AT&T Wireless 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

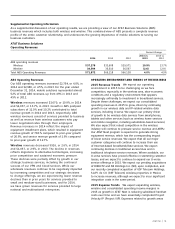

AT&T INC.

|

17

Wireline

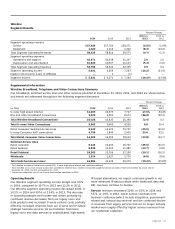

Segment Results

Percent Change

2014 vs. 2013 vs.

2014 2013 2012 2013 2012

Segment operating revenues

Service $57,405 $57,700 $58,271 (0.5)% (1.0)%

Equipment 1,020 1,114 1,302 (8.4) (14.4)

Total Segment Operating Revenues 58,425 58,814 59,573 (0.7) (1.3)

Segment operating expenses

Operations and support 42,471 41,638 41,207 2.0 1.0

Depreciation and amortization 10,323 10,907 11,123 (5.4) (1.9)

Total Segment Operating Expenses 52,794 52,545 52,330 0.5 0.4

Segment Operating Income 5,631 6,269 7,243 (10.2) (13.4)

Equity in Net Income (Loss) of Affiliates — 2 (1) — —

Segment Income $ 5,631 $ 6,271 $ 7,242 (10.2)% (13.4)%

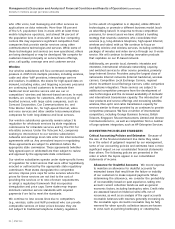

Supplemental Information

Wireline Broadband, Telephone and Video Connections Summary

Our broadband, switched access lines and other services provided at December 31, 2014, 2013, and 2012 are shown below

and trends are addressed throughout the following segment discussion.

Percent Change

2014 vs. 2013 vs.

(in 000s) 20143 2013 2012 2013 2012

U-verse high speed Internet 12,205 10,375 7,717 17.6% 34.4%

DSL and Other Broadband Connections 3,823 6,050 8,673 (36.8) (30.2)

Total Wireline Broadband Connections1 16,028 16,425 16,390 (2.4) 0.2

Total U-verse Video Connections 5,943 5,460 4,536 8.8 20.4

Retail Consumer Switched Access Lines 9,243 12,403 15,707 (25.5) (21.0)

U-verse Consumer VoIP connections 4,759 3,849 2,905 23.6 32.5

Total Retail Consumer Voice Connections 14,002 16,252 18,612 (13.8) (12.7)

Switched Access Lines

Retail consumer 9,243 12,403 15,707 (25.5) (21.0)

Retail business 8,939 10,363 11,483 (13.7) (9.8)

Retail Subtotal 18,182 22,766 27,190 (20.1) (16.3)

Wholesale 1,514 1,627 1,776 (6.9) (8.4)

Total Switched Access Lines2 19,896 24,639 29,279 (19.2)% (15.8)%

1 Total wireline broadband connections include DSL, U-verse high speed Internet and satellite broadband.

2 Total switched access lines include access lines provided to national mass markets and private payphone service providers of 200 at December 31, 2014, 246 at

December 31, 2013, and 313 at December 31, 2012.

3 Connections reflect the sale of our Connecticut wireline operations in 2014.

IP-based alternatives, we expect continued growth in our

more advanced IP data products while traditional data and

DSL revenues continue to decline.

Service revenues decreased $295, or 0.5%, in 2014 and

$571, or 1.0%, in 2013. Lower service revenues from

business customers (which include integration, government-

related and outsourcing services) and the continued decline

in revenues from legacy services that we no longer actively

market were largely offset by higher service revenues from

our residential customers.

Operating Results

Our Wireline segment operating income margin was 9.6%

in 2014, compared to 10.7% in 2013 and 12.2% in 2012.

Our Wireline segment operating income decreased $638, or

10.2%, in 2014 and $974, or 13.4%, in 2013. The decrease

in operating margins and income was driven primarily by

continued revenue decreases from our legacy voice and

data products and increased U-verse content costs, partially

offset by increased revenues from our U-verse and IP-based

strategic business services. As we transition from basic

legacy voice and data services to sophisticated, high-speed,