, accordingly,

included the assets in “Other current assets,” and the related

liabilities in “Accounts payable and accrued liabilities,” on

our consolidated balance sheets at December 31, 2013.

However, the business did not qualify as discontinued

operations as we expect significant continuing direct cash

flows related to the disposed operations. Assets and

liabilities of the Connecticut operations included the

following as of December 31, 2013:

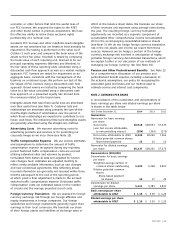

Assets held for sale:

Current assets $ 155

Property, plant and equipment – net 1,289

Goodwill 799

Other assets 17

Total assets $2,260

Liabilities related to assets held for sale:

Current liabilities $ 128

Noncurrent liabilities 480

Total liabilities $ 608

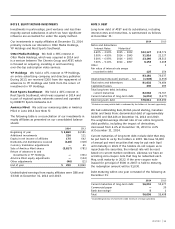

América Móvil In 2014, we sold our remaining stake in

América Móvil for approximately $5,885 and recorded a

pre-tax gain of $1,330, which is included in “Other income

(expense) – net,” on our consolidated statements of income.

In 2013, we sold a portion of our shares in América Móvil

for approximately $1,179. América Móvil was accounted for

as an equity method investment (see Note 8).

Advertising Solutions In May 2012, we completed the

sale of our Advertising Solutions segment to an affiliate of

Cerberus Capital Management, L.P. for approximately $740

in cash after closing adjustments, a $200 advance, which

was repaid in 2013, and a 47 percent equity interest in

the new entity, YP Holdings. Our operating results include

the results of the Advertising Solutions segment through

May 8, 2012.