AT&T Wireless 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

40

|

AT&T INC.

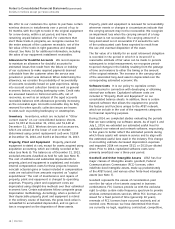

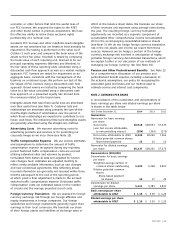

restrictions on cash repatriation, foreign exchange controls,

fluctuations in currency values, trade restrictions and other

regulations that may affect materially our earnings. While

the countries involved represent significant opportunities to

sell our advanced services, a number of these same

countries have experienced unstable growth patterns and at

times have experienced high inflation, currency devaluation,

foreign exchange controls, instability in the banking sector

and high unemployment. Should these conditions reoccur,

customers in these countries may be unable to purchase

the services we offer or pay for services already provided.

In addition, operating in foreign countries also typically

involves participating with local businesses, either to

comply with local laws or, for example, to enhance product

marketing. Involvement with foreign firms exposes us to the

risk of being unable to control the actions of those firms

and therefore exposes us to violating the Foreign Corrupt

Practices Act. Violations of the FCPA could have a material

adverse effect on our operating results.

A majority of our workforce is represented by labor

unions. Absent the successful negotiation of agreements

that are scheduled to expire during 2015, we could

experience lengthy work stoppages.

A majority of our employees are represented by labor

unions as of year-end 2014. Labor contracts covering many

of the employees will expire during 2015. We experienced

a work stoppage in 2004 when the contracts involving our

wireline employees expired, and we may experience

additional work stoppages in 2015. A work stoppage could

adversely affect our business operations, including a loss of

revenue and strained relationships with customers, and we

cannot predict the length of any such strike. We cannot

predict the new contract provisions or the impact of any

new contract on our financial condition.

Increases in our debt levels to fund acquisitions,

additional spectrum purchases, or other strategic

decisions could adversely affect our ability to finance

future debt at attractive rates and reduce our ability to

respond to competition and adverse economic trends.

We have increased the amount of our debt during 2014

and 2015 to fund acquisitions, including spectrum

purchases needed to compete in our business. While we

believe such decisions were prudent and necessary to take

advantage of both growth opportunities and respond to

industry developments, banks and potential purchasers of

our publicly-traded debt may decide that these strategic

decisions and similar actions we may take in the future, as

well as expected trends in the industry, will increase the

risk of investing in our debt and may demand a higher rate

of interest, impose restrictive covenants or otherwise limit

the amount of potential borrowing.